EUR/USD: 45 pip volatility on Fed's hawkish statement

- Fed leaves interest rates unchanged says moderation in asset purchases "may soon be warranted".

- EUR/USD volatile on the FOMC statement.

The price of the euro is moving on Wednesday following the Federal Reserve's interest rate decision that has just been released.

EUR/USD has moved violently between a low of 1.1705 and 1.1750 so far within seconds of the release of the statement that gives rise to an imminent taper announcement.

Key takeaways, first glance

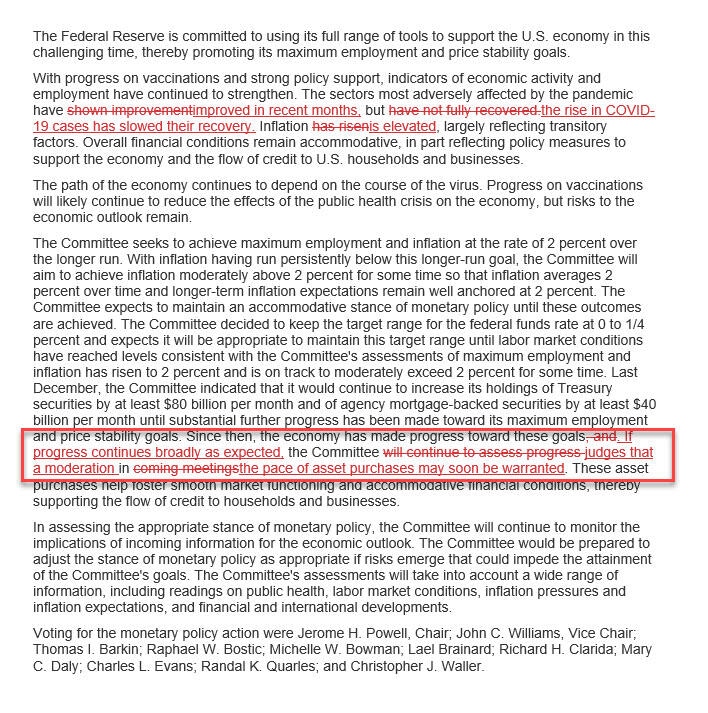

Fed leaves interest rates unchanged says moderation in asset purchases "may soon be warranted".

If progress continues as expected, a taper may soon be warranted.

Hawkish changes on the statement:

Next up is the Federal Reserve chairman's press conference. Jerome Powell will be answering questions likely related to the Evergrande risks and timings of tapering as well as inflation and economic outlooks.

Watch live, Fed's chair Powell

EUR/USD technical analysis

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.