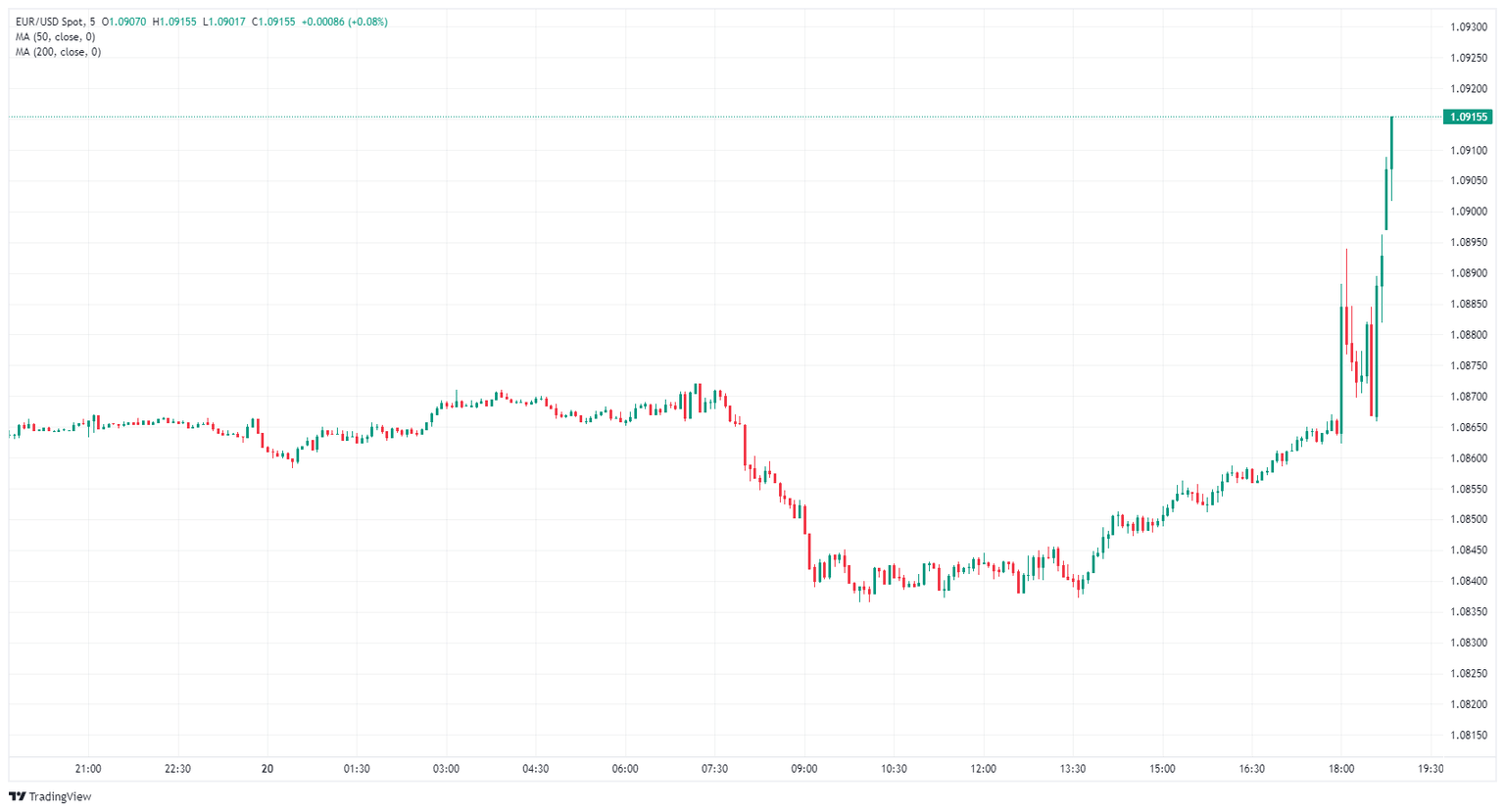

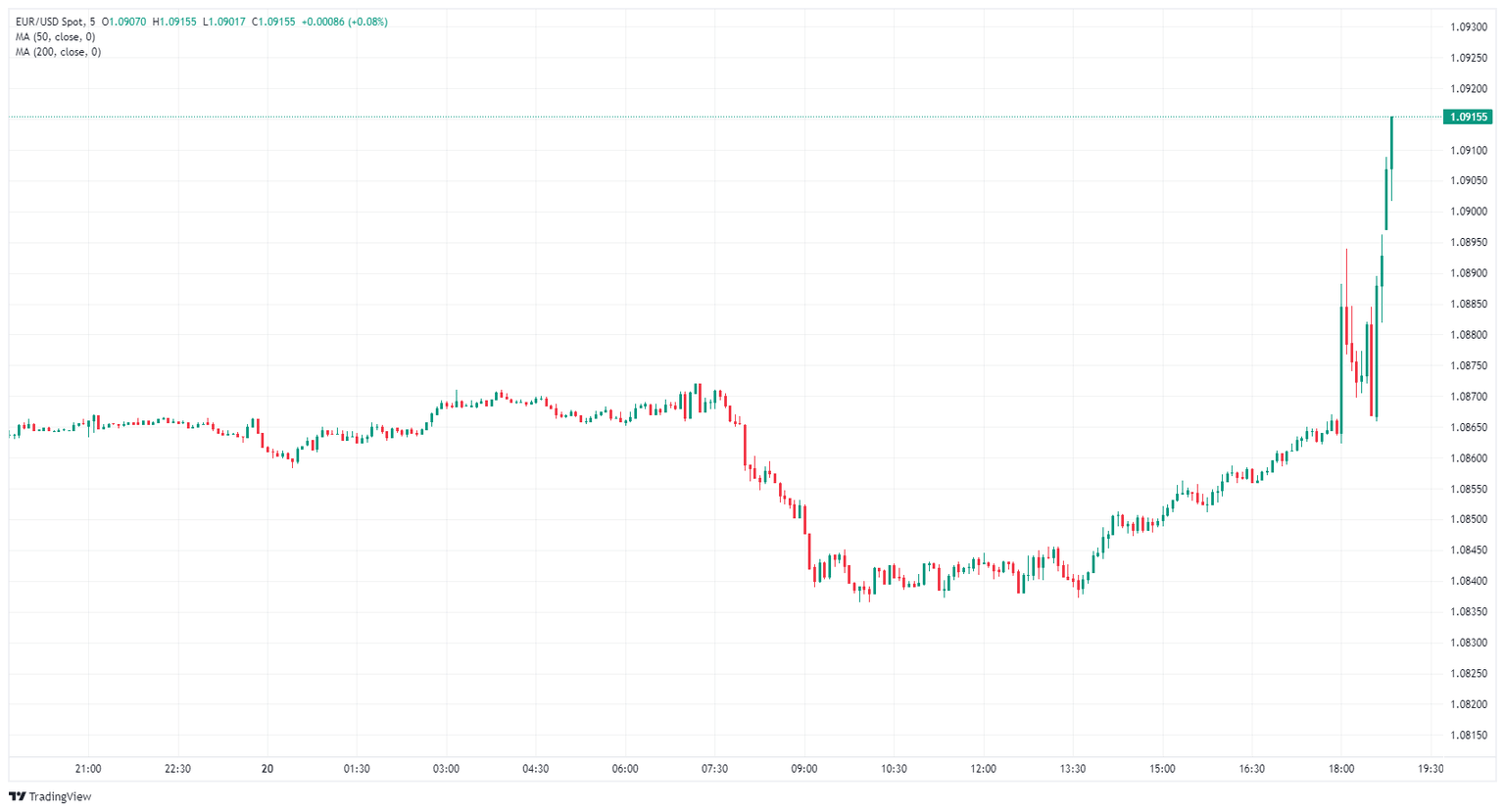

EUR/USD jumps over 1.0900 after Fed rate hold, markets interpret dovish FOMC stance

- EUR/USD bumped towards 1.0900 after Fed held steady.

- Fed Dot Plot still sees 75 bps in 2024.

- Fed expects rates to be held higher by end of 2026.

EUR/USD jumped on reaction to the Federal Reserve’s (Fed) latest rate call, which held rates at 5.5% as markets had broadly predicted. Investor expectations are pricing in additional easing in 2024, despite the Federal Open Market Committee seeing stronger growth through 2024 and 2025 than initially expected. The FOMC’s Dot Plot of interest rate expectations also saw a rise in the long tail end of the curve, with end-2026 rates now forecast to land somewhere around 3.1% versus the previous 2.9%.

The Fed is now projecting a higher long-term policy rate through December, ticking up to 2.6% from 2.5%, but markets are shrugging off the Fed’s growth expectations to push down the US Dollar (USD), sending the Euro (EUR) higher. EUR/USD crossed 1.0890 following the market’s pre-baked reaction to the Fed’s rate call.

Read more: Fed leaves interest rate unchanged at 5.25%-5.5% as forecast

Fed Chair Powell noted during the FOMC Press Conference that while inflation continues to ease, price growth remains a key issue the Fed can't dismiss, as a tight labor market and higher-than-expected growth continues to complicate the future of rate cuts.

Powell speech: January and February inflation numbers did not add to our confidence

EUR/USD 5-minute chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.