EUR/USD gains momentum as dovish Fed comments and weak US data drive USD lower

- EUR/USD reaches 1.0746, surging over 0.50% from its opening price, following a weekly low of 1.0635.

- Weakening US manufacturing activity, as indicated by the ISM Manufacturing PMI falling to 46.9 in May, fuels speculation of a Fed pause on tightening.

- Mixed employment data shows private hiring surging but falling short of April’s numbers, while Initial Jobless Claims indicate a tight labor market.

EUR/USD shifted gears after printing a weekly low of 1.0635, climbs bolstered by dovish US Federal Reserve (Fed) officials’ comments, alongside soft economic data from the United States (US). Therefore, investors looking towards a less hawkish Fed dumped the US Dollar (US) in favor of riskier assets. At the time of writing, the EUR/USD exchanges hands at 1.0746, more than 0.50% above its opening price.

Sentiment improves as Fed takes a dovish stance; US economic data disappoints

US equities are trading in positive territory amidst weakening manufacturing activity in the United States (US), which could warrant a Fed’s pause on its tightening cycle. The ISM Manufacturing PMI in May, slipped to 46.9, falling under both April’s 47.1 and the expected 47. These sub-50 readings generally indicate a recessionary phase, weighed by a plunge in new orders.

The EUR/USD printed a subsequent leg-up toward 1.0750 in the release of the ISM, though mixed employment data already bolstered it. Although private hiring surged by 278K, as shown by the ADP National Employment report for May, smashing estimates of 170K, it fell short of April’s impressive 291K.

After that report, Initial Jobless Claims rose to 232K or the week ending May 27, slightly below estimates but higher than the previous week’s downward-revised 230K, pointing to a persistently tight labor market.

In light of these data, Philadelphia Fed President Patrick Harker is expected to weigh in later today. Notably, EUR/USD traders should remember recent remarks by Fed Governor Philip Jefferson, who suggested a pause in rate hikes at June’s meeting - a view Harker supports. However, he notes that upcoming data could sway his stance.

Concerning the Eurozone (EU) economic calendar, recently revealed data showed that inflation somewhat eased in the bloc. However, the European Central Bank (ECB) President Christine Lagarde delivered hawkish remarks, saying, “ There is no clear evidence that underlying inflation has peaked.”

Given the backdrop, interest rates futures markets expect another 25 bps lift by the ECB at the upcoming meeting. Even though Germany entered a recession, as shown by the latest Gross Domestic Product (GDP) report, a recovery in Retail Sales cushioned the German economy.

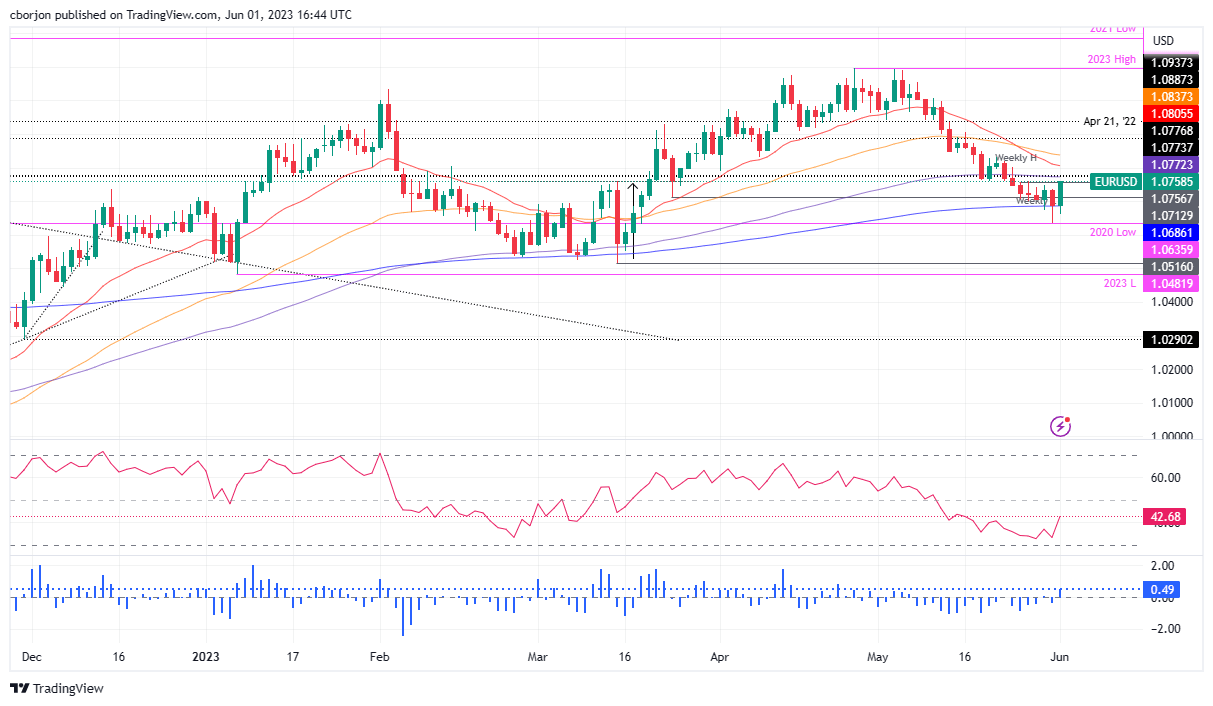

EUR/USD Price Analysis: Technical outlook

The EUR/USD is still neutral to downward biased, capped on the upside, by dynamic resistance levels, in the likes of the 100-day Exponential Moving Average (EMA) at 1.0772, followed by the psychological 1.0800 figure. The 20-day EMA immediately appears at 1.0805, followed by the 50-day EMA at 1.0837. Nevertheless, the Relative Strength Index (RSI) indicator and the 3-day Rate of Change (RoC) remain in bearish territory, warranting further downside. But, the EUR/USD must fall below the May 31 open of 1.0734, which could pave the way for further losses. Support levels lie at 1.0700, followed by the 20—day EMA at 1.0686, briefly tested on June 1.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.