EUR/USD churns as Powell reiterates well-calibrated stance

- EUR/USD saw an uptick in volatility, but little in the way of daily change.

- Fed held rates steady as rate futures broadly anticipated.

- Fed Chair Powell reiterated the Fed's data-dependent stance.

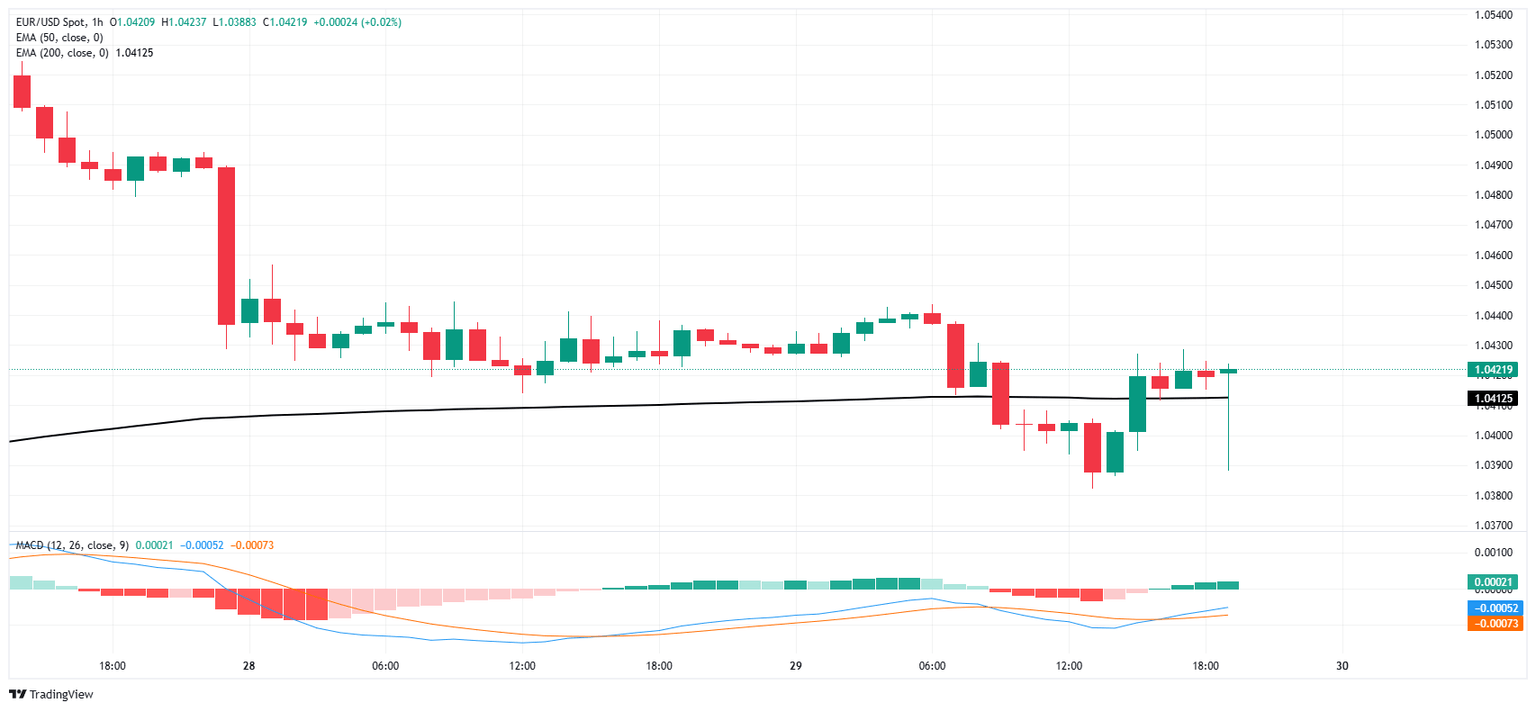

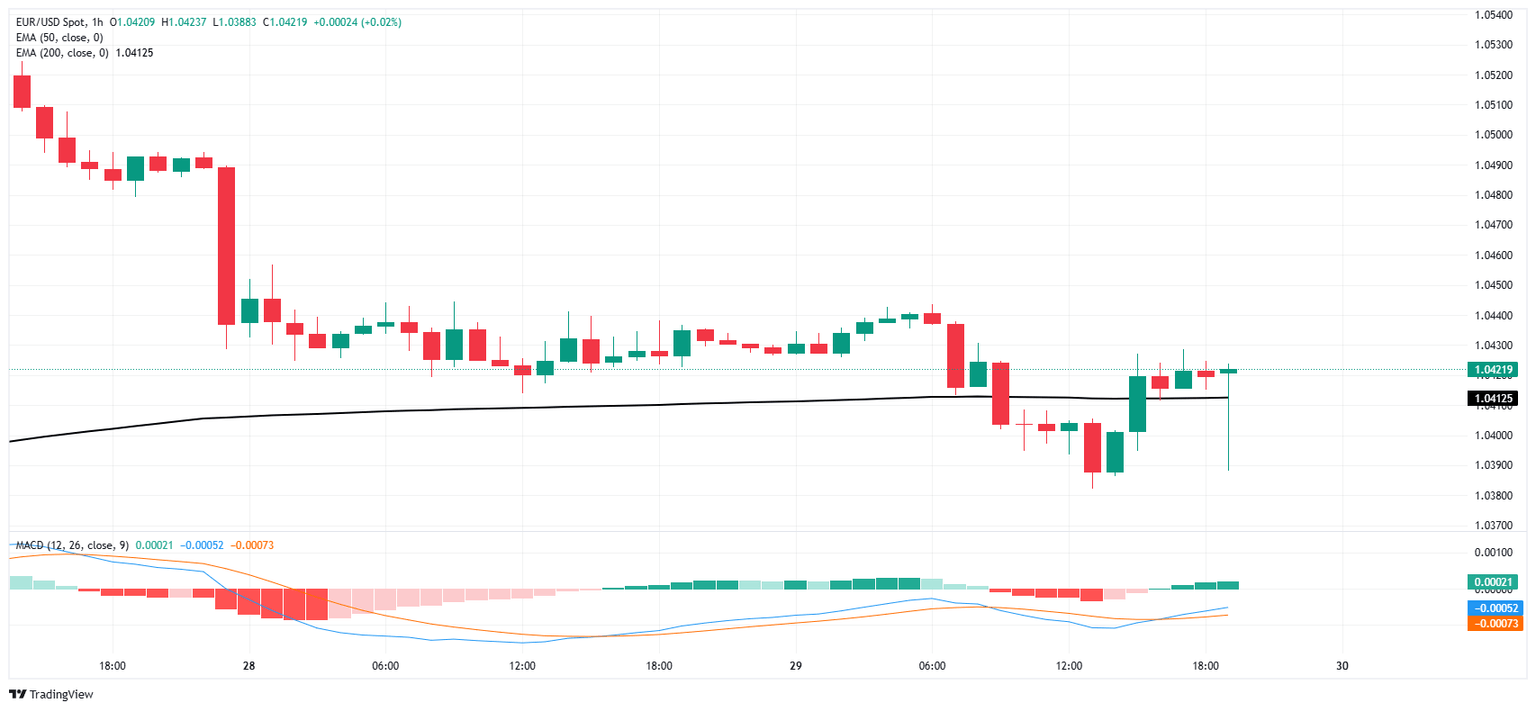

EUR/USD frothed on Wednesday, testing down to 1.0390 before recovering back above the 1.0400 handle as the tug-of-war between bulls and bears translates into chart churn at the intraday level. The Federal Reserve (Fed) held rates steady, as rate futures markets had broadly predicated, and Fed Chair Jerome Powell reiterated the Fed's data-dependent approach to making rate adjustments.

Read More: The Fed will keep its inflation goal

Fed Chair Powell noted that the Federal Open Market Committee (FOMC) is closely watching what kind of policies are enacted by US President Donald Trump, but denied that the newly-minted US President has been in contact with the Fed directly. As an independent federal institution, the White House holds little sway over policy guidance set by the Federal Reserve.Fed Chair Powell noted that the Federal Open Market Committee (FOMC) is closely watching what kind of policies are enacted by US President Donald Trump, but denied that the newly-minted US President has been in contact with the Fed directly. As an independent federal institution, the White House holds little sway over policy guidance set by the Federal Reserve.

Fed Chair Powell also noted that while inflation is still grinding its way toward median target levels, the current economic landscape, plus some concerns over massive trade policies being pursued by US President Trump, means the Fed is in no particular rush to adjust the restrictiveness of policy rates.

Rate markets have trimmed their bets of Fed rate cuts in 2025. According to the CME's FedWatch Tool, rate futures markets are pricing in no moves on the fed funds rate until June at the earliest.

EUR/USD, one-hour chart

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Last release: Wed Jan 29, 2025 19:00

Frequency: Irregular

Actual: 4.5%

Consensus: 4.5%

Previous: 4.5%

Source: Federal Reserve

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.