EUR/USD drops below 1.0850 on mixed inflation data, ECB-Fed rate hike speculations

- US PCE inflation aligns with estimates but shows an uptick, while Initial Jobless Claims come in lower than expected, adding complexity to the Fed’s rate decision.

- ECB board member Isabel Schnabel reignites stagflation fears but doesn’t rule out more rate hikes; EU inflation data mixed, with core HICP falling to 5.3% YoY.

- Market participants now focus on Friday’s US Nonfarm Payrolls report and ISM Manufacturing PMI, which could provide further direction for the EUR/USD pair.

The Euro (EUR) reversed Wednesday’s gains vs. the US Dollar (USD), as the currency pair tanked, despite investors trimming the chances for a US Federal Reserve rate hike in September on a session that witnessed global bond yields falling. Hence, the EUR/USD is trading at 1.0843 after reaching a daily high of 1.0939, down 0.735.

Euro gave back its gains amid mixed EU inflation, ahead of US NFP report

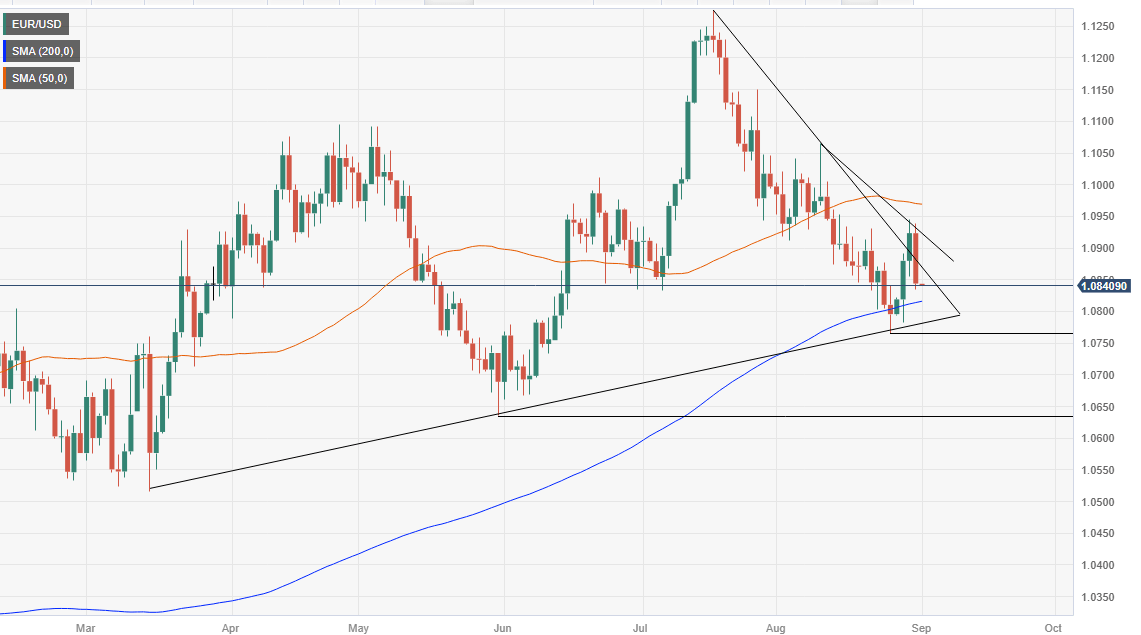

After Wall Street closed, the EUR/USD finished the session in the mid-range of the week, with traders eyeing a drop toward the 200-day Moving Average (DMA) at 1.0815. All that is propelled by data from the United States (US) and the Eurozone (EU), as both economic blocs remain on a tightening cycle.

Beginning with the US, inflation data revealed by the Commerce Department showed the Fed’s favorite inflation gauge, the PCE, came at 3.3% YoY, as expected, but above June’s data at 3%. Core PCE followed the same path of aligning with estimates but increased from 4.1% to 4.2% YoY. Even though the advancement in inflation is not to worry about, solid labor market data justifies the Fed’s need to keep rates higher for longer.

Initial Jobless Claims for the last week came below estimates of 235K, at 229K, contrary to earlier data revealed during the week, namely job openings and the ADP National Employment report, that underscored the labor market was losing traction.

The EU’s agenda showed that inflation in the whole bloc was mixed, while a European Central Bank (ECB) board member, Isabel Schnabel, reignited stagflation fears after acknowledging growth headwinds but didn’t discount the need for more rate hikes. Data from the EU showed inflation remained unchanged at 5.3% YoY in August, but excluding volatile items, core HICP was 5.3%, below July’s 5.5%.

That opened the door for the ECB to take an approach similar to the Fed, of skipping rate hikes, as some voices had taken a cautious approach. Traders should be aware that before Christine Lagarde’s speech at Jackson Hole, ECB sources mentioned that hawks in the committee eased its previous posture.

All that said, market participants’ focus shifts to tomorrow’s US Nonfarm Payrolls report, which is expected to show the US economy added 170K jobs. The Unemployment rate and Average Hourly Earnings are expected at 3.5% and 4.4%, respectively. After that report, the ISM Manufacturing PMI will update the industry status in the world’s largest economy.

EUR/USD Price Analysis: Technical outlook

The EUR/USD is set to extend its losses. Price action in the last couple of days formed a ‘bearish engulfing’ candlestick pattern, warranting further downside. Still, the major will face strong support at the 200-DMA at 1.0815, the 1.0800 figure, and a five-month-old support trendline at around 1.0760/85. If those areas are cleared, sellers will set their eyes on the May 31 low of 1.0635.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.