EUR/JPY Price Analysis: Interim hurdle aligns above 131.00

- EUR/JPY meets some resistance around the 131.00 area.

- A drop to recent lows near 129.50 remains in the pipeline.

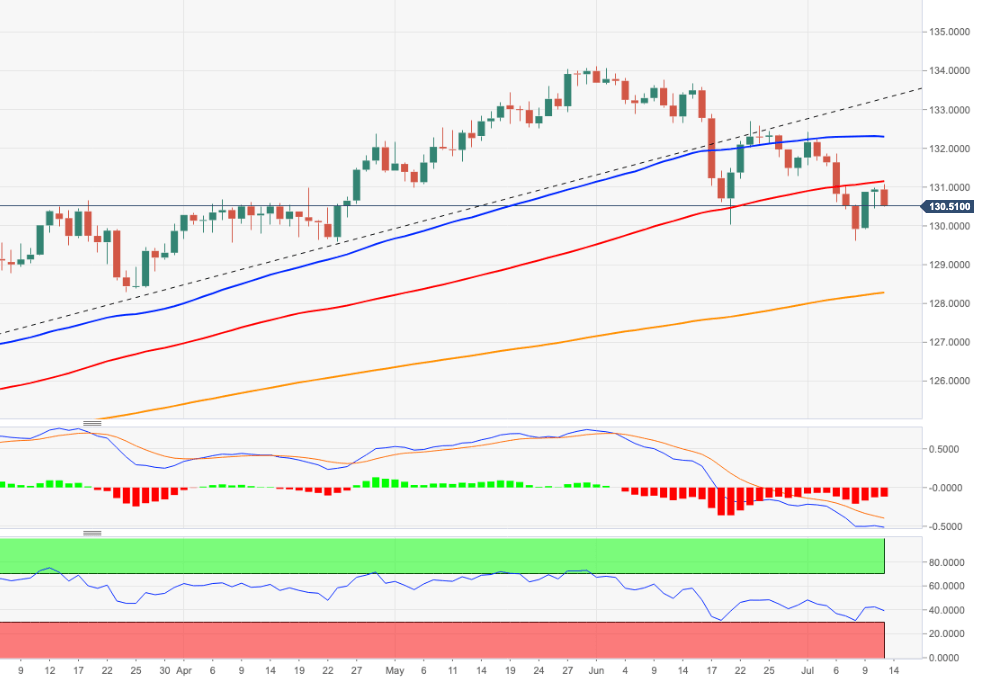

The upside momentum in EUR/JPY seems to have met a decent hurdle in the 131.00 neighbourhood so far this week. This resistance area coincides with the 100d-day SMA (131.11).

Failure to clear this area should expose further downside and the probable test of the monthly lows in the mid-129.00s in the short-term horizon.

If bulls regain the upper hand, then the so far July peaks around 132.40 (July 1) should emerge as the next target of note. This zone is also reinforced by the proximity of the 50-day SMA (132.32).

The broader outlook for the cross is seen as constructive while it trades above the 200-day SMA, today at 128.22.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.