EUR/USD eased lower on Wednesday after FOMC Meeting Minutes miss the mark

- EUR/USD declined on post-FOMC Greenback bid.

- Odds of a September rate cut are getting a second look from investors.

- EU & US PMIS in the barrel for Thursday.

EUR/USD knocked lower on Wednesday after the Federal Reserve’s (Fed) latest Meeting Minutes revealed the Federal Open Market Committee (FOMC) are grimly determined to wait for more proof inflation will ease to 2%, sending risk appetite lower as rate-cut-hungry investors keep hoping for dovish signs from the US central bank.

While the FOMC’s latest Meeting Minutes didn’t rule out a September rate cut directly, investors are growing nervous that the Fed will not be able to find enough confirming data that inflation is making definitive progress to the Fed’s 2% annual inflation target. Odds of a September quarter-point rate cut have eased to 60% according to the CME’s FedWatch Tool.

Read more: Fed Minutes leave the door open to a probable rate cut in September

On Thursday, pan-European Purchasing Managers Index (PMI) data is expected to recover. The EU’s Manufacturing PMI in May is expected to climb to 46.2 from 45.7, while the Services PMI is expected to tick upwards slightly to 53.5 from 53.3.

US PMI figures will follow during Thursday’s US market session, with both the Manufacturing and Services PMIs expected to hold steady at 50.0 and 51.3, respectively.

EUR/USD technical outlook

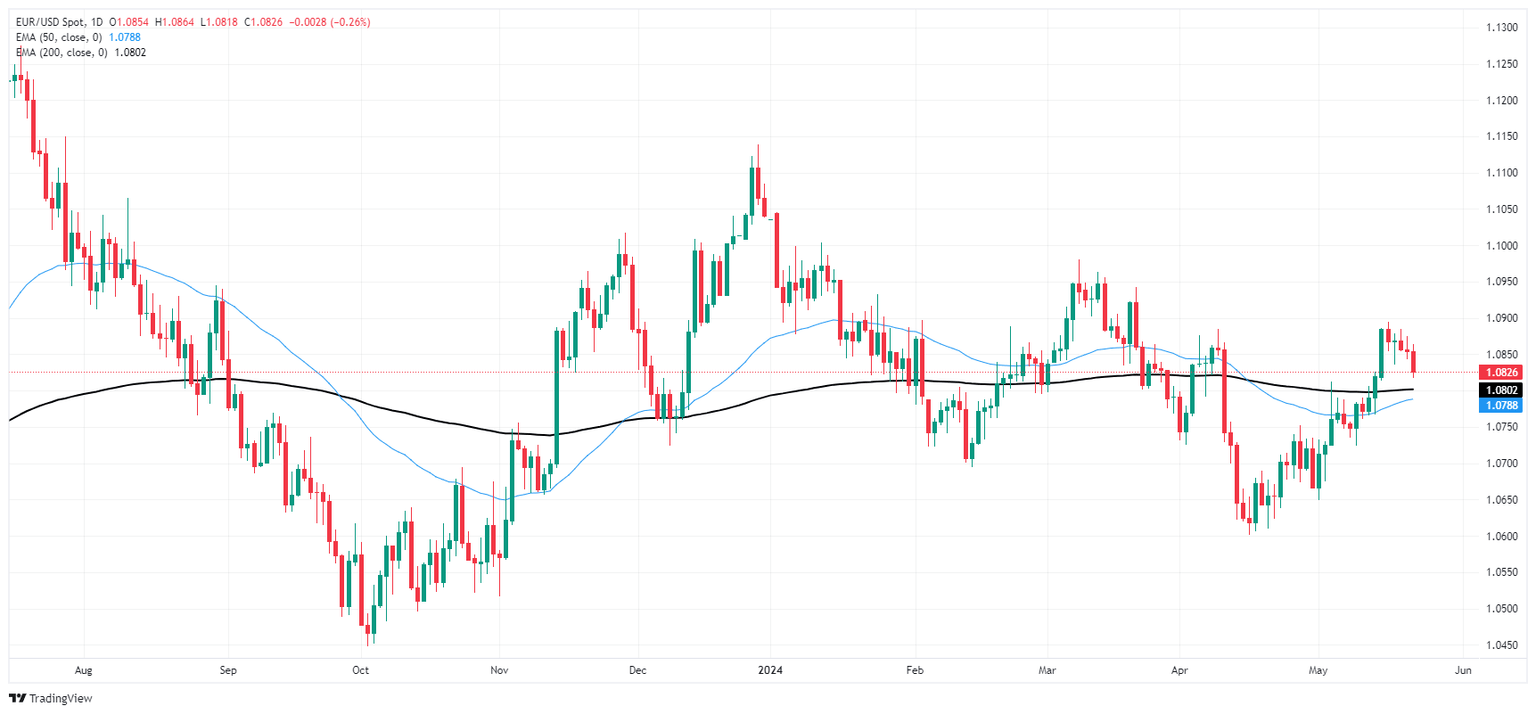

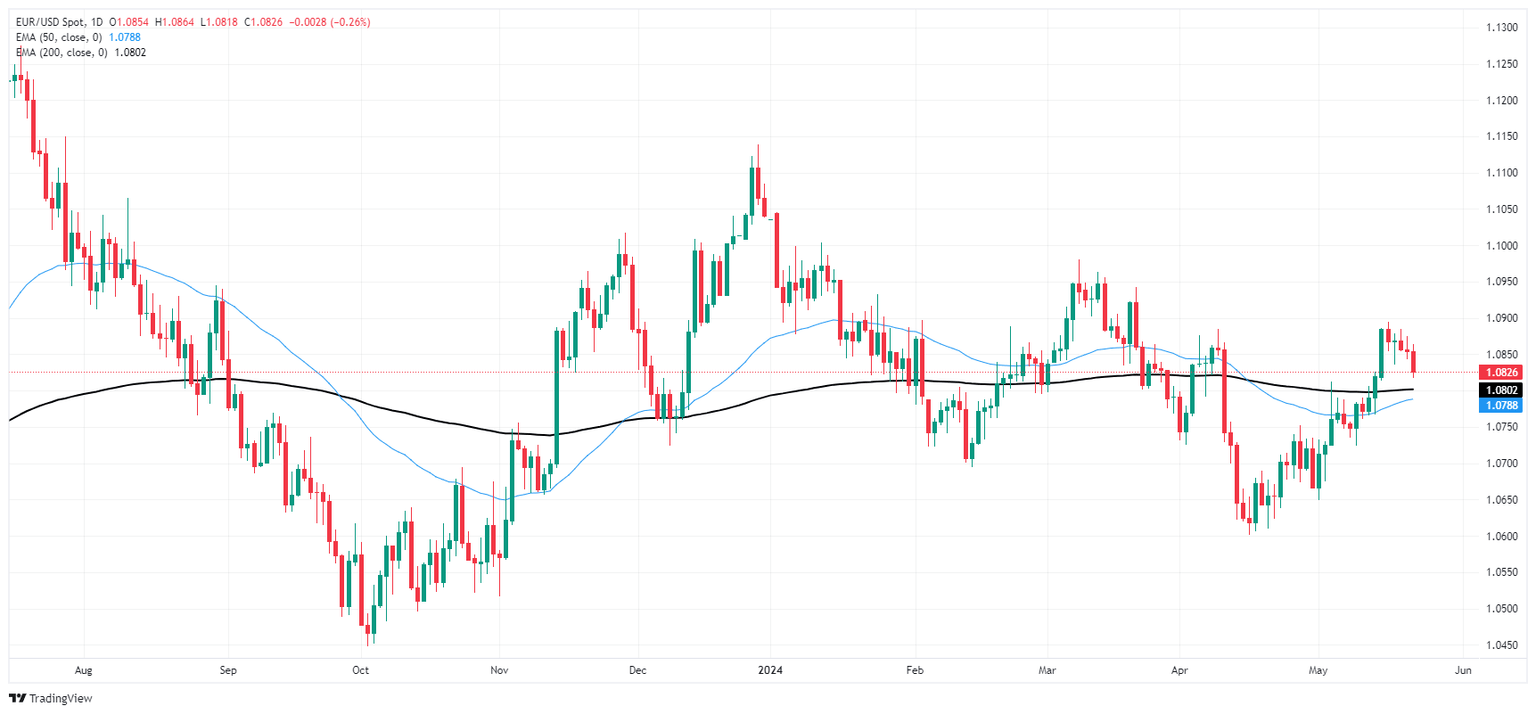

EUR/USD has drifted below the 200-hour Exponential Moving Average (EMA) at 1.0834, and the Fiber is battling to keep afloat of the 1.0820 level. The pair has eased back after a failed bull run at the 1.0900 handle.

Daily candles are inching towards the 200-day EMA at 1.0802, and EUR/USD has closed in the red for three of the last four straight trading days. Despite a near-term bearish pullback, the pair is still up from the last major swing low into 1.0600 in mid-April.

EUR/USD hourly chart

EUR/USD daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.