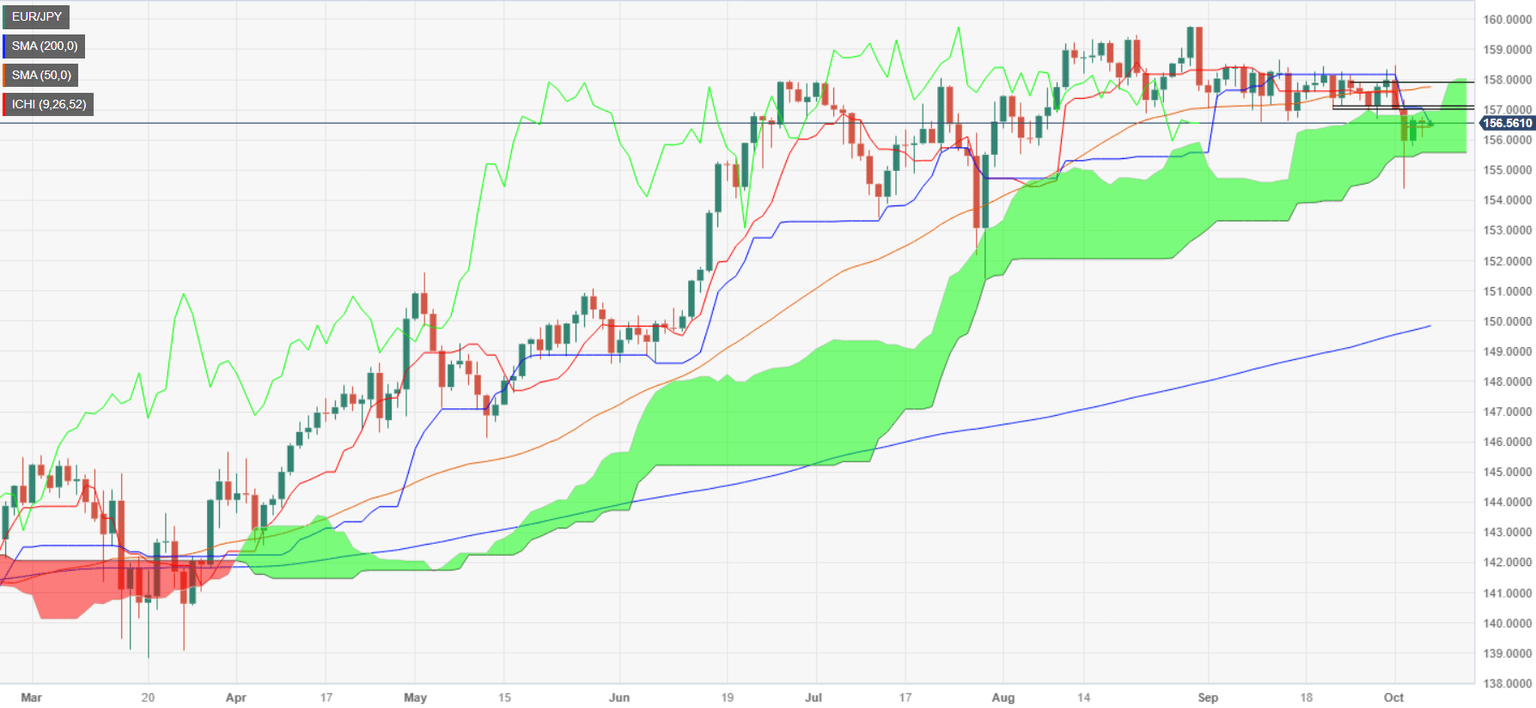

EUR/JPY Price Analysis: Consolidates inside the Kumo, though tilted to the downside

- EUR/JPY stalls at 156.60, encapsulated within the Kumo, with a discernible tilt towards a downward trajectory.

- A potential breach below Senkou Span B at 155.58 could trigger a descent towards the October 3 low of 154.34.

- Conversely, surpassing the Kumo top at 157.00 may pave the way to challenge the October 2 high at 158.47.

The EUR/JPY trades sideways as Friday’s Asian session commences, following Thursday’s price action, in which indecision was the main driver that printed a doji. At the time of writing, the EUR/JPY exchanges hand at 156.60, almost unchanged.

Consolidation is the name of the game, inside the Kumo, capped on the downside by the Kijun-Sen at 156.49. However, due to the latest drop on Tuesday, the pair is neutral to slightly downwards, and once it breaks below the Senkou Span B at 155.58, that would exacerbate a drop to test the October 3 low of 154.34, before slumping toward the July 28 cycle low of 151.40.

Conversely, if EUR/JPY climbs past the top of the Kumo at 157.00, that would open the door to test the October 2 daily high at 158.47 before challenging the 159.00 mark.

EUR/JPY Price Action – Daily chart

EUR/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.