EUR/USD holds tight waiting the next catalyst

- EUR/USD is flat in Asia, stuck around 1.0840 as markets consolidate the overnight volatility.

- The Fed and ECB took the spotlight on Thursday into the end of the week, both of which impacted the euro and USD.

EUR/USD is flat on the day after a relatively choppy end to the week with the US dollar that was supported by the US yield rising overnight. The single currency was also finding support from remarks from European central bankers but the move faded into New York day.

Meanwhile, the euro has traded in a tight 14-pip range in Asia, between a low of 1.0830 and 1.0846 so far. The markets are in consolidation following the Federal Reserve chair Jerome Powell's remarks in Washington DC as part of the IMF and World Bank spring meetings.

Powell explained that a 50 bp hike is on the table for May. He also said that it was appropriate to speed up and front load tightening. However, he did not discuss the policy path beyond that. The US dollar got a boost from the comments in midday NY trade but the euro had been a driving force in the forex space.

Firstly, the incumbent French President Emmanuel Macron's election debate was favoured in the polls, supporting the single currency. Additionally, the euro climbed to a more than one-week high on Thursday against the dollar after a spate of hawkish comments from European Central Bank officials raised bets that eurozone interest rates will rise soon. Joachim Nagel, president of Germany's Bundesbank, joined a chorus of policymakers in saying the ECB could raise interest rates at the start of the third quarter.

However, it was the greenback that stole the show again and the hawkish rhetoric from the Fed has even driven analysts at Nomura to predict that the Fed will actually raise rates by 75 basis points at each of their meetings in June and July. After a 50 bps move in May, that would push the fed-funds rate to a 2.25%-2.5% range by the end of July. Consequently, the 2-year government bond yields rose from 2.57% to 2.68%, and 10-year government bond yields climbed from 2.82% to 2.91%.

Looking to the US data from overnight, US Weekly Initial Jobless Claims were close to expectations at 184k (estimates of. 180k). Meanwhile, Continuing Claims undershot expectations again at 1.417m (est. 1.459m). However, the US Philadelphia Fed Manufacturing Index was considerably weaker than expected. The index fell to 17.6pts in April (down from 27.4 in March) and was well below expectations.

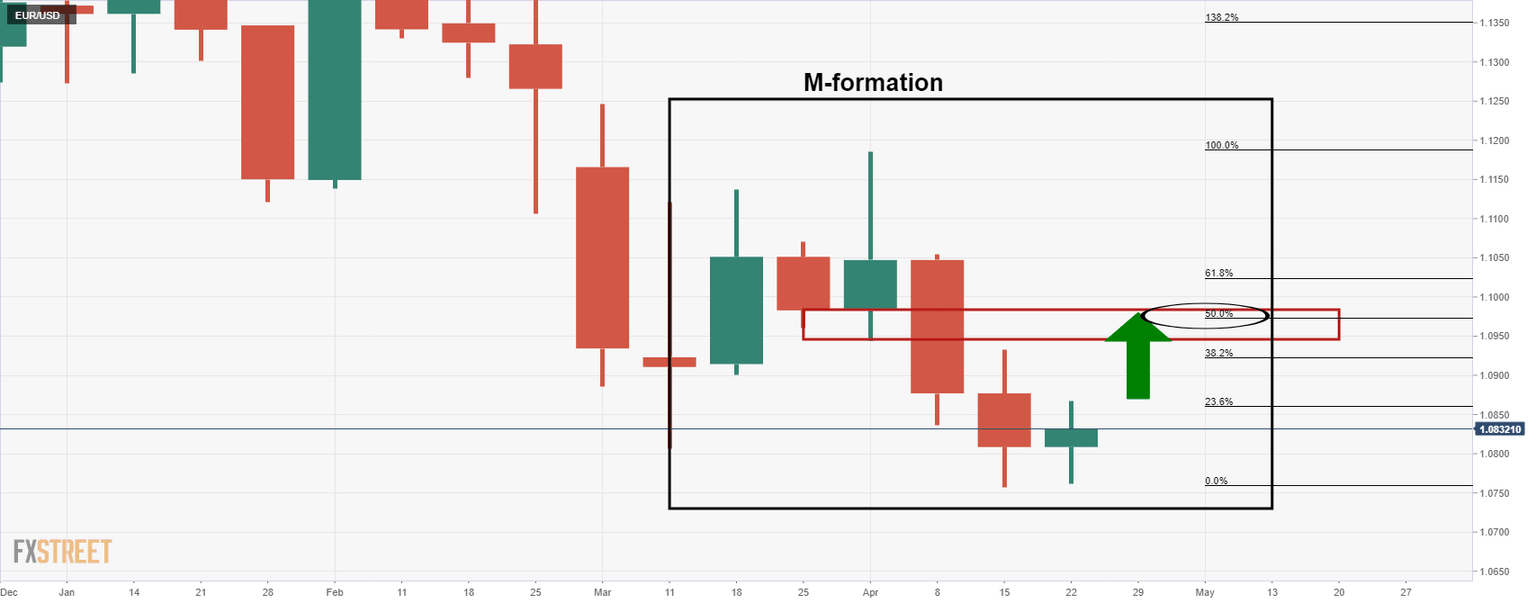

EUR/USD weekly chart

The M-formation identified on the weekly chart is a reversion pattern. The bulls will be eyeing the neckline in order to mitigate the imbalance of the price. ''The area can be targeted from a lower time frame perspective. The daily chart is the first place to start such analysis in order to determine the progress of the formation of a bullish structure.''

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.