- EUR/USD surpasses the 1.0700 mark, or 4-week highs.

- The dollar remains well on the defensive post-Payrolls.

- The next risk event will be the US CPI due on Tuesday.

The optimism around the European currency remains well in place at the beginning of the week and lifts EUR/USD back above the 1.0700 hurdle, or new 4-week tops.

EUR/USD now looks at US CPPI, ECB

EUR/USD advances for the third session in a row and moves north of the 1.0700 barrier, where some initial resistance seems to have emerged so far.

The continuation of the pair’s rebound comes in response to the persistent sell-off in the greenback, which was particularly exacerbated following the mixed results from the February Payrolls published last Friday.

By the same token, the USD Index (DXY) starts the week well in the negative territory and navigates multi-week lows pari passu with investors repricing of a 25 bps rate hike by the Fed at the March 22 gathering, while some speculation around a no rate at all seems to have also kicked in.

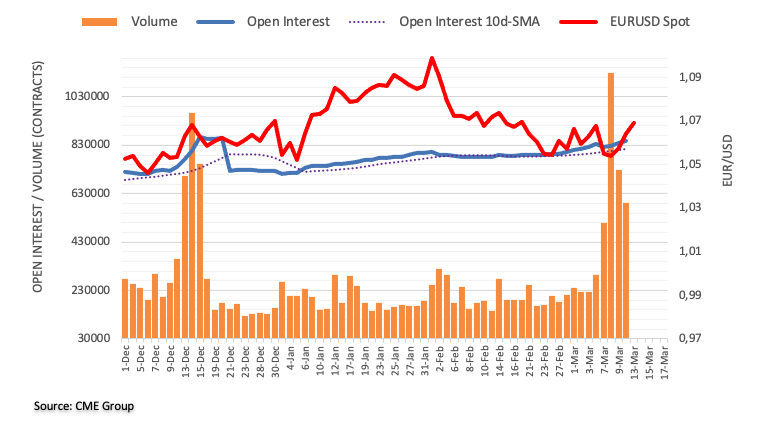

Supporting the view of a stronger EUR/USD, open interest increased in the last three sessions, while volume retreated to more “normal” levels following the post-Powell spike on March 7.

No data releases in the euro area should leave Tuesday’s release of US CPI for the month of February as the salient event in the first half of the week. Moving forward, the ECB meeting on March 16 should see the central bank hiking the policy rate by 50 bps.

What to look for around EUR

EUR/USD manages to reclaim the area above 1.0700 the figure at the beginning of the week, always amidst the persevering retracement in the greenback.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB past the March meeting, when the bank has already anticipated another 50 bps rate hike.

Key events in the euro area this week: Eurogroup Meeting (Monday) – ECOFIN Meeting (Tuesday) – EMU Industrial Production (Wednesday) – ECB Interest Rate decision, ECB Lagarde (Thursday) – EMU Final Inflation Rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is advancing 0.33% at 1.0673 and the breakout of 1.0737 (monthly high March 13) would target 1.0804 (weekly high February 14) en route to 1.1032 (2023 high February 2). On the downside, the initial support comes at 1.0524 (monthly low March 8) seconded by 1.0481 (2023 low January 6) and finally 1.0323 (200-day SMA).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD languishes near multi-year lows below 0.6250 after dovish RBA Minutes

AUD/USD remains depressed below 0.6250 early Tuesday after the December RBA Minutes reiterated that upside inflation risks had diminished, which reaffirms bets for a rate cut in early 2025. This, along with concerns about China's fragile economic recovery and US-China trade war, undermines the Aussie and weighs on the pair.

USD/JPY eases toward 157.00 after Japanese verbal intervention

USD/JPY has come under renewed selling pressure, easing toward 157.00 after Japanese Finance Minister Kato's verbal intervention. The pair erased early gains, induced by the October BoJ meeting Minutes. However, the downside could be limited as the US Dollar hold the previous rebound.

Gold remains stuck between two key barriers amid thin trading

Gold price is attempting another run higher while defending the $2,600 threshold early Tuesday. In doing so, Gold price replicates the recovery moves seen in Monday’s trading, which eventually fizzled out on a broad US Dollar comeback in tandem with US Treasury bond yields.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.