EUR/USD edges high amid soft US Dollar, central bank speculations

- EUR/USD makes modest gains in a mixed market environment, reacting to shifts in US Treasury yields.

- Anticipation of rate cuts by ECB and Fed in June adds to the currency dynamics, with both currencies under watch.

- ECB policymakers hint at cautious approach to rate cuts, emphasizing inflation targets ahead of key decisions.

The EUR/USD registered solid gains of 0.19% on Wednesday, courtesy of a softer US Dollar amidst high US Treasury bond yields. An absent economic docket in the US, left traders adrift to Eurozone economic data and European Central Bank (ECB) speakers. At the time of writing, the pair exchanges hands at 1.0948 and gains 0.01% as the Thursday Asian session begins.

Euro gains as market eyes ECB and Fed rate decisions

The market mood was mixed, while the macroeconomic outlook involving the Eurozone (EU) bloc and the United States stood pat. The European Central Bank (ECB) and the Federal Reserve (Fed) are expected to slash borrowing costs in June, which could weaken the Euro and the Greenback.

During the session, US Treasury bond yields capped the EUR/USD advance, as the 10-year benchmark note rate edged up almost four basis points to 4.19%. The FedWatch Tool suggests the probability of 25 basis points has been lowered from around 72% to 65%.

ECB policymaker Villeroy suggested a potential rate cut in spring hinge, adding that the Government Council would monitor inflation until it reached 2%. His colleague Kazaks echoed some of his comments, adding that a decision to cut rates will be made at upcoming meetings.

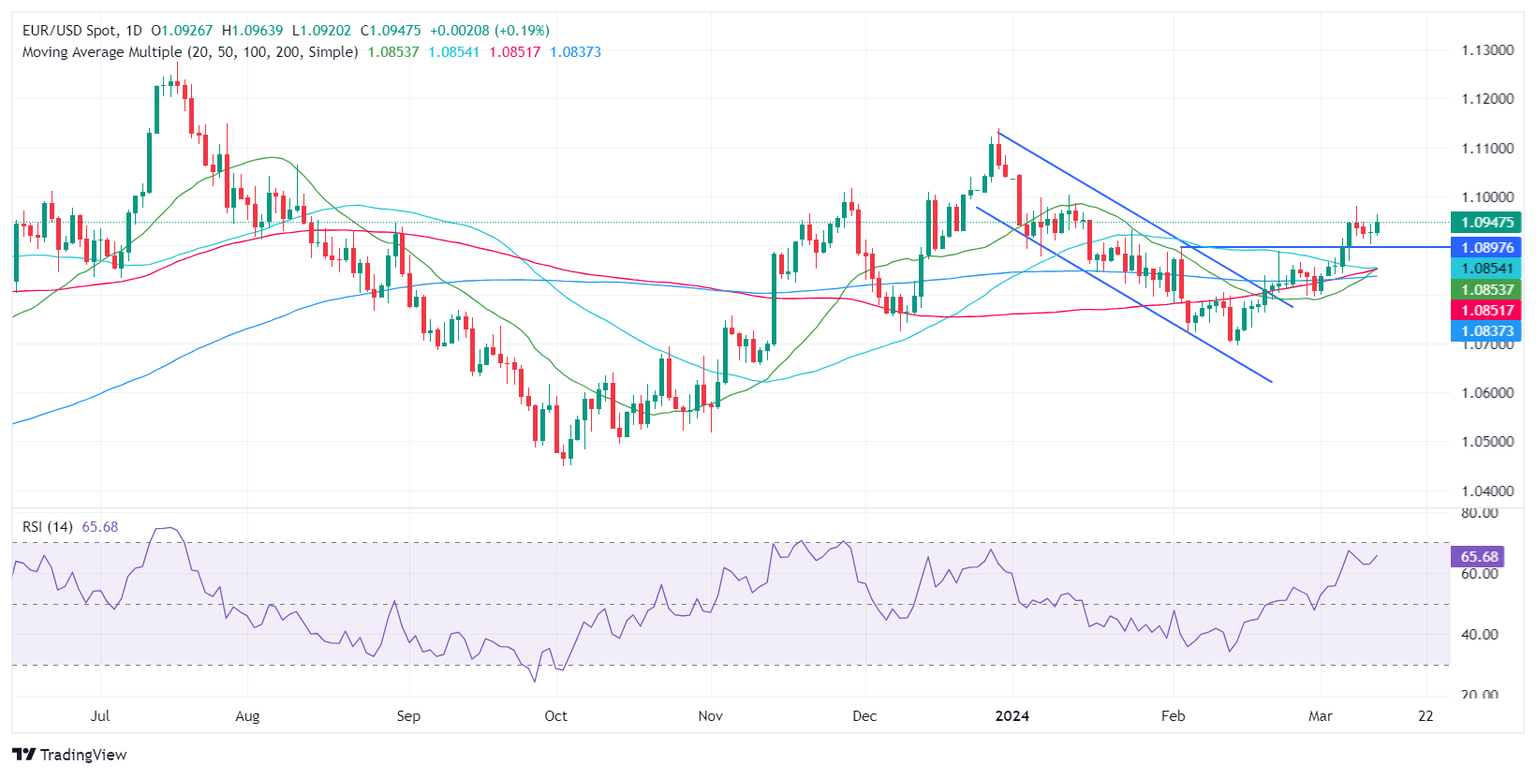

EUR/USD Price Analysis: Technical outlook

The pair is upward biased, though the Relative Strength Index (RSI) indicator, suggests that buyers are losing momentum. They need to reclaim Wednesday’s high of 1.0963, so they can test a downslope resistance trendline drawn from 2021 yearly highs at around 1.2260, which passes at around 1.0965/80. Next key resistance level lie at 1.1000. On the other hand, if sellers stepped in and drag the EUR/USD exchange rate below 1.0919, March’s 13 low. Once surpassed, the 1.0900 figure is up next.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.