EUR/USD bears pile into critical monthly territory, but is parity a reality just now?

- EUR/USD is meeting a very key monthly area on the charts.

- The US dollar could be in for a correction into the Fed next week.

EUR/USD remains in the red despite a pick-up in global shares. The single currency is taking some of the brunt due to the volatility in the forex space following the Bank of Japan's dovish announcements and a subsequent dash for the US dollar.

At the time of writing, EUR/USD is trading off its cycle lows but is still down some 0.48% at 1.0505. The pair has travelled from a high of 1.0564 to a low of 1.0470 so far. Earlier, the US dollar touched its highest level since 2002 while Wall Street rose and European shares moved off six-week lows as strong earnings reports offset some of the gloomy US economic data. Additionally, US government bonds rose after signs of strength in the US job market that has superseded an expected decline in economic growth in the first quarter.

The advance estimate of Q1 Gross Domestic Product dropped 1.4% saar, versus consensus expectations for a 1.0% lift. However, traders cheered the details that were reasonably robust, with personal consumption up 2.7% saar, disposable income rising 4.8% and gross private investment up 2.3%.

''So underlying private demand growth remains firm,'' analysts at ANZ Bank argued. However, other components of GDP swamped those gains. Excessive domestic demand drove a 17% saar lift in imports, while exports contracted 5.9%. That meant net trade subtracted 3.2% from GDP.''

Nevertheless, the dollar stays firm along with the higher yields, which can be chalked up to the dollar smile theory that suggests the dollar will gain during periods of strong U.S. data and rising U.S. rates as well as bouts of risk-off sentiment, analysts at Brown Brothers Harriman said.

''Furthermore, we must stress that negative developments in the rest of the world (Russian gas supplies, dovish BOJ, etc.) are playing a big part in the dollar’s strength by highlighting relative fundamentals that favour the greenback.''

For next week, Fed tightening expectations have been robust leading into the meeting. Markets are looking for at least a 50 bp hike at the May 3-4 meeting and again at the June 14-15 meeting. This is fully priced in, with nearly 25% odds of a possible 75 bp move in June. the surprise will come if there is anything short or above this consensus at next week's meeting.

''Looking ahead, swaps market is pricing in 275 bp of tightening over the next 12 months that would see the policy rate peak near 3.25%. While this almost meets our own call for a 3.5% terminal rate, we continue to see risks that the expected terminal rate moves even higher if inflation proves to be even more stubborn than expected,'' analysts at BBH said.

As for the eurozone, German headline inflation is surging. The war in Ukraine and sent energy and commodity prices through the roof and inflationary pressure broadens. According to a first estimate based on the regional inflation data, German headline inflation arrived at 7.4% YoY in April, from 7.3% YoY in March. The HICP measure came in at 7.8% YoY, from 7.6% in March.

Observes are now calling for double-digit inflation in the summer. this will put pressure on the European Central Bank to act in order to normalise policy. However, will the sentiment be enough to prevent parity in EUR/USD for the first time since October 2002?

EUR/USD technical analysis

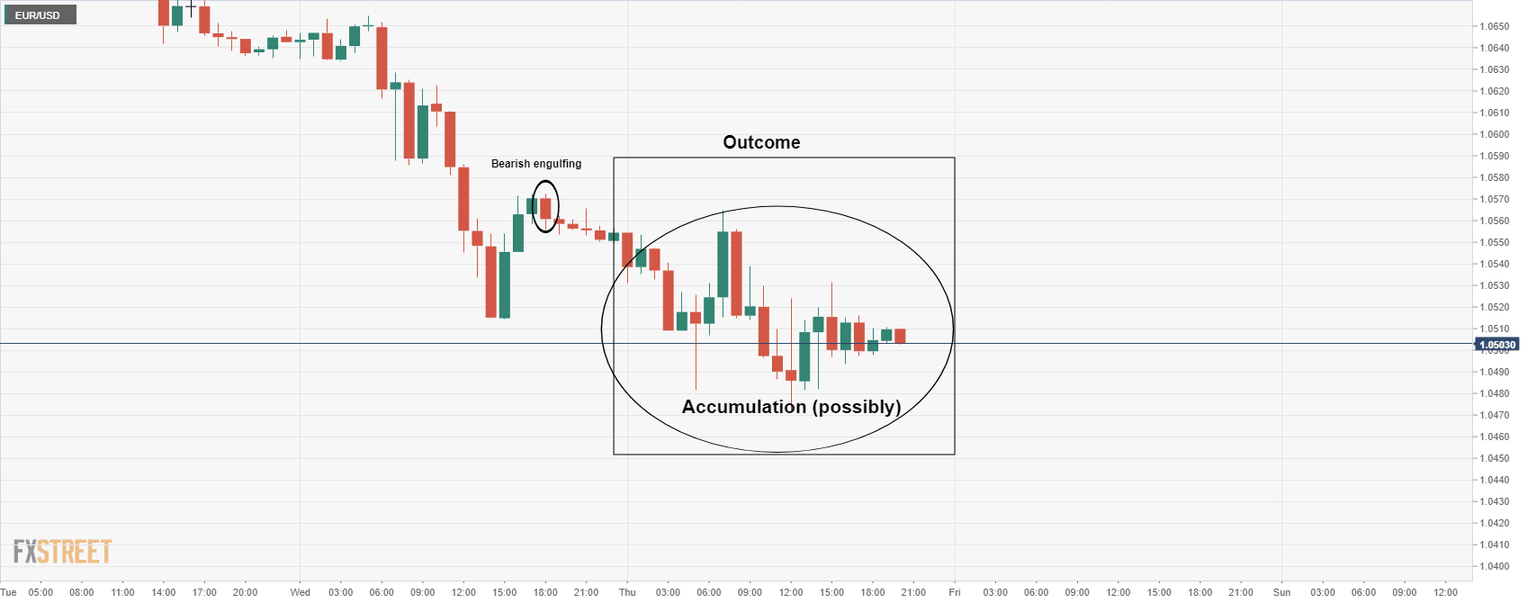

As per the prior sessions analysis, calling for further downside, EUR/USD bears refuelling from a 50% mean reversion, eye US GDP, the bears did indeed start up their engines and took the euro fir another ride even lower:

Prior analysis:

''From an hourly perspective, there is the potential for a downward continuation as per the correction meeting the 50% mean reversion mark, a bearish engulfing and drift to the downside again:''

Live market:

As seen, the price has melted some more, however, there is no bias and this could be the beginning to the end of the downside, at least for the meantime. After all, these are very key monthly levels that could protect parity, for now.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.