EUR/USD turns sideways with Eurozone, US inflation data under spotlight

- EUR/USD steadies below 1.1200 with investors focusing on the inflation data from both the Eurozone and the US.

- The ECB is expected to deliver two more interest rate cuts by year-end.

- Fed’s Mary Daly vows for a 25-basis-points interest-rate reduction in September.

EUR/USD trades in a tight range below the immediate resistance of 1.1200 in Tuesday’s North American session. The major currency pair consolidates as investors look for fresh cues about how much the European Central Bank (ECB) and the US Federal Reserve (Fed) will cut interest rates this year.

Market participants currently see an ECB September interest rate cut as certain. The central bank is also expected to cut its key borrowing rates again somewhere during the last quarter of this year. This growing speculation of two additional interest rate cuts responds to easing price pressures in the Eurozone and the uncertainty over its economic outlook.

For the latest update on the current status of Eurozone inflation, investors await the flash Harmonized Index of Consumer Prices (HICP) data for August, which will be published on Friday. On year, the headline and core HICP – which excludes volatile components like food, energy, alcohol, and tobacco – are estimated to have slowed to 2.2% and 2.8%, respectively. The scenario of soft inflationary pressures could weigh on the Euro as it would strengthen market speculation for further rate cuts. On the contrary, surprisingly hot inflation figures would weaken them, providing support to the Euro.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.04% | -0.19% | -0.01% | -0.11% | -0.07% | -0.37% | -0.16% | |

| EUR | -0.04% | -0.23% | -0.05% | -0.16% | -0.11% | -0.43% | -0.19% | |

| GBP | 0.19% | 0.23% | 0.19% | 0.09% | 0.12% | -0.18% | 0.04% | |

| JPY | 0.01% | 0.05% | -0.19% | -0.11% | -0.07% | -0.38% | -0.15% | |

| CAD | 0.11% | 0.16% | -0.09% | 0.11% | 0.03% | -0.27% | -0.03% | |

| AUD | 0.07% | 0.11% | -0.12% | 0.07% | -0.03% | -0.31% | -0.07% | |

| NZD | 0.37% | 0.43% | 0.18% | 0.38% | 0.27% | 0.31% | 0.22% | |

| CHF | 0.16% | 0.19% | -0.04% | 0.15% | 0.03% | 0.07% | -0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: EUR/USD consolidates while US Dollar remains inside bearish trajectory

- EUR/USD consolidates slightly below 1.1200 in Tuesday's New York session as the US Dollar (USD) struggles to gain ground after posting a fresh year-to-date low. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, hovers below 101.00. The Greenback is expected to remain sideways as investors focus on the United States (US) core Personal Consumption Expenditure Price Index (PCE) data for July, which will be published on Friday.

- The Federal Reserve’s (Fed) preferred inflation measure could provide cues about the likely pace at which the central bank will cut interest rates in September. The annual core PCE is estimated to have accelerated to 2.7% from the prior release of 2.6%, with monthly figures seen growing steadily by 0.2%.

- According to the CME FedWatch tool, 30-day Federal Funds Futures pricing data shows that the probability of a 50-basis points (bps) interest rate reduction in September is 28.5%, while the rest points to a 25-bps rate cut, indicating that the Fed return to policy-normalization is certain.

- Meanwhile, most Fed officials also see rate cuts in September as appropriate, given that the central bank is now more worried about emerging risks to the job market. San Francisco Fed Bank President Mary Daly said that "the time is upon us" to cut interest rates, in an interview with Bloomberg on Monday. When asked about the likely size of interest rate cuts, Daily said that she expects a 25-bps interest rate reduction is most likely, however, she left doors open for a 50-bps rate cut if the labor market deteriorates.

Technical Analysis: EUR/USD hovers below 1.1200

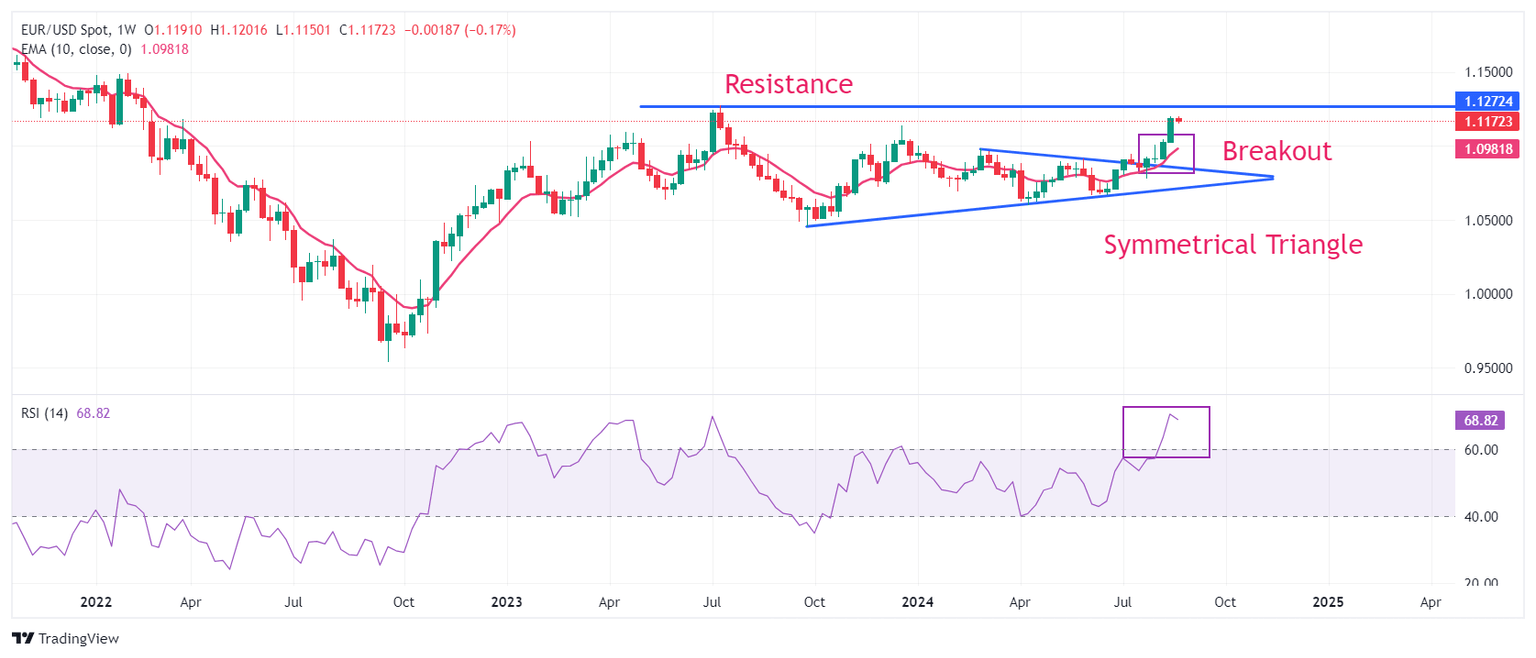

EUR/USD turns sideways after posting a fresh swing high at 1.1200. The major currency pair strengthened after a breakout of the Symmetrical Triangle chart pattern on the weekly time frame. The upward-sloping 10-week Exponential Moving Average (EMA) near 1.0940 supports more upside ahead.

The 14-period Relative Strength Index (RSI) oscillates in the bullish range of 60.00-80.00, suggesting a strong upside momentum. Still, it has reached overbought levels at around 70.00, increasing the chances of a corrective pullback. On the upside, the July 2023 high at 1.1275 will be the next stop for the Euro bulls.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.