EUR/USD gets buoyed around 1.0850 after mixed Eurozone data, US PMI awaited

- EUR/USD rises even as Fed Minutes reflected concerns over premature interest-rate cuts.

- Eurozone, German PMI data for February suggest improving activity in the services sector, but manufacturing lags.

- The US Dollar loses ground despite expectations of higher prolonged policy rates.

- S&P US PMI data, weekly Initial Jobless Claims, and Existing Home Sales are due on Thursday.

The EUR/USD pair extends its winning streak for the seventh consecutive day on Thursday as the US Dollar (USD) weakens despite market expectations of prolonged higher interest rates by the Federal Reserve (Fed). The Federal Open Market Committee (FOMC) Minutes reflected policymakers' concerns about early interest rate cuts, suggesting that policy easing will not begin in the upcoming monetary meetings.

In Europe, Eurozone and German Purchasing Managers Index (PMI) data posted mixed figures for February. The preliminary Eurozone and German Services PMIs rose higher than the expected figures, while Manufacturing PMIs were weaker than market expectations. Traders’ focus shifts to the United States to observe S&P Global PMI figures, weekly Initial Jobless Claims, and Existing Home Sales later in the North American session.

The US Dollar Index (DXY) declines to 103.70, with the 2-year and 10-year yields on US bonds at 4.65% and 4.31%, respectively, at the time of writing. The FOMC Meeting Minutes for January emphasized the need for additional evidence of disinflation to mitigate concerns of upside inflation risks. This cautious stance comes after hot figures from the Consumer Price Index (CPI) and Producer Price Index (PPI) from January, along with robust employment data from February.

Daily digest market movers: EUR/USD extends gains amid mixed Eurozone, Germany PMI data

- German Services PMI improved to 48.2 in February, exceeding the market expectations of 48.0 and 47.7 prior.

- German Manufacturing PMI declined to 42.3 against the expected increase to 46.1 from the previous reading of 45.5.

- HCOB German Composite PMI decreased to 46.1 from the previous reading of 47.0.

- Eurozone Services PMI rose to 50 reading in February against the expected 48.8 and 48.4 prior.

- Eurozone Manufacturing PMI decreased to 46.1 against the expected increase to 47.0 from the previous reading of 46.6.

- HCOB Eurozone composite PMI improved to 48.9 against the expected 48.5 and 47.9 prior.

- According to the German Bundesbank Monthly Report, economists at Deutsche Bundesbank anticipate a general decline in the inflation rate in the upcoming months. The earlier timing of Easter this year compared to last year is expected to influence the prices of package holidays, consequently impacting the inflation rate.

- German Buba Monthly Report projected that inflation for food and other goods will likely decrease further in the coming months. However, price pressures in the services sector are expected to ease at a slower pace, primarily due to the sustained strength in wage growth.

- According to the CME FedWatch Tool, the probability of a Federal Reserve rate cut has notably decreased to 4.5% for March and to 29.8% for May. The tool indicates a slight decrease in the likelihood of a cut in June, with a probability of 52.2%, down from 53.3% previously. The probability of a rate cut has increased for July, rising to 37.4% from the previous 33.4%.

- S&P's analysis of the FOMC minutes suggests that inflation is expected to continue cooling in the upcoming months, despite ongoing uneven disinflationary trends. They maintain their outlook for monetary policy in 2024, expecting no changes. S&P predicts that the Federal Reserve will likely reduce its policy rate by 25 basis points at its June meeting, with further cuts totaling 75 basis points by the end of the year.

- Richmond Federal Reserve Bank President Thomas Barkin said that the United States still has "ways to go" to achieve a soft landing, Reuters reports. Barkin highlighted the overall positive trajectory of US data concerning inflation and employment. However, he noted that recent figures on the PPI and CPI have been less favorable, indicating a reliance on disinflation from goods. He suggested that the US is nearing the end of its inflation challenge, with the pressing question being the duration until resolution.

- The last Federal Reserve's dot plot for this year suggests an anticipation of 75 basis points in rate cuts, while the Fed funds futures market is pricing in approximately 89 basis points in cuts. Additionally, ANZ anticipates that the Federal Reserve (Fed) will commence rate cuts from July 2024.

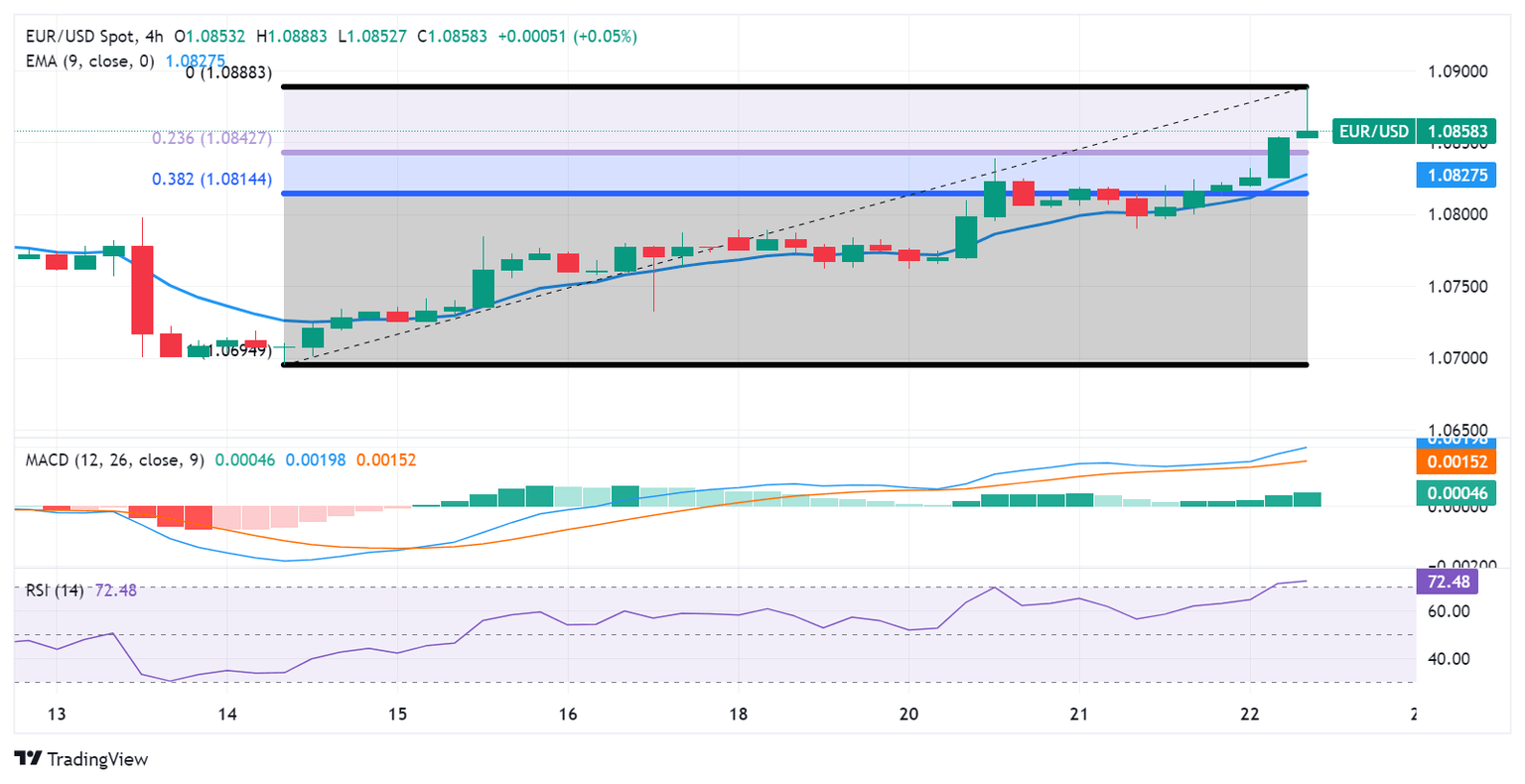

Technical Analysis: EUR/USD hovers around the major level of 1.0850

EUR/USD trades near 1.0860 on Thursday, which is positioned above the immediate support of 1.0850 followed by a 23.6% Fibonacci retracement level of 1.0842 and the nine-4hour Exponential Moving Average (EMA) at 1.0829. A break below the latter could lead the EUR/USD pair to navigate towards the support region around the 38.2% Fibonacci retracement level at 1.0814 and the psychological level of 1.0800.

The 14-hour Relative Strength Index (RSI) is above the 50 level, suggesting bullish momentum. Additionally, the Moving Average Convergence Divergence (MACD) is positioned above both the centerline and the signal line, further confirming the bullish trend.

On the upside, the EUR/USD pair tests February’s high of 1.0897, which is aligned with the psychological level of 1.0900. A breakthrough above this psychological barrier could prompt the pair to explore the area around the 1.0950 level.

EUR/USD: 4-Hour Chart

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.26% | -0.26% | -0.31% | -0.41% | -0.05% | -0.42% | -0.13% | |

| EUR | 0.26% | 0.00% | -0.06% | -0.15% | 0.21% | -0.15% | 0.14% | |

| GBP | 0.26% | 0.01% | -0.05% | -0.15% | 0.22% | -0.14% | 0.14% | |

| CAD | 0.29% | 0.06% | 0.06% | -0.08% | 0.27% | -0.09% | 0.21% | |

| AUD | 0.40% | 0.14% | 0.15% | 0.09% | 0.37% | 0.00% | 0.28% | |

| JPY | 0.05% | -0.22% | -0.23% | -0.27% | -0.39% | -0.35% | -0.06% | |

| NZD | 0.42% | 0.15% | 0.15% | 0.09% | 0.00% | 0.36% | 0.30% | |

| CHF | 0.13% | -0.14% | -0.14% | -0.20% | -0.28% | 0.08% | -0.30% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.