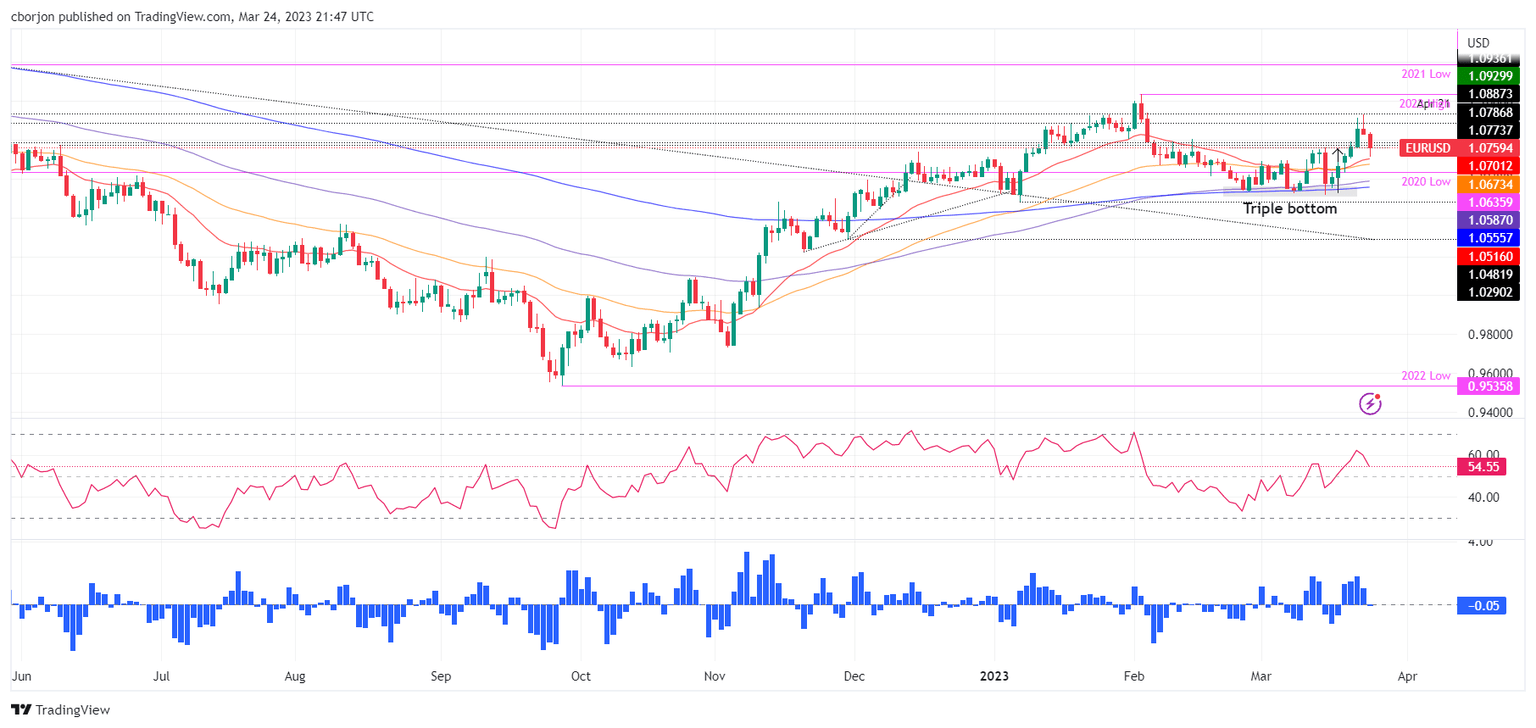

EUR/USD edges lower, and tests 1.0750 support as a triple bottom stays in play

- EUR/USD is set to finish the week with decent gains of 0.89%.

- US economic data was mixed, though it portrays a deceleration of the economy.

- ECB policymakers remain focused on tackling high inflation levels in the Eurozone.

As the New York session finished, EUR/USD fell 0.64% or 69 pips. A risk-on impulse did not help the Euro (EUR), which, pressured by a banking crisis threatening to spread to the Eurozone, weakened the shared currency. At the time of writing, the EUR/USD is trading at 1.0759.

EUR/USD drops on US Dollar strength, weak EU PMIs

Despite experiencing another turbulence, the US equities market is poised to finish the week positively. Deutsche Bank’s stock experienced a sharp decline due to concerns over the possibility of default, reflected in a 220 basis point increase in Credit Default Swaps (CDS). Although this harmed Wall Street at the beginning of the session, investors appeared to dismiss these fears and instead speculated that the Federal Reserve (Fed) would lower interest rates in 2023.

Wall Street finished the week with gains. Deutsche Bank’s stock experienced a sharp decline due to concerns that the bank may default, as evidenced by the 220 basis point rise in Credit Default Swaps (CDS). Although this initially caused some concern on Wall Street, investors ultimately dismissed these fears, speculating that the Federal Reserve (Fed) would reduce interest rates in 2023.

St. Louis Fed President James Bullard expressed that rates should be raised further to reach the 5.50%-5.75% range, which would mean an additional 75 bps of rate hikes on top of the Fed’s recent increase of 4.75%-5.00%. Meanwhile, Atlanta Fed President Raphael Bostic commented that the decision made in March was not easy, as there was a lot of debate and it was not a simple choice.

Thomas Barkin, the President of the Richmond Federal Reserve, stated that he felt the banking sector was very stable when they arrived at the meeting. Therefore the conditions were suitable for implementing monetary policy as intended.

The S&P Global PMI showed improvement in March, surpassing both expectations and the data from the previous month. Although the Manufacturing Index remained in a state of contraction, Durable Good Orders saw a 1% drop, which was still an improvement compared to the reading from the previous month.

In the Euro area (EU), March’s S&P Global PMIs were positive, except for the Manufacturing component, which remained in recessionary territory. European Central Bank (ECB) policymakers crossed news wires, led by the ECB’s President Christine Lagarde, saying there’s no trade-off between price and financial stability.

Bundesbank President Joachim Nagel commented that a pause is not in order as inflation, seen averaging around 6% in Germany, the euro zone’s biggest economy, will take too long to come back to the ECB’s 2% target.“Wage developments are likely to prolong the prevailing period of high inflation rates,” Nagel said in Edinburgh. “In other words: Inflation will become more persistent.”

EUR/USD Technical analysis

The EUR/USD failed to hold to its previous gains, though the triple bottom chart pattern remains in play as long as it stays above 1.0759. A breach of the latter would invalidate the pattern, and open the door for further losses. On the upside, the first resistance would be 1.0800, followed by the 1.0900 figure, ahead of the YTD high at 1.1032.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.