EUR/GBP weakens simultaneously with Euro depreciation

- EUR/GBP is resuming its downward trend, edging closer to its yearly low, signaling potential bearish momentum in the pair.

- The current trend remains undecided below the 0.8700 resistance, awaiting a clear direction pressured down by failing German Yields.

- Market awaits ECB President Lagarde's speech and German inflation data on Wednesday for potential developments.

The Euro is currently experiencing widespread losses and depreciation, which is having an impact on its pairs against the US Dollar, Japanese Yen and the Swiss Franc.

The EUR/GBP pair is showing a resumption of its downward trend, getting closer to its yearly low and indicating a potential bearish momentum. With the pair's trend remaining uncertain below the 0.8670 zone, market participants are awaiting ECB President Lagarde's upcoming speech and German inflation data on Wednesday for possible developments that could provide clarity and influence the market's direction.On Tuesday, Spanish inflation data, released by the National Statistics Institute may also have an impact on the Euro price dynamics.

EUR/GBP faced losses as yields diverge between Germany and UK

German yields decreased on Monday. The 10-year bond yield stands at 2.43%, showing a minor decline of 0.08%. The 2-year yield is at 2.90% with losses of 0.5%, while the 5-year yield is at 2.46% with limited losses of 0.08%. Conversely, British yields rose. The 10-year bond yield reached 4.37% with gains of 0.87%, the 2-year yield stands at 4.55% with gains of 1.35%, and the 5-year yield is at 4.34% with gains of 1.51%.

On Wednesday, Destatis will release inflation figures from Germany which are expected to have further decelerated in May. In that sense, the inflationary figures for the biggest economic block from the Eurozone may have an impact on the Euro against major currency counterparts.

Levels to watch

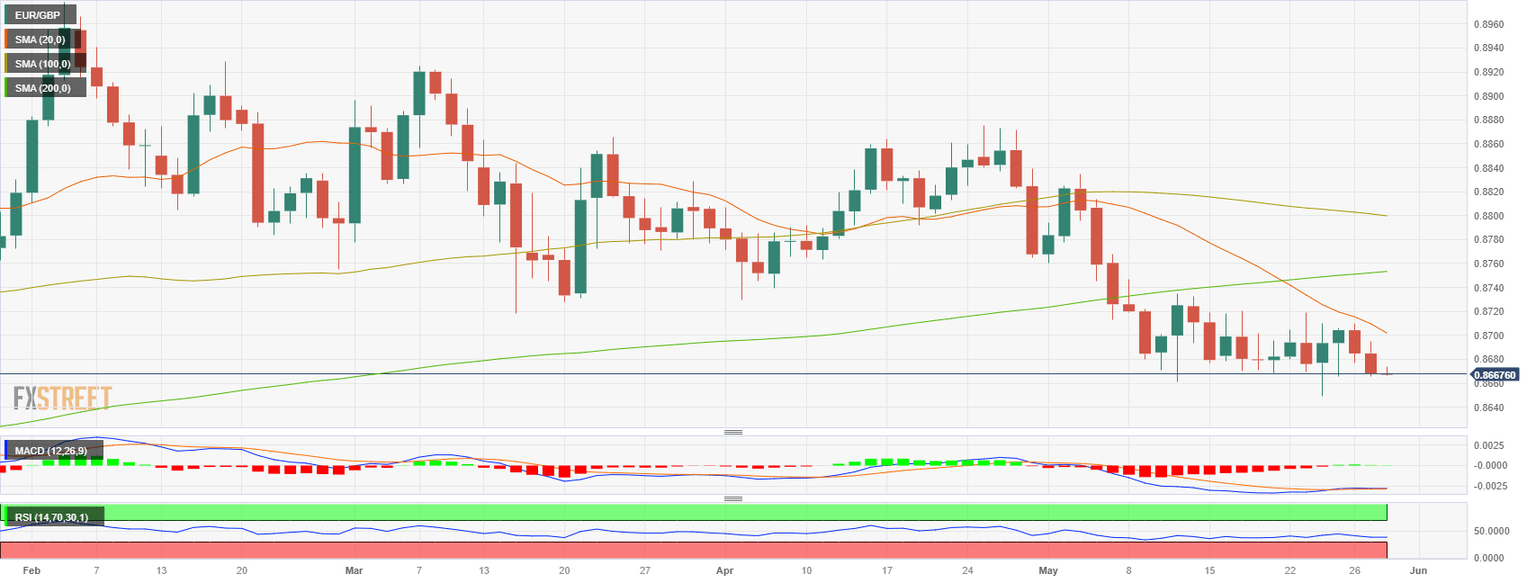

According to the daily chart, the EUR/GBP pair maintains a neutral-to-bearish outlook in the short term, as the bears have seemingly retreated while the market enters a phase of consolidation. However, technical indicators continue to show negativity, suggesting the potential for further downward movement.

In the event of a decline in the EUR/GBP exchange rate, immediate support levels are observed at the 0.8660 zone, followed by the yearly low at 0.8645 and 0.8600 level. On the other hand, upcoming resistance levels for EUR/GBP are anticipated at the 0.8700 level, followed by the zone at 0.8725 and the 100-day Simple Moving Average (SMA) at 0.8750.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.