EUR/GPB Price Analysis: Steady around 0.8340

- The shared currency edges lower during the New York session by 0.14%.

- EUR/GBP Technical Outlook: Downward biased, but a break under the 0.8300 figure, would push the pair towards lower prices.

The EUR/GBP slide for the second time of the week, though, remains trapped in the 0.8320-65 range for the sixth consecutive day. The EUR/GBP is trading at 0.8347 as the New York session winds down. at the time of writing

The market mood is downbeat, as shown by global equity indices posting losses on Friday. In the US, except for the Nasdaq 100 gaining half percent, the rest print losses between 0.08% and 0.75%.

EUR/GBP Price Forecast: Technical outlook

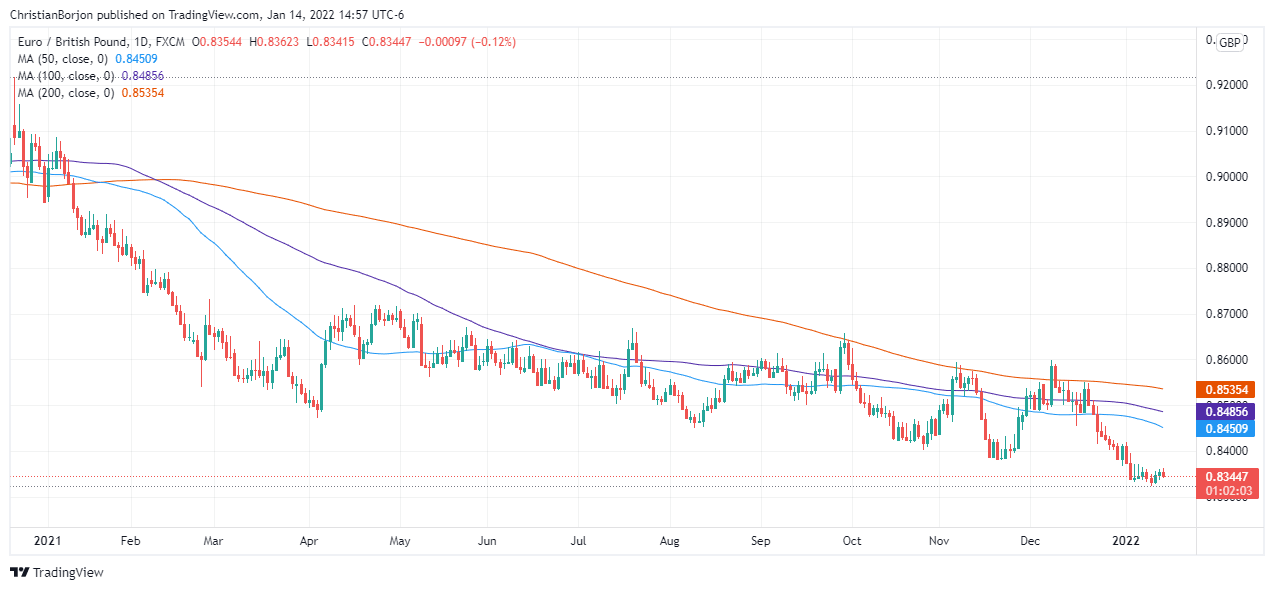

The EUR/GBP daily chart shows the cross-currency is making a strong base in the 0.8320-65 area. From a technical perspective, the EUR/GBP is downward biased but, the 0.8300 barriers kept GBP bulls uncommitted of opening fresh bets vs. the euro.

On the downside, the EUR/GBP first support level would be the YTD low at 0.8324. A breach of the latter would expose the figure at 0.8300, followed by November 2019, with monthly lows around 0.8276.

Contrarily, to the upside, the first resistance would be 0.8372. A clear break of that level would expose January 3 daily high at 0.8419, which, once broken, might open the door for further gains for the shared currency. The next supply zone would be the 50-day moving average (DMA) at 0.8455, followed by the confluence of the 100-DMA and the psychological 0,8500 level.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.