- EUR/USD is set to finish Friday a little softer, but pretty much band in line with where it started the week.

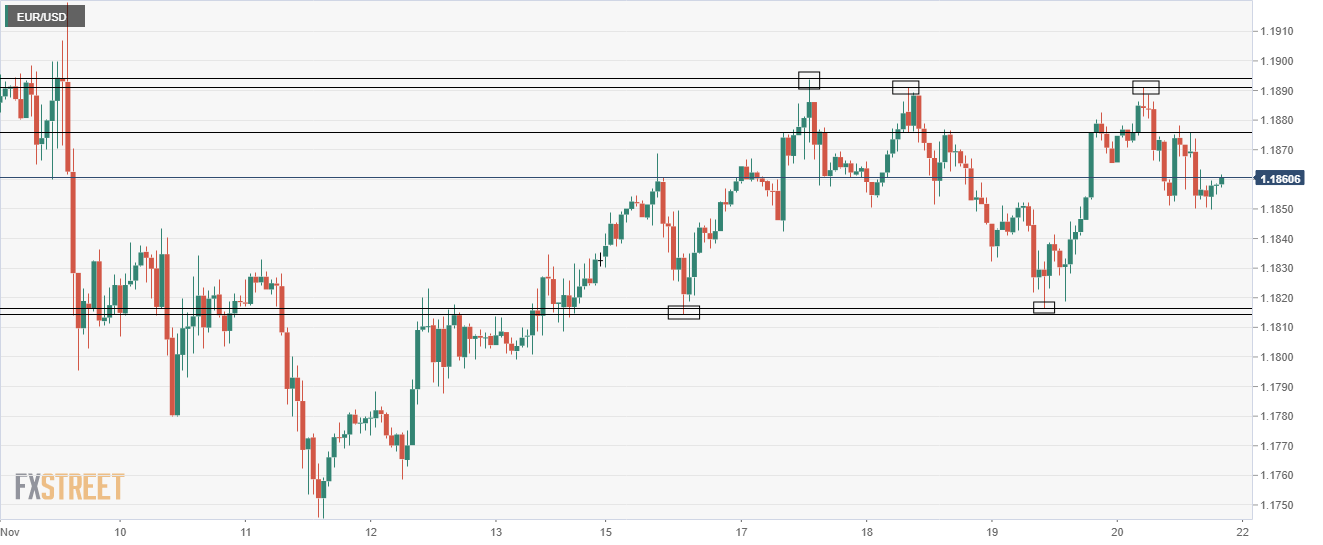

- EUR/USD has respected its 1.1815-1.1890ish range nicely thus far, reflective of a broader lack of direction in the market this week.

EUR/USD is set to finish the week pretty much bang on where it started it, within 10 pips of the 1.1850 mark. On the day, the pair is around 15 pips or 0.1% lower, with the pair having run into significant selling pressure ahead weekly highs close to 1.1890. Recent trade has become characteristically thin as the weekend approaches.

EUR/USD indicative of indecisive markets

EUR/USD has traded very nicely within a 1.1815-1.1890ish range this week; buoyed initially by a risk on start to the week given vaccine optimism (Moderna’s update) and a dovish tone from the FOMC and making highs in the 1.1890s, before reversing lower to set lows in the low 1.1800s on renewed fears regarding the worsening state of the global Covid-19 outbreak. Then the pair rallied again on Thursday as US fiscal stimulus talks between the Democrats got going again, testing the weekly highs again before pulling back to current levels.

Moving forward, the balancing act of pandemic and lockdown concerns (USD bullish) versus vaccine optimism, an increasingly dovish tone to FOMC speak and US political uncertainty (likely all USD bearish factors) is set to continue.

How the US Treasury’s decision not to renew emergency Fed lending programmes from 31 December (and to repatriate $455B in funds to the treasury coffers) will affect markets is unclear; a Fed with less ammunition to support the economy might be a USD negative as it might signal slower US growth ahead. Or would that trigger USD upside on the subsequent stronger demand for havens? Meanwhile, the repatriated funds are likely to be used to fund further fiscal stimulus. So does that actually mean faster growth ahead (likely a risk appetite positive)? Or does it take the pressure of Congress to get a new stimulus bill passed (risk appetite negative)?

Either way, the run into the end of the year will be anything but boring; how the pandemic develops and how the Fed and ECB react, how the early vaccine rollout goes, how the Trump to Biden Administration transition (which hasn’t even started yet) goes will all be crucial determinants of future EUR/USD direction.

With stronger global economic growth expected in 2021 following mass vaccinations and a return to normality, as well as better global trade conditions given the Biden Administration’s less protectionist stance, a number of banks are forecasting a weaker USD ahead. This might keep USD’s upside capped in the short-term, even if the pandemic does get significantly worse than expected this winter.

EUR/USD bang in the middle of its weekly range

EUR/USD is finishing the week right in the middle of its range this week. Thus, the most significant upside resistance comes in the form of weekly highs around 1.1890, while the most significant support comes at the weekly lows around 1.1815. A break in either direction next week (or in the coming weeks) will be indicative of either a continuation of the USD weakness we have already seen this November or a pullback on it.

In terms of notable levels outside of this week’s range; to the upside, the next level of note is just beyond the 1.1900 mark, the 10 September and 9 November highs at 1.1919. To the downside, the 11 November lows at just under 1.1750 will be important to watch.

EUR/USD one hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD climbs above 0.6200 amid broad USD weakness and trade jitters

The Australian Dollar extended its advance on Thursday, climbing toward the 0.6240 zone. The pair built on recent strength as the US Dollar Index slid further toward multi-month lows near the 101 area. This move came after markets digested the White House’s confirmation of a steep 145% tariff on Chinese goods, combined with a cautious Federal Reserve tone.

EUR/USD surges higher as tariff walk-back eases tensions further

EUR/USD roared into its highest bids in nearly two years on Thursday, breaching and closing above the 1.1200 handle for the first time in 21 months. Market tensions continue to ease following the Trump administration’s last-minute pivot away from its own tariffs, sparking a softening in US Dollar flows.

Gold rises to record high near $3,200 on US-China tariff war

Gold price surges to near an all-time high around $3,190 during the early Asian session on Friday. The weakening of the US Dollar and escalating trade war between the United States and China provide some support to the precious metal.

Bitcoin miners scurry to import mining equipment following Trump's China tariffs

Bitcoin miners are reportedly scrambling to import mining equipment into the United States following rising tariff tensions in the US-China trade war, according to a Blockspace report on Wednesday.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.