EUR/USD climbs as sentiment pushes Greenback lower

- EUR/USD gained 0.7% on Thursday, bolstered by investor confidence.

- New tariff threats turn out to be more of the same: unclear and hypothetical.

- European data surprises nobody, US PPI inflation pressure eases slightly.

EUR/USD caught a bid on Thursday, climbing seven-tenths of one percent and vaulting back over the 1.0400 handle. A general weakening in the Greenback bolstered Fiber flows off the back of not-as-bad-as-expected US Producer Price Index (PPI) inflation figures. Continued wavering by the Trump administration on ongoing tariff threats has investors assuming a trade war isn’t going to happen.

Forex Today: Markets now look at tariffs and US fundamentals

European economic data came in exactly as expected on Thursday, giving traders nothing meaningful to chew on. Still, although broadly above forecasts, US PPI figures helped ease investor concerns about a resurgence in inflation pressures. Core PPI inflation for the year ended in January came in at 3.6% YoY, well above the forecast 3.3% but a tick below the revised figure of 3.7%, which initially printed at 3.5%.

US Retail Sales are all that remains in the barrel for the remainder of the week’s key data. Markets will be hoping for another firm print, with the monthly Retail Sales figure forecast to come in at a slight contraction of -0.1% compared to the previous 0.4%.

US President Donald Trump unveiled his latest strategy for boosting tax revenues amidst significant administrative tax cuts. The concept of "reciprocal tariffs"—imposing fees on countries that charge tariffs on American goods—is set to develop in the following months, with US Commerce Secretary Howard Lutnick designated to finalize the details.

The timeline for additional tariff threats remains unclear, and investors are treating these new tariff threats as unlikely to materialize, reminiscent of Trump’s proposed "day one tariffs," as well as tariffs concerning Canada, Mexico, and specific imports like automobiles, microchips, and pharmaceuticals. Overall, while there are various ideas about implementing strict import taxes on US consumers and businesses to punish foreign businesses and countries, there has been limited real advancement, leading investors to speculate that this trend will persist.

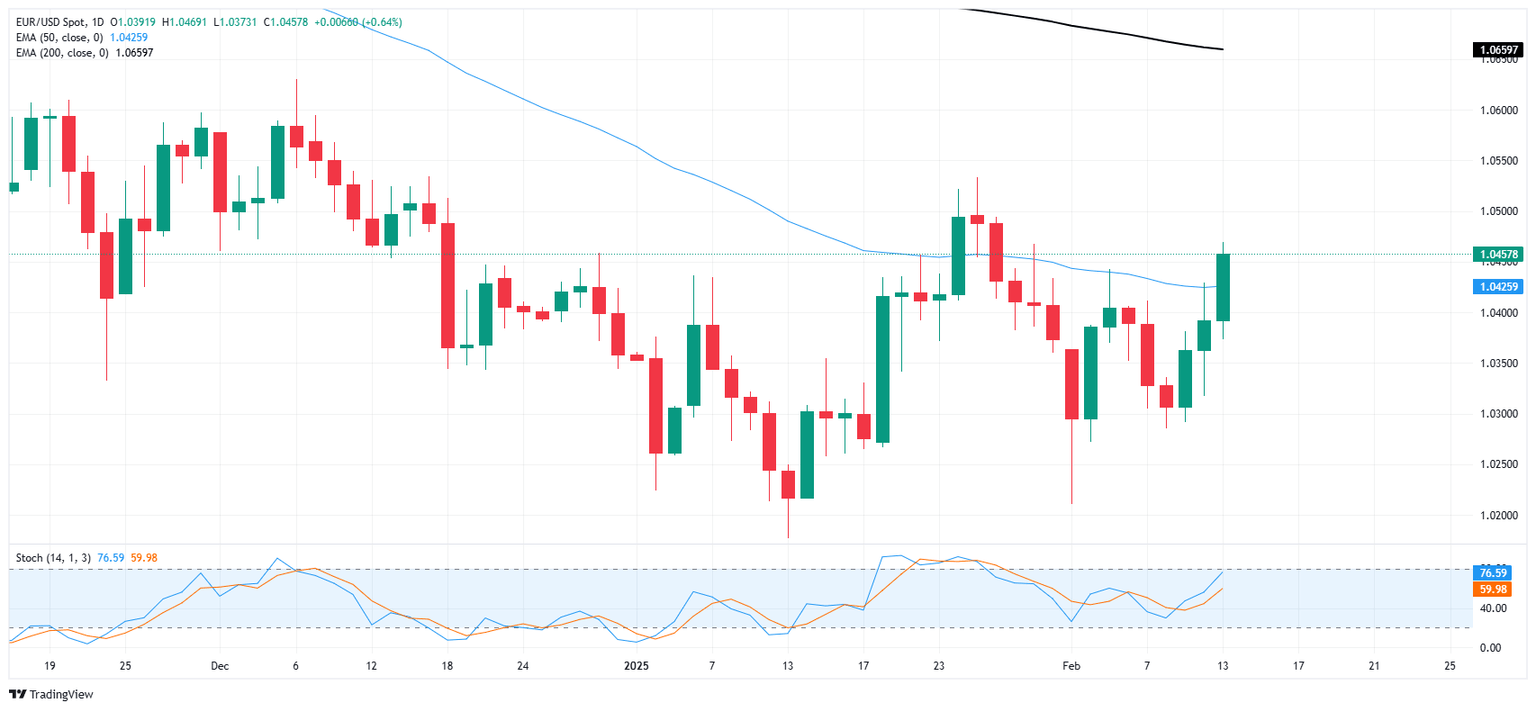

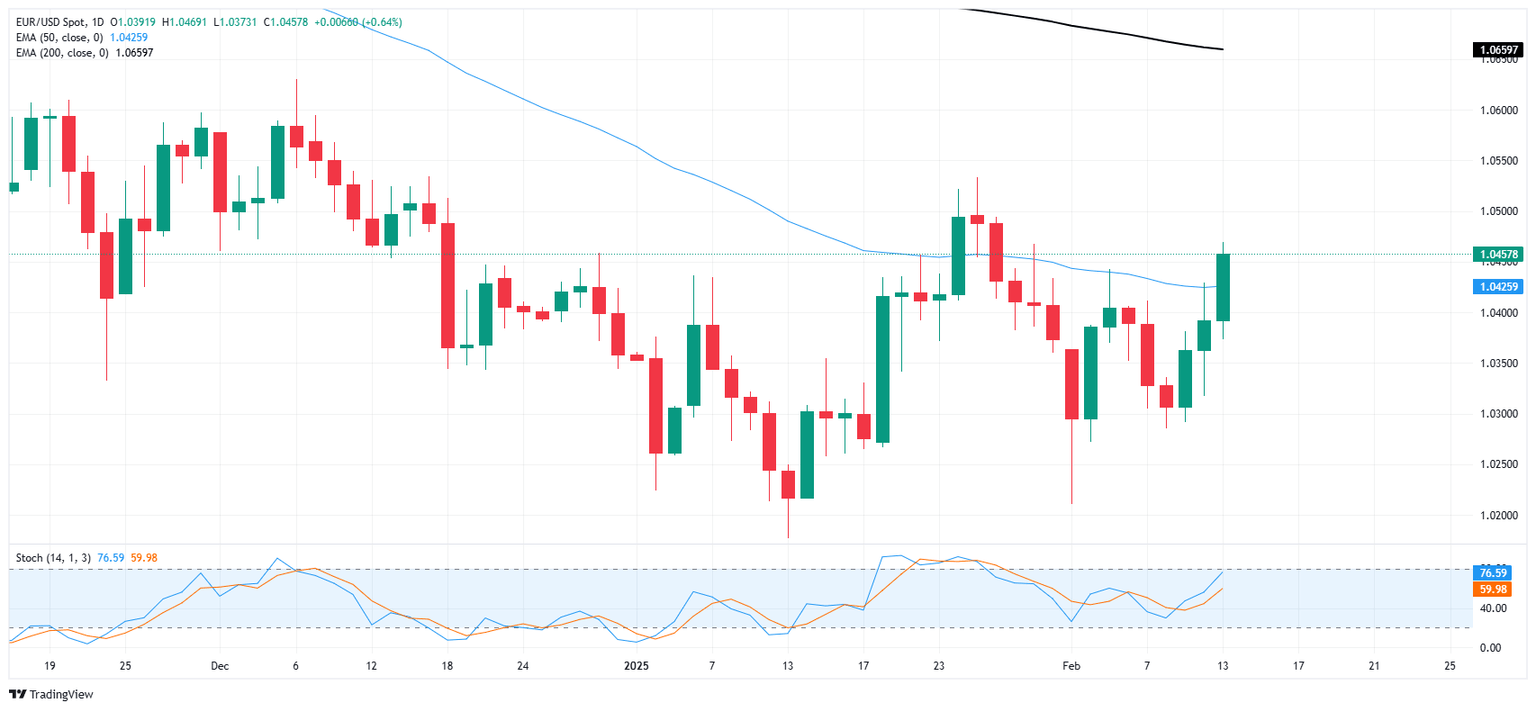

EUR/USD price forecast

EUR/USD stepped into a third straight bullish day on Thursday, crossing the 1.0400 handle once again and climbing over the 50-day Exponential Moving Average (EMA) near 1.0425. Fiber has kicked into a near-term bullish tilt, but price action still remains on the low end of the last swing high into 1.0525 in mid-January.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.