EUR/USD looks firm around 1.0150 ahead of EMU data, US CPI

- EUR/USD adds to the weekly uptick around the 1.0150 region.

- The greenback remains offered amidst persistent risk on trade.

- EMU, Germany ZEW Economic Sentiment, US CPI all due later.

The optimism around the European currency remains unchanged and lifts EUR/USD back to the 1.0150 zone on turnaround Tuesday.

EUR/USD remains bid ahead of EMU, US results

EUR/USD advances for the third session in a row and extends the auspicious start of the week well north of the parity level, always against the backdrop of the resolute selling pressure around the dollar.

As investors practically digested the latest ECB gathering and with a ¾ point interest rate hike by the Fed practically priced in, market participants now look to the upcoming key data releases to determine the pair’s price direction in the next sessions.

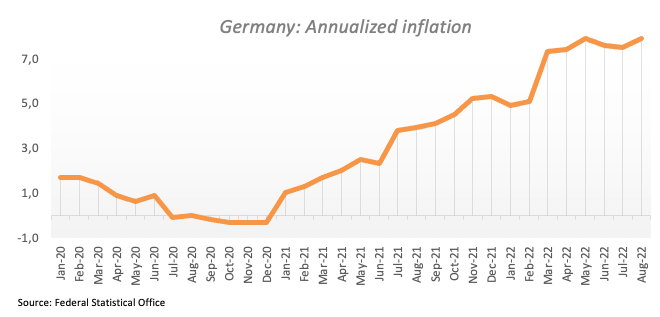

On that, the Economic Sentiment gauged by the ZEW institute is due later in Germany and the broader Euroland for the current month, while US inflation figures tracked the CPI will gather all the attention later in the NA session. Earlier on Tuesday, Germany’s final CPI rose 0.3% MoM and 7.9% in the year to August.

What to look for around EUR

EUR/USD keeps the bid bias unchanged so far this week and aims at revisiting Monday’s peaks in the 1.0200 zone sooner rather than later.

So far, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals.

Key events in the euro area this week: Germany Final Inflation Rate, Germany/EMU ZEW Economic Sentiment (Tuesday) – EMU Industrial Production (Wednesday) – France Final Inflation Rate, EMU Balance of Trade (Thursday) – Italy, EMU Final Inflation rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is advancing 0.24% at 1.0144 and now faces the initial barrier at 1.0197 (monthly high September 12) followed by 1.0202 (August 17 high) and then 1.0333 (100-day SMA). On the flip side, the breakdown of 0.9863 (2022 low September 6) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2002 low).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.