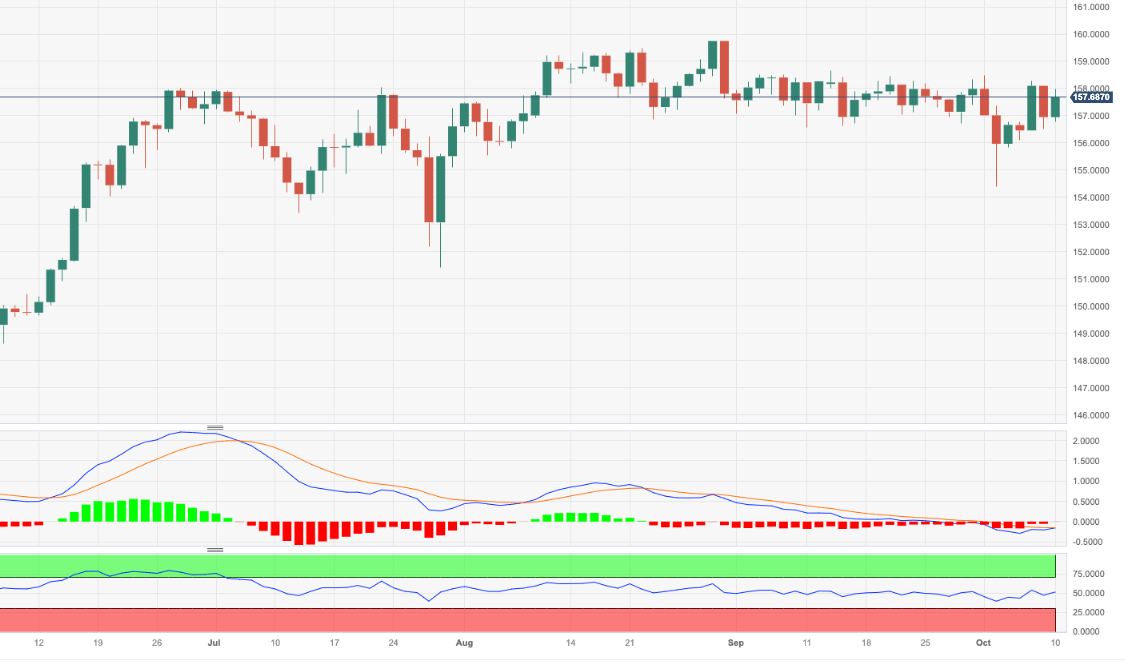

EUR/JPY Price Analysis: No change to the consolidative theme

- EUR/JPY fades Monday’s drop and climbs to the 158.00 region.

- Further side-lined trade appears favoured so far.

EUR/JPY sets aside Monday’s small pullback and resumes the upside to the boundaries of the 158.00 zone on Tuesday.

In the meantime, the cross remains stuck within the consolidative range and the breakout of it exposes a visit to the so far monthly high of 158.65 (September 13) prior to the 2023 top at 159.76 (August 30), which precedes the key round level at 160.00.

On the downside, the so far monthly low of 154.34 (October 3) emerges as the initial contention in case of bearish attempts.

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 150.00.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.