EUR/USD bounces back as investors doubt USD’s safe-haven appeal

- EUR/USD rebounds sharply to near 1.1400 as the US Dollar falls back due to Trump’s erratic tariff announcements.

- The ECB is expected to cut interest rates by 25 bps on Thursday.

- Spain’s Economy Minister Cuerpo is confident about a balanced and fair trade deal between the EU and the US.

EUR/USD recovers strongly to near 1.1390 during European trading hours on Wednesday after a slight correction on Tuesday. The major currency pair strengthens as the US Dollar (USD) resumes its downside journey after a short-lived recovery move. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, tumbles to near 99.40.

Financial market participants brace for more weakness in the US Dollar and further upside in the EUR/USD pair amid growing doubts over the Greenback’s structural attractiveness due to erratic tariff announcements by United States (US) President Donald Trump.

Analysts at ING see the EUR/USD pair advancing to 1.1500 due to “weakening of the US Dollar’s appeal” as a “reserve and safe-haven asset”, while the “Euro’s (EUR) high liquidity” is expected to “absorb much of the rotation away from the USD.”

Last week, President Trump declared a 90-day pause in executing reciprocal tariffs, except for China. Trump increased additional duties on Chinese imports to 145% for retaliating against reciprocal levies. Investors doubt that the decision was well-thought-out as US importers would need to increase prices of substitutes of Chinese goods to offset the impact of sustained demand. Such a scenario will be inflationary and slow down economic growth.

In Wednesday’s session, investors will focus on the US Retail Sales data for March, which will be published at 12:30 GMT. The Retail Sales data, a key measure of consumer spending, is estimated to have grown at a robust pace of 1.3% during the month compared to the 0.2% increase seen in February.

Daily digest market movers: EUR/USD gains as Euro performs strongly ahead of ECB meeting

- EUR/USD trades firmly near 1.1400 as the Euro demonstrates strength ahead of the European Central Bank’s (ECB) monetary policy decision on Thursday. The ECB is expected to cut its Deposit Facility Rate by 25 basis points (bps) to 2.25%. This would be the sixth straight interest rate cut by the ECB in a row.

- Traders have become increasingly confident that the ECB will cut interest rates on Thursday due to a significant slowdown in the Eurozone service inflation. The underlying inflation rose by 3.4% year-on-year in March. This was the lowest growth in services inflation since July 2022.

- As investors are confident about an interest rate cut on Thursday, they will pay close attention to the monetary policy outlook and how well the European Commission (EC) is handling trade deals with the US. Analysts at Standard Chartered Bank expect, “If the ECB cuts this month, then the June meeting could offer an opportunity to hold, which for now is our base case.” They added that the market would have greater clarity on Germany’s fiscal stimulus plans, as well as broader defence spending increases by the June meeting, which could impact their expectations.

- Meanwhile, Spanish Economy Minister Carlos Cuerpo is confident that the European Union (EU) and the US will close a fair deal soon. Cuerpo gained strong conviction about a smooth trade deal between the EU and Washington after meeting with US Treasury Secretary Scott Bessent on Tuesday. "We’re convinced that, with EU Trade Commissioner Maros Sefcovic leading the European negotiation, we’ll be able to reach an agreement that is balanced, fair and beneficial to both sides,” Cuerpo said, according to Reuters.

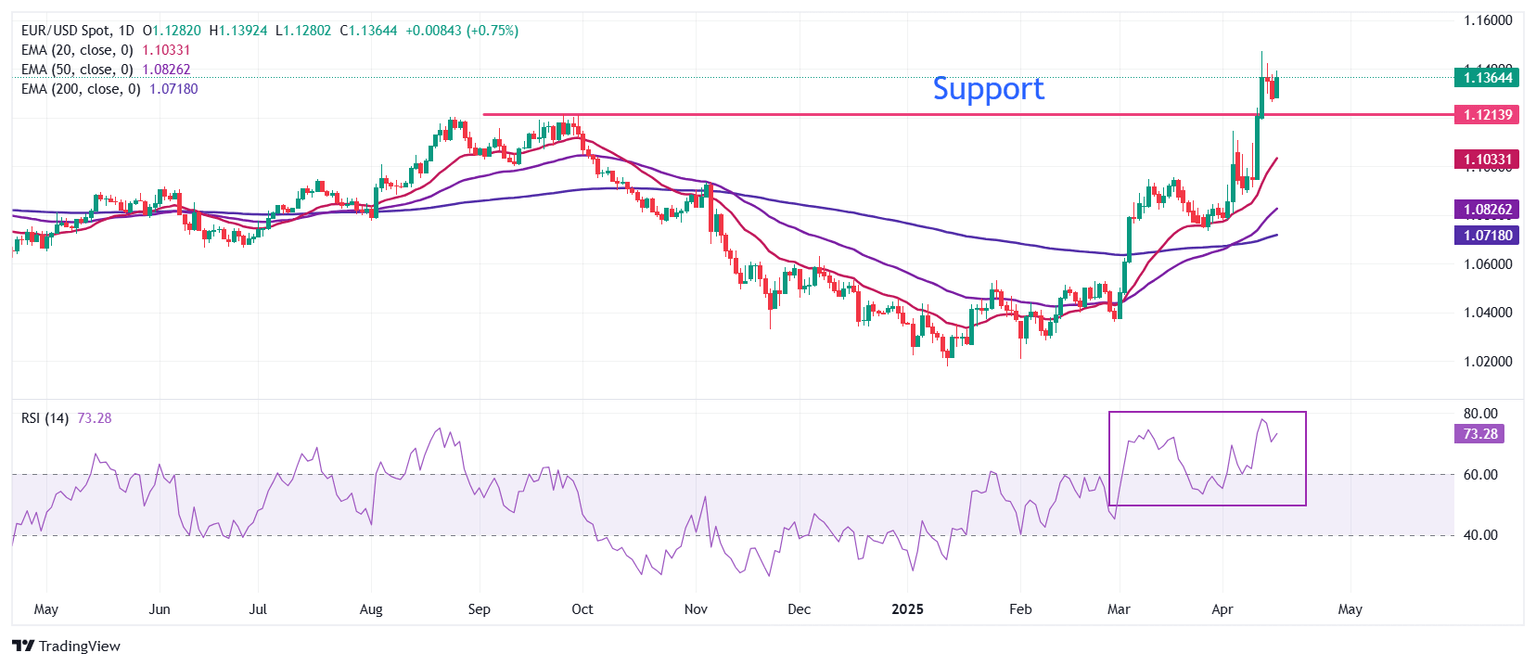

Technical Analysis: EUR/USD climbs to near 1.1400

EUR/USD jumps to near 1.1400 in Wednesday’s European session. The overall outlook of the major currency pair is strongly bullish as all short-to-long Exponential Moving Averages (EMAs) slope higher.

The 14-day Relative Strength Index (RSI) holds above 70.00, indicating a strong bullish momentum.

Looking up, the psychological resistance of 1.1500 will be the major resistance for the pair. Conversely, the April 11 low of 1.1190 will be the key support for the Euro bulls.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

BRANDED CONTENT

Finding the right broker for trading EUR/USD is crucial, and we've identified the top choices for this major currency pair. Read about their unique features to make an informed decision.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.