- EUR/JPY registers losses below the 156.00 area due to mixed market sentiment, but the overall uptrend remains.

- The bearish-harami candlestick pattern suggests a potential pullback while maintaining the upward bias.

- EUR/JPY’s key support levels are the Tenkan-Sen line at 155.26, the Senkou Span A at 155.01, and the Kijun-Sen levels at 154.76.

- For buyers to regain control, EUR/JPY must not achieve a daily close below 156.00. Resistance levels lie at the July 19 high of 157.20, and (YTD) high at 157.99.

Late in the North American session, the EUR/JPY registered losses below the 156.00 area amid a mixed market sentiment triggered by upbeat US economic data, underpinning safe-haven currencies in the FX space. At the time of writing, the EUR/JPY exchanges hand at 155.99, after hitting a daily high of 156.62.

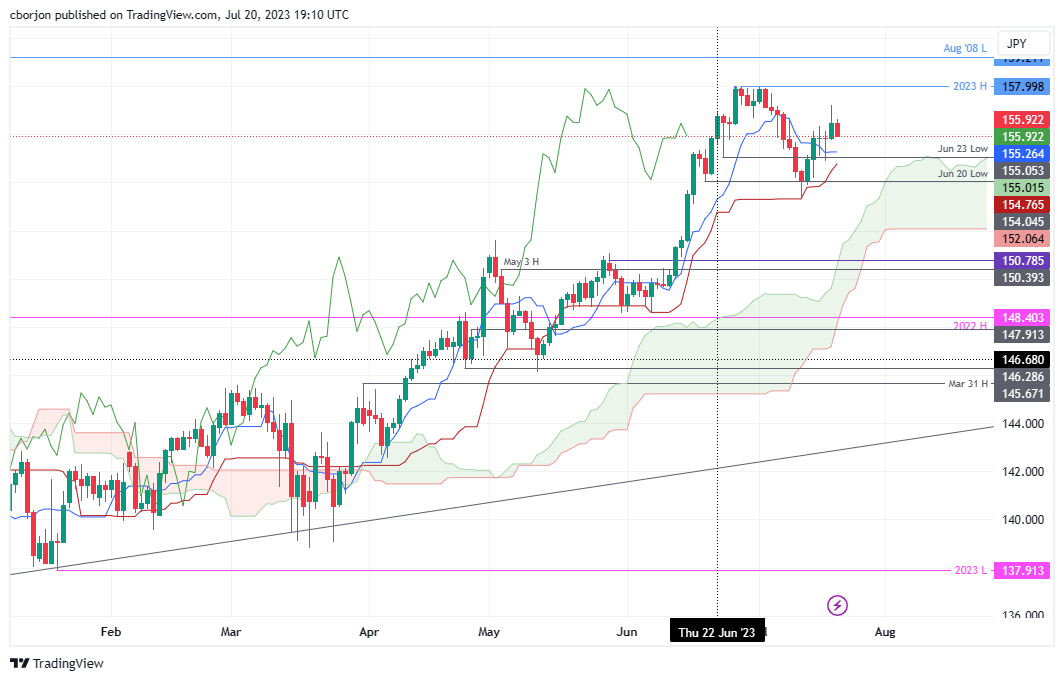

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY uptrend remains in play, but today’s price action, coupled with Wednesday, is forming a two-candlestick chart pattern called ‘bearish-harami,’ which suggests the EUR/JPY could be ready for a pullback while maintaining its upward bias.

It should be said that on the EUR/JPY way down, the Tenkan-Sen would be the first support at 155.26. A breach of the latter will expose the Senkou Span A at 155.01, followed by the Kijun-Sen levels emerging at 154.76.

On the flip side, for EUR/JPY buyers to regain control, they must keep prices from achieving a daily close below 156.00. Once done, buyers could remain hopeful for higher prices, with the first resistance being the July 19 high at 157.20, followed by the year-to-date (YTD) high at 157.99.

EUR/JPY Price Action – Daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD trades at yearly lows below 1.0500 ahead of PMI data

EUR/USD stays on the back foot and trades at its lowest level since October 2023 below 1.0500 early Friday, pressured by persistent USD strength. Investors await Manufacturing and Services PMI surveys from the Eurozone, Germany and the US.

GBP/USD falls to six-month lows below 1.2600, eyes on key data releases

GBP/USD extends its losses for the third successive session and trades at a fresh fix-month low below 1.2600. This downside is attributed to the stronger US Dollar (USD) as traders continue to evaluate the Fed's policy outlook following latest data releases and Fedspeak.

Gold rises toward $2,700, hits two-week top

Gold continues to attract haven flows for the fifth consecutive day and rises toward $2,700. XAU/USD continues to benefit from risk-aversion amid intensifying Russia-Ukraine conflict. Investors keep a close eye on geopolitics while waiting for PMI data releases.

Ripple surges to a new yearly high; XRP bulls aim for three-year high of $1.96

Ripple extends its gains by around 10% on Friday, reaching a new year-to-date high of $1.43 and hitting levels not seen since mid-May 2021. The main reasons behind the rally are the announcement that the US SEC's Chair Gary Gensler will resign and the launch in Europe of an XRP ETP by asset management company WisdomTree.

A new horizon: The economic outlook in a new leadership and policy era

The economic aftershocks of the COVID pandemic, which have dominated the economic landscape over the past few years, are steadily dissipating. These pandemic-induced economic effects are set to be largely supplanted by economic policy changes that are on the horizon in the United States.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.