EUR/JPY faces downward pressure and slumps to a five-day low

- EUR/JPY experienced a downturn, touching a five-day low of 161.77.

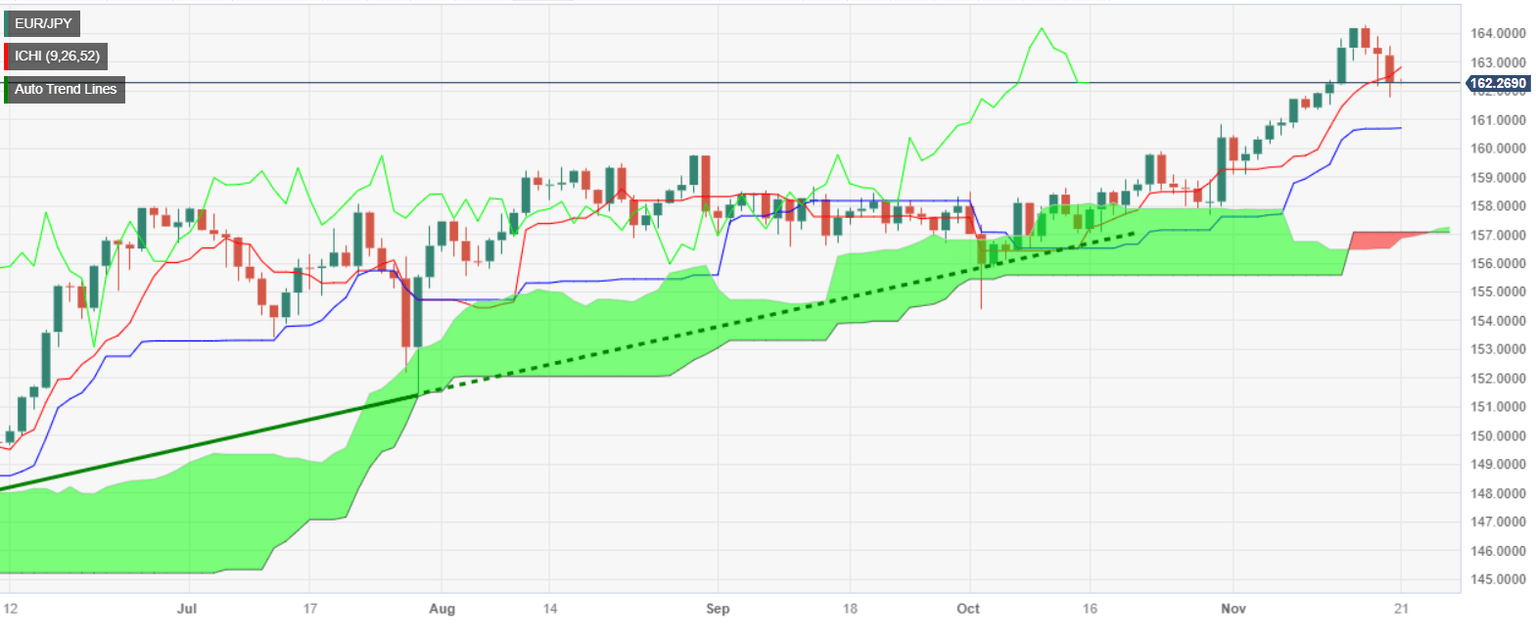

- Technical analysis reveals that EUR/JPY has slipped below the Tenkan-Sen at 162.82, indicating potential for further declines.

- The EUR/JPY upward bias remains in place, though buyers must reclaim the Tenkan-Sen at 162.83.

EUR/JPY remains trading in the red, stumbles to a new five-day low of 161.77, before recovering some ground, toward the end of Monday’s session, registering losses of 0.61%. Nonetheless, the pair is trading with a positive tone in the early Asian session, trading at 162.25, gaining 0.01%.

The lack of fundamental news triggered safe-haven flows toward the Japanese Yen (JPY), opening the door for a pullback. The EUR/JPY daily chart witnessed the cross-pair slipping below the Tenkan-Sen at 162.82, which could exacerbate further downside. The next demand zone would be the Senkou Span A at 161.76, followed by the 161.00 mark. The next floor level would be the Kijun-Sen at 160.69.

On the other hand, the path of least resistance suggests the EUR/JPY might resume its ongoing rally, though traders must reclaim the Tenkan-Sen at 162.83. Upside risks remain above that level, followed by the 163.00 figure. A breach of the latter could open the door to challenging the year-to-date (YTD) high at 164.31.

EUR/JPY Price Analysis – Daily Chart

EUR/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.