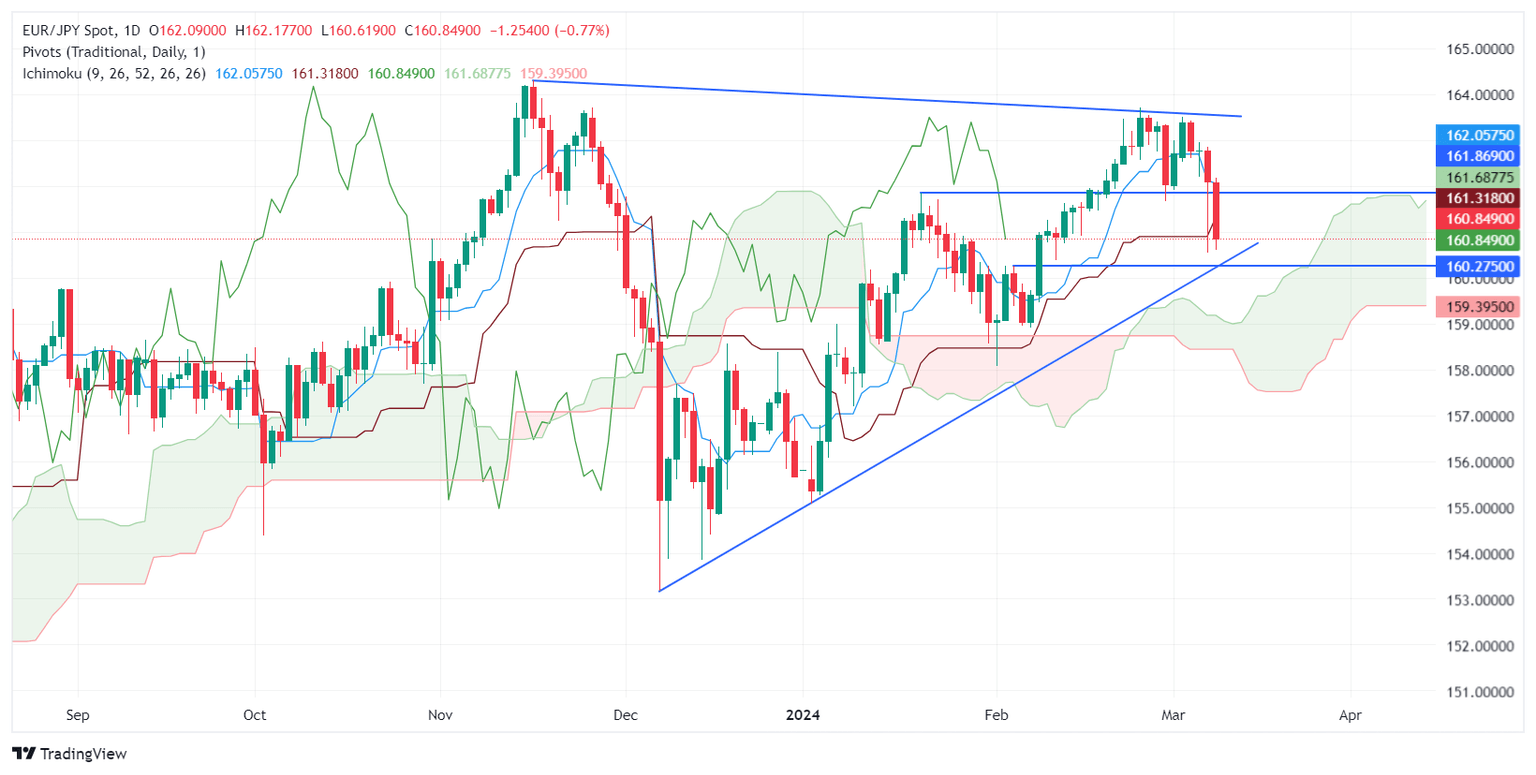

EUR/JPY Price Analysis: Slips below 161.00 on BoJ’s hike speculation

- EUR/JPY falls to 160.86, reacting to rumors of Bank of Japan possibly ending negative interest rates.

- Technical analysis indicates potential for further pullback if pair closes below the 161.31 Kijun-Sen level.

- Recovery above 161.00 could signal a rebound towards the 162.00 mark, with eyes on the March 7 high.

The EUR/JPY dives for the second consecutive day, losing 0.64% in early trading during the North American session. Rumors that the Bank of Japan (BoJ) could end negative rates are growing, hence sponsoring a leg-up in the Japanese Yen (JPY) against most G7 currencies. At the time of writing, the pair exchanges hands at 160.86.

EUR/JPY Price Analysis: Technical outlook

Despite posting a three-week low, the EUR/JPY is slightly tilted to the upside. Nevertheless, if sellers achieve a daily close below the Kijun-Sen at 161.31, that could pave the way for a deeper pullback. The next support would be the 160.00 psychological figures, followed by the Senkou Span B at 159.39 and the top of the Ichimoku Cloud (Kumo) at around 159.00/15.

On the other hand, if buyers lift the exchange rate above 161.00 and reclaim the Kijun-Sen, a leg-up toward 162.00 is on the cards. Once cleared, look for a test of the March 7 high at 162.81.

EUR/JPY Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.