EUR/USD leaps to fresh highs with a bullish hourly close

EUR/USD is benefitting from a weaker US dollar on stimulus hopes.

The single currency has rallied from a low of 1.1923 to a high of 1.2076 and is currently trading 1.22% higher on the day.

This is a dollar-based moved as highlighted in the following charts:

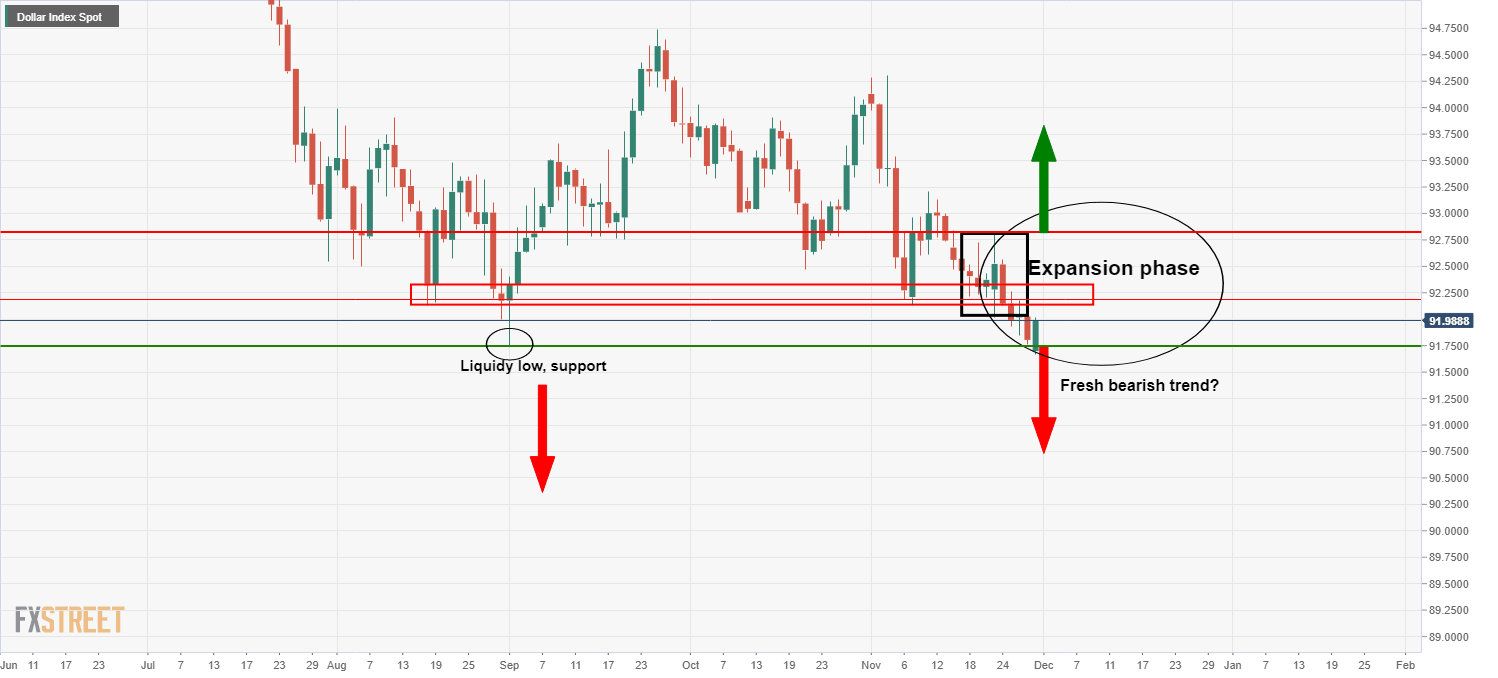

From the prior day's analysis, it was noted that the dollar could be on the verge of a fresh wave of selling below critical resistance as follows:

As it stands, the index is now well on its way for a break of the 91 level in a new bearish trend. The greenback has dropped to its lowest level in more than 2-1/2 years:

Investors' appetite for risk increased on prospects of further fiscal stimulus from the United States as mentioned here:

McConnell: Will revise his targeted relief bill for a floor vote

The news of a proposed COVID bill sank the dollar while the resumption of fresh discussions between US Treasury Secretary Steve Mnuchin and House of Representatives Speaker Nancy Pelosi on Tuesday about a stimulus package keeps the risk-on flows flowing.

There has been a proposed relief bill of $908 billion that would fund measures through March 31, including $228 billion in additional paycheck protection funds for hotels, restaurants and other small businesses, Reuters reported.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.