EUR/JPY Price Analysis: Bears are in charge, as the pair drops below 158.00

- EUR/JPY trades down 0.06% at 157.94, failing to sustain gains above the 158.00 level after the Fed’s hawkish announcement.

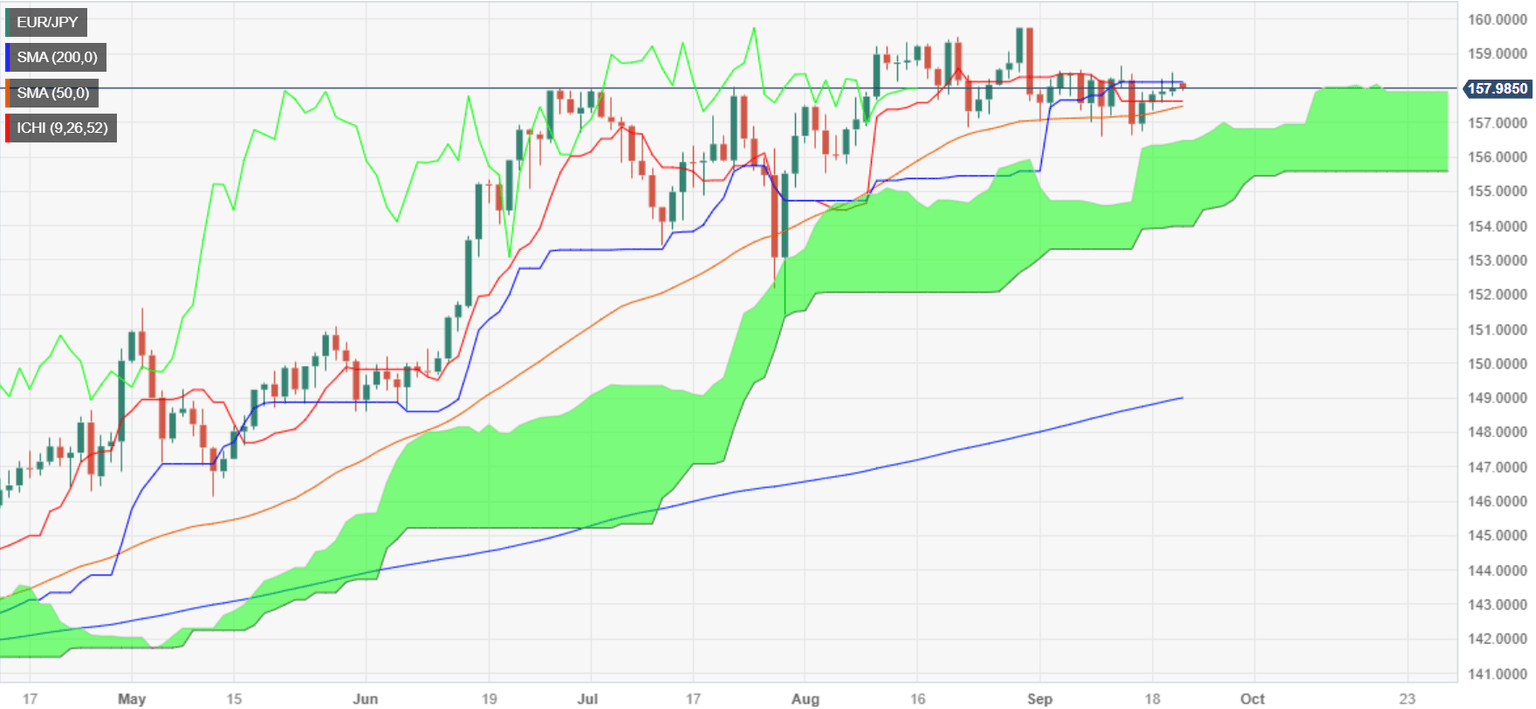

- First support levels in sight: Senkou Span A at 157.89 and Tenkan-Sen at 157.61, with further downside at Ichimoku Cloud top at 156.50.

- Upside potential exists if the pair breaks 158.00, targeting YTD high at 159.76.

The EUR/JPY hovers below the 158.00 area after clinging to slim gains on Wednesday. The Federal Reserve’s decision to hold rates while upward revising its estimates on interest rates for the next year is a headwind for the Euro (EUR) as Thursday’s Asian session begins. At the time of writing, the cross exchanges hands at 157.94, down 0.06%.

The daily chart portrays the pair is trading sideways, though it printed a new weekly high of 158.45, but failure to cling to 158.00 opened the door for a pullback. In that event, the EUR/JPY first support would be the Senkou Span A at 157.89, followed by the Tenkan-Sen at 157.61. Further downside is expected at the top of the Ichimoku Cloud (Kumo) at 156.50.

Conversely, if EUR/JPY reconquers the 158.00 mark, the next resistance would be the September 20 high at 158.45. A breach of the latter will expose the 159.00 mark, followed by the year-to-date (YTD) high at 159.76.

EUR/JPY Price Action – Daily chart

EUR/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.