EUR/USD weakens as US Dollar rises ahead of FOMC minutes

- EUR/USD drops as President Trump has threatened to impose 25% tariffs on a few items.

- The Fed is expected to keep interest rates steady for longer.

- Firm ECB dovish bets would continue to cap the Euro’s upside.

EUR/USD declines to near 1.0420 in Wednesday’s early North American session as the US Dollar (USD) extends its upside due to multiple tailwinds. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, rises to near 107.20.

The Greenback moves higher as fears of United States (US) President Donald Trump’s tariffs have renewed. On Tuesday, President Trump announced that he plans to impose 25% tariffs on automobiles, semiconductors, and pharmaceuticals and that duties will increase further next year. He didn’t provide a clear timeline for when these tariffs will come into effect but said that some of them will be enacted by April 2.

Market participants expect Germany, Japan, South Korea, Taiwan, and India would be major casualties of Trump’s latest tariff threat.

Trump’s tariffs on automobiles would weigh on the German economy, which has been experiencing an economic contraction for the past two years. ECB policymaker and Bundesbank President Joachim Nagel said on Monday that our “strong export orientation” makes us “particularly vulnerable from potential Trump tariffs”.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.14% | 0.16% | -0.36% | 0.14% | 0.06% | -0.16% | -0.06% | |

| EUR | -0.14% | 0.01% | -0.49% | -0.01% | -0.08% | -0.30% | -0.20% | |

| GBP | -0.16% | -0.01% | -0.53% | -0.02% | -0.09% | -0.31% | -0.21% | |

| JPY | 0.36% | 0.49% | 0.53% | 0.49% | 0.42% | 0.19% | 0.30% | |

| CAD | -0.14% | 0.00% | 0.02% | -0.49% | -0.08% | -0.30% | -0.20% | |

| AUD | -0.06% | 0.08% | 0.09% | -0.42% | 0.08% | -0.22% | -0.12% | |

| NZD | 0.16% | 0.30% | 0.31% | -0.19% | 0.30% | 0.22% | 0.10% | |

| CHF | 0.06% | 0.20% | 0.21% | -0.30% | 0.20% | 0.12% | -0.10% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Daily digest market movers: EUR/USD weakens on Trump's tariff threats

- EUR/USD is down as the US Dollar gains with investors becoming increasingly confident that the Federal Reserve (Fed) will keep interest rates in the current range of 4.25%-4.50% for longer. According to the CME FedWatch tool, the Fed is expected to keep interest rates steady in the March, May, and June policy meetings.

- On Tuesday, San Francisco Fed Bank President Mary Daly said in a community banking conference hosted by the American Bankers Association that monetary policy needs to remain “restrictive” until she sees that we are really continuing to make “progress on inflation”. Daly added that she wants to be careful before making any policy adjustment, with the labor market and economy remaining solid.

- Regarding the impact of President Trump’s agenda on the economy, Daly said it is difficult to assess the impact of Trump’s policies on economic growth, labor supply, and inflation until she knows details and their "scope, magnitude, and timing."

- For more cues on the interest rate outlook, investors will focus on the Federal Open Market Committee (FOMC) minutes for the January policy meeting, which will be published at 19:00 GMT.

- On the ECB front, traders have fully priced in three more interest rate cuts this year as a few policymakers see risks to inflation undershooting the 2% target. The ECB also reduced its Deposit Facility rate by 25 basis points (bps) to 2.75% but didn’t commit to a pre-defined monetary expansion path.

- Contrary to market expectations, ECB executive board member Isabel Schnabel said in an interview with the Financial Times (FT) that she expects the central bank could announce a "halt" in the monetary expansion cycle as risks to inflation have "skewed to the upside" while borrowing costs had eased a lot. Schnabel warned that domestic inflation was "still high" and wage growth was "still elevated", amid "new shocks to energy prices".

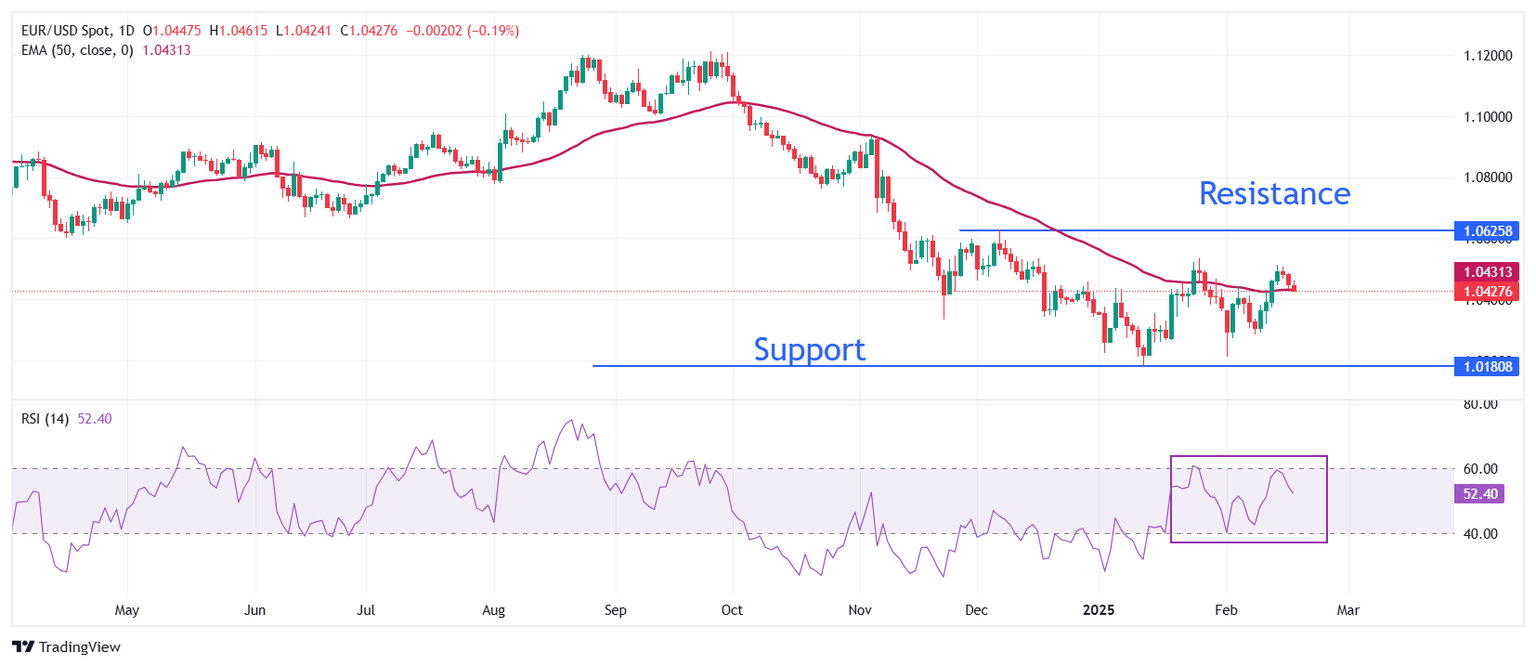

Technical Analysis: EUR/USD struggles to sustain above 50-day EMA

EUR/USD slides to near 1.0420 in early North American trading hours on Wednesday. The major currency pai drops to near the 50-day Exponential Moving Average (EMA), which trades around 1.0430.

The 14-day Relative Strength Index (RSI) struggles to break above 60.00. A bullish momentum would activate if the RSI (14) manages to sustain above that level.

Looking down, the February 10 low of 1.0285 will act as the major support zone for the pair. Conversely, the December 6 high of 1.0630 will be the key barrier for the Euro bulls.

(This story was corrected on February 19 at 10:45 GMT to say ECB policymaker and Bundesbank President Joachim Nagel, not Joachin.)

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Read more.Next release: Wed Feb 19, 2025 19:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.