EUR/USD edges up as US inflation print fuels Fed rate cut speculation

- EUR/USD rises in North American trading, buoyed by softer US core PCE inflation data.

- Fed's core PCE index fall to 2.9% raises hopes for interest rate cut, aiding EUR/USD's climb.

- Mixed European signals: German consumer confidence falls, Spanish unemployment at 16-year low, ahead of Fed decision.

The EUR/USD gained some 0.14% in early trading during the North American session as prices in the United States (US) remained above the US Federal Reserve’s goal but eased compared to November’s figures. The major trades at 1.0866 after diving to a low of 1.0812.

The Euro got a life-line of a softer US PCE report

The Fed’s preferred gauge for inflation, the Personal Consumption Expenditures (PCE), rose 2.6% in the 12 months to December, as expected on an annual basis, while core PCE dipped from 3.2% to 2.9% and below forecasts. After the data, the EUR/USD climbed sharply and clocked a daily high of 1.0885 before retreating toward current exchange rates, as the data reaffirmed investors' speculations that the Fed could begin cutting rates by the summer.

The CME FedWatch Tool depicts the odds for a quarter of a percentage rate cut by the Fed at 51.4%, while 50 basis points stand at 37.8%. Nevertheless, US Treasury bond yields reversed its course, climbing higher and putting a lid on the EUR/USD rise.

Meanwhile, data across the pond showed that German consumers remain pessimistic amidst economic uncertainty after the GfK Consumer Confidence for February plunged from .25.4 in January to -29.7. In Spain, the Unemployment Rate fell to levels last seen in 2007, from 11.84% to 11.76% in the last quarter of 2023, according to an INE report.

Ahead of the next week, the main spotlight would be the Federal Reserve’s monetary policy decision on January 30-31.

EUR/USD Price Analysis: Technical outlook

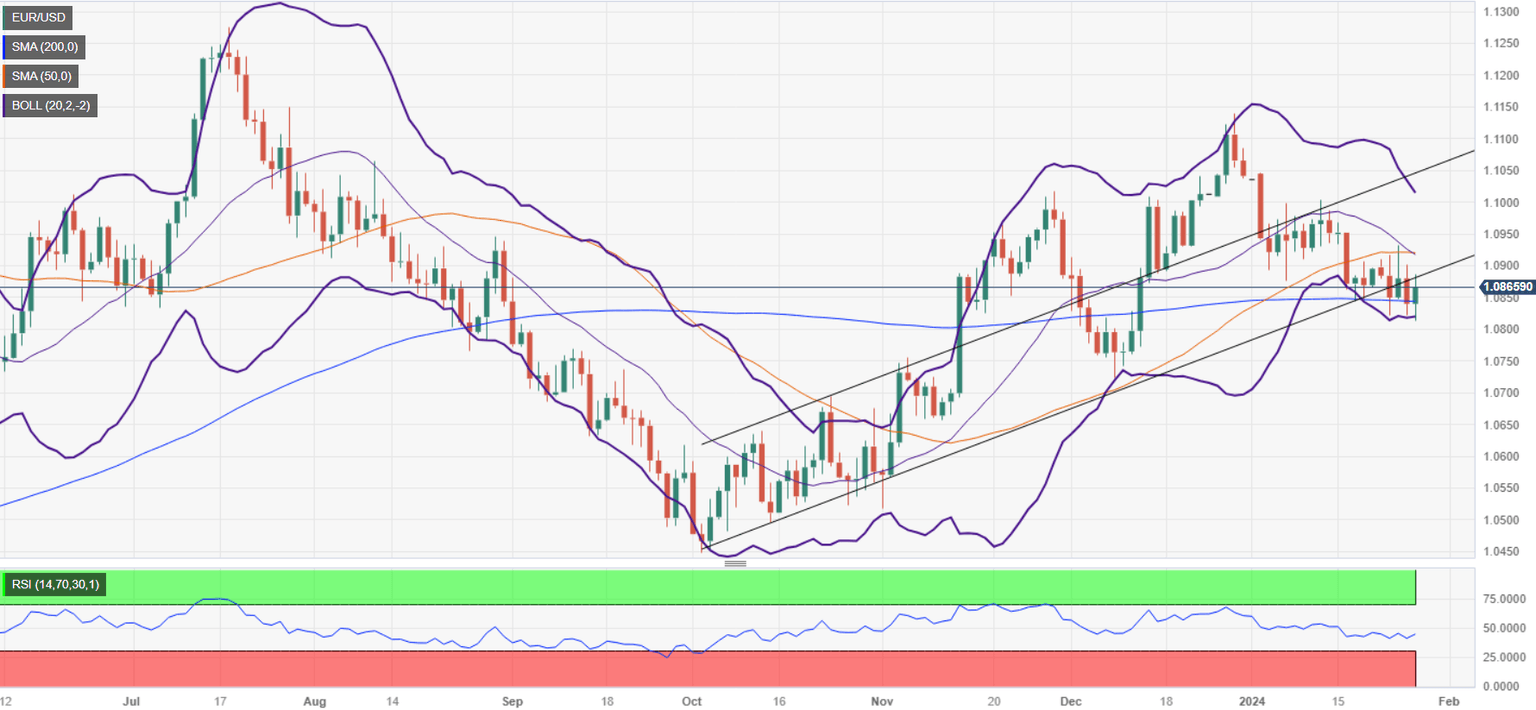

Following the US data release, the EUR/USD advanced towards 1.0900 but failed to break yesterday’s high, which could pave the way for a pullback to the 200-day moving average (DMA) at 1.0843. Downside risks are seen at today’s low 1.0812, followed by the 1.0800 figure. Conversely, if buyers lift the spot prices above 1.0900, as they eye the 50-DMA at 1.0920.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.