EUR/USD slides below 1.0700 as Fed's hawkish remarks strengthen US Dollar

- EUR/USD slips below 1.0700 as the Fed maintains hawkish guidance on interest rates.

- Fed’s Bowman sees no rate cuts this year.

- Investors will focus on the US core PCE and preliminary inflation data for the major economies of the Eurozone this week.

EUR/USD declines below the round-level support of 1.0700 in Wednesday’s American session. The major currency pair remains on the backfoot as the Euro’s near-term outlook weakens amid uncertainty over European Union (EU) legislative elections and growing speculation that the European Central Bank (ECB) could deliver subsequent rate cuts.

Fears over Eurozone elections intensified after French President Emmanuel Macron called for a snap election when his party suffered defeat in preliminary results from Marine Le Pen’s far-right National Rally (RN). The Euro could face more pressure if the shared continent sees a major policy shift.

Meanwhile, expectations for the ECB to deliver back-to-back rate cuts improve as the German economic outlook appears to be worsening due to weak demand prospects. Data showed on Monday that the German IFO Expectations index unexpectedly dropped to 89.0 from the estimates of 91.0 and the former release of 90.3 (downwardly revised from 90.4). On the data release, IFO President Clemens Fuest said, "The German economy is having difficulty overcoming stagnation."

This week, investors will focus on preliminary June inflation data for Spain, France, and Italy, which will be published on Friday.

Daily digest market movers: EUR/USD tumbles as US Dollar surges

- EUR/USD comes under pressure as the US Dollar (USD) advances due to hawkish guidance on interest rates by Federal Reserve (Fed) policymakers, who continue to argue in favor of maintaining the current interest rate framework as they want to see a decline in inflation for months before considering rate cuts. The US Dollar Index (DXY), which tracks the Greenback's value against six major currencies, jumps to a crucial resistance of 106.00. The United States (US) inflation declined more than expected in May, however, officials expect that a one-time decline in price pressures will be insufficient to make rate cuts appropriate.

- On Tuesday, Fed Governor Michelle Bowman delivered hawkish guidance on interest rates. Bowman said they are not at a point where rate cuts become appropriate. She pushed back expectations of rate cuts to 2025 and warned of more hikes if disinflation appears to stall or reverse.

- Contrary to the Fed’s hawkish outlook on interest rates, investors expect two rate cuts this year, and the policy-easing process will begin in the September meeting. For more cues on the interest rate outlook, investors await the core Personal Consumption Expenditures Price Index (PCE) data for May, which will be published on Friday.

- According to the estimates, the PCE inflation report will show that price pressures grew at a slower pace of 0.1% month-on-month from the prior release of 0.2%. Annually, the underlying inflation is expected to rise modestly by 2.6% from 2.8% in April. Soft inflation data would boost expectations of the Fed reducing interest rates in September, while hotter-than-expected figures would weaken them.

Euro Price Today:

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the New Zealand Dollar.

| EUR | USD | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| EUR | -0.41% | -0.01% | 0.05% | -0.15% | -0.36% | 0.30% | -0.16% | |

| USD | 0.41% | 0.40% | 0.48% | 0.28% | 0.03% | 0.69% | 0.26% | |

| GBP | 0.00% | -0.40% | 0.08% | -0.14% | -0.36% | 0.32% | -0.14% | |

| JPY | -0.05% | -0.48% | -0.08% | -0.23% | -0.47% | 0.21% | -0.24% | |

| CAD | 0.15% | -0.28% | 0.14% | 0.23% | -0.28% | 0.43% | -0.03% | |

| AUD | 0.36% | -0.03% | 0.36% | 0.47% | 0.28% | 0.66% | 0.22% | |

| NZD | -0.30% | -0.69% | -0.32% | -0.21% | -0.43% | -0.66% | -0.44% | |

| CHF | 0.16% | -0.26% | 0.14% | 0.24% | 0.03% | -0.22% | 0.44% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

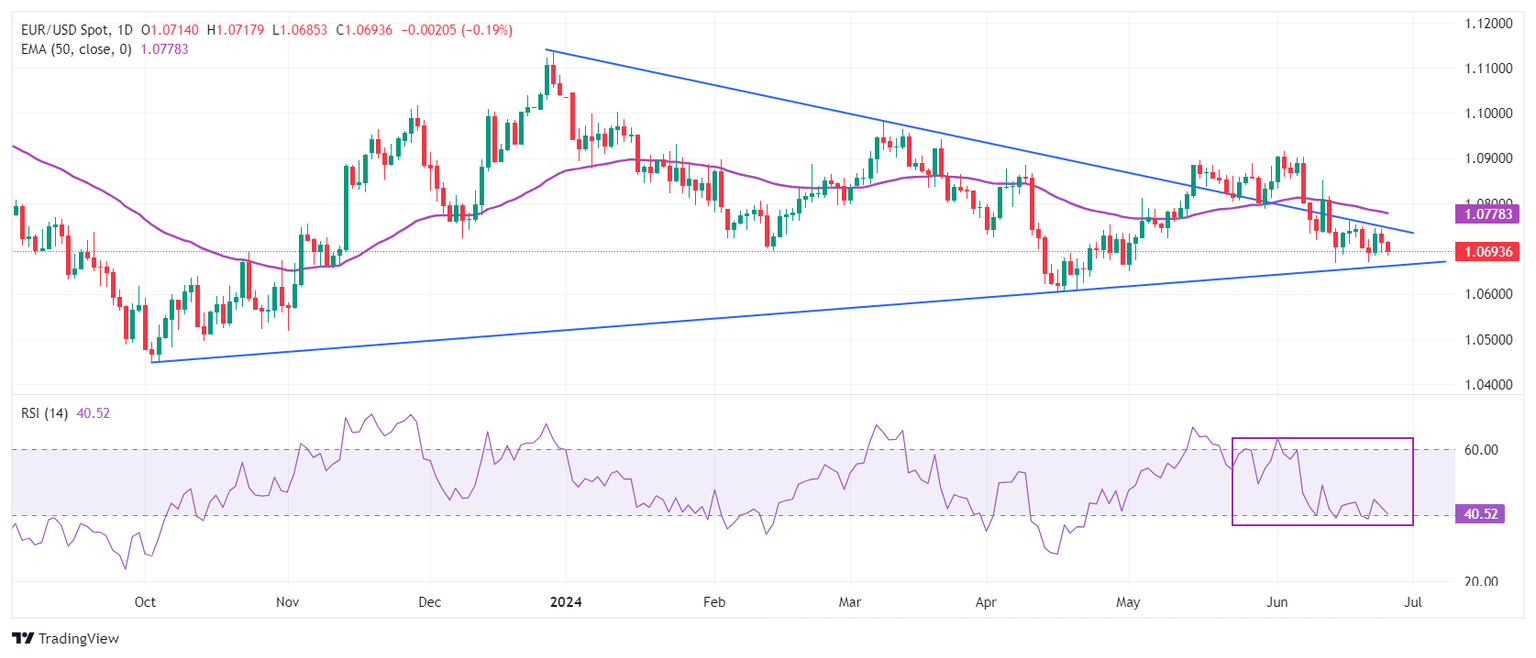

Technical Analysis: EUR/USD establishes below 1.0700

EUR/USD falls slightly below the crucial support of 1.0700. The major currency pair faces selling pressure near the downward-sloping border of a Symmetrical Triangle in the daily chart near 1.0750, which is plotted from 28 December 2023 high around 1.1140. The pair trades below the 50-day Exponential Moving Average (EMA), which indicates that the short-term outlook is bearish.

The 14-period Relative Strength Index (RSI) hovers near 40.00. A bearish momentum would trigger if the oscillator slips below this level.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.