- EUR/USD reverses the recent weakness and targets 1.0200.

- German 10y Bund yields add to the ongoing recovery.

- Germany Construction PMI eased to 43.7 in July.

The single currency so far manages to regain some upside traction and pushes EUR/USD back to the 1.0180 region on Thursday.

EUR/USD stronger on USD-selling

The now soft stance surrounding the greenback allows the current rebound in the risk complex and prompts EUR/USD to attempt another move to the key barrier in the 1.0200 region.

The dollar, in the meantime, appears on the back foot despite higher yields and the recent hawkish rhetoric from several Fed speakers, who in general reinforced the ongoing tightening process and advocated for further rate hikes in the next months, always amidst the current context persistent elevated inflation.

The bounce in the pair so far comes pari passu with another improvement in the German 10y Bund yields, this time flirting with the 0.90% area.

In Germany, the Construction PMI worsened to 43.7 in July and Factory Orders contracted at a monthly 0.4% in June.

Data across the pond will include Initial Claims and the Balance of Trade.

What to look for around EUR

EUR/USD looks to regain composure and initially targets the 1.0200 zone ahead of recent tops near 1.0300, always on the back of the renewed selling pressure hitting the dollar.

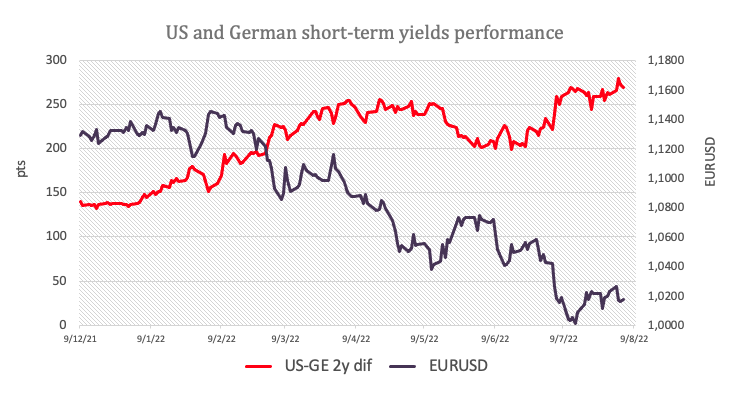

Price action around the European currency, in the meantime, is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerges the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment readings among investors and the renewed downtrend in some fundamentals.

Key events in the euro area this week: Germany Construction PMI (Thursday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of monetary conditions. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is advancing 0.17% at 1.0180 and a breakout of 1.0293 (monthly high August 2) would target 1.0409 (55-day SMA) en route to 1.0615 (weekly high June 27). Next on the downside comes the next support at 1.0096 (weekly low July 26) seconded by 1.0000 (psychological level) and finally 0.9952 (2022 low July 14).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Upside appears capped at 0.6300 on Trump's tariff fallout

AUD/USD struggles to build on the previous day's rebound and remains below the 0.6300 mark early Wednesday, anticipating US President Trump's tariffs announcement later in the day. However, buyers continue to draw support from China's stimulus optimism and RBA's prudence on the policy outlook.

USD/JPY holds losses below 150.00 as traders await Trump's tariffs

USD/JPY stays defensive below 150.00 in Wednesday's Asian trading as traders turn cautious ahead of Trump's reciprocal tariffs announcement. A cautious market mood and BoJ Ueda's comments underpin the Japanese Yen, keeping the pair under pressure amid a subdued US Dollar.

Gold price holds comfortably above $3,100 amid trade jitters

Gold price attracts some dip-buyers following the previous day's retracement slide from the record high amid persistent safe-haven demand, bolstered by worries about a tariff-driven global economic slowdown. Furthermore, Fed rate cut expectations and the lack of USD buying interest offer additional support to the XAU/USD.

US Government to conclude BTC, ETH, XRP, SOL, and ADA reserves audit next Saturday

Bitcoin price rose 3% on Tuesday, as MicroStrategy, Metaplanet and Tether all announced fresh BTC purchase. However, BTC price is likely to remain volatile ahead of the anticipated disclosure of U.S. government crypto holdings, which could fuel speculation in the coming days.

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.