EUR/USD explores further downside ahead of EU GDP prints

- EUR/USD lost grip of the 1.0850 level, poised for further downside.

- EU GDP data due on Tuesday as Fed rate call looms ahead.

- US NFP jobs data dump slated for Friday as markets bet on September rate cut.

EUR/USD lost control of a near-term bullish recovery, testing into fresh two-week lows near the 1.0800 handle as momentum drains out of the pair ahead of an update to pan-EU Gross Domestic Product (GDP) figures. The Federal Reserve’s (Fed) latest rate call is due on Wednesday, with another round of US Nonfarm Payrolls (NFP) on the books for Friday.

Forex Today: Flash GDPs in Europe and US jobs in the spotlight

A slew of European data is slated for Tuesday, with both German and pan-EU GDP update figures due during the Europe market session. QoQ German GDP is expected to ease to 0.1% in Q2 compared to the previous print of 0.2%, while annualized pan-EU GDP growth is forecast to increase to 0.6% from the previous 0.4%, though the QoQ figure for the second quarter is expected to tick down to 0.2% from the previous 0.3%.

Preliminary EU Harmonized Index of Consumer Prices (HICP) inflation is due on Wednesday, with YoY HICP inflation forecast to tick down to 2.8% from the previous 2.9%. After that, global markets will be pivoting to see the latest outing from the Fed.

The Federal Reserve's upcoming rate call on Wednesday will be closely watched by investors who are hoping for signs that the Fed is gearing up to implement a widely-anticipated rate cut when the Federal Open Market Committee (FOMC) meets again in September. The market is generally expecting a minimum 0.25% rate cut on September 18, with rate markets indicating a 90% likelihood of a 25 basis point reduction and a hopeful 10% chance of a larger cut, according to the CME's FedWatch Tool.

In addition, US Nonfarm Payroll (NFP) data is set to be released on Friday, which is an important factor in the Fed's employment criteria. Investors will be monitoring these figures closely in the hope of seeing a continued slowdown in hiring, which could encourage the Fed to initiate a new cycle of rate cuts in September. ADP Employment Change figures for July will be published on Wednesday, providing a forecast for Friday's NFP jobs report, but this forecast is somewhat unreliable due to its inconsistent track record for accuracy.

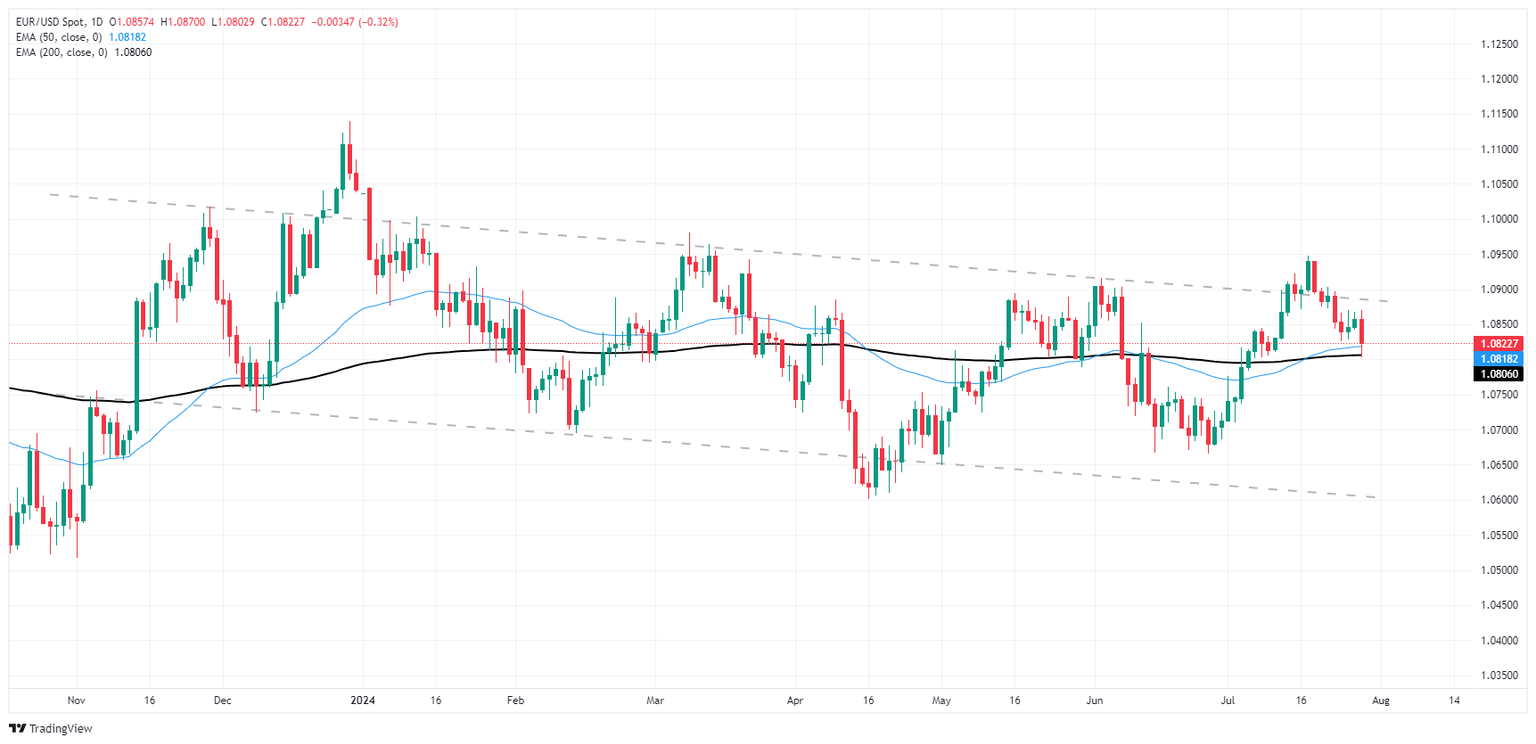

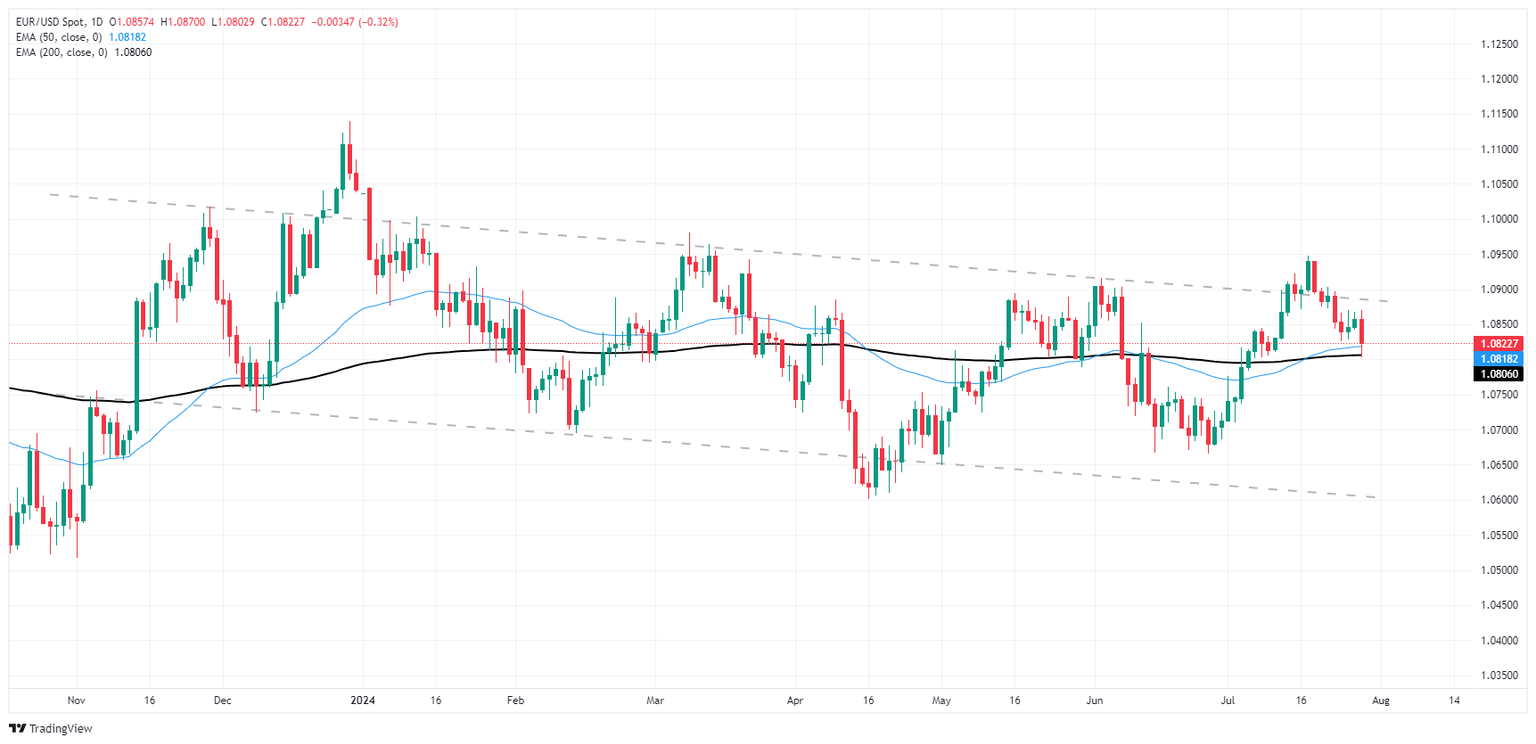

EUR/USD technical outlook

Fiber’s downside push into the 1.0800 region sees the pair coming back into range of the 200-day Exponential Moving Average (EMA) at 1.0795 as markets add in to EUR/USD’s near-term decline from multi-month highs that fell just short of breaking through 1.0950.

EUR/USD has fallen 1.3% top-to-bottom as bids backslide into long-term averages, and buyers are struggling to find a foothold as intraday price action battles with the 50-day EMA at 1.0818.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.