EUR/GBP struggling to hold above 0.8550

- EUR/GBP is losing momentum as the tug-of-war reaches a midpoint.

- The Euro is struggling to build up momentum for a rebound after steep declines.

- EUR markets to pull towards the midrange ahead of Wednesday's Eurozone Retail Sales.

The EUR/GBP is flatlining on the trading week, cycling near 0.8570 with Eurozone Retail Sales due early Wednesday.

The Euro (EUR) has shed two and a quarter percent against the Pound Sterling (GBP) since late November's peak of 0.8765, losing chart ground in one-sided action, closing in the red for nine of the last eleven trading sessions.

Tuesday saw mid-tier data for both the EUR and the GBP, which all beat expectations across the board, but sending both currencies nowhere quickly as markets focused elsewhere.

The UK's BRC Like-For-Like Sales for the year into November held steady at 2.6% versus the expected 2.5%, and the Eurozone's HCOB Composite Purchasing Managers' Index (PMI) for November beat expectations to climb to 47.6 versus the forecast 47.1.

Wednesday will land a bit harder on the economic calendar, with the UK's latest Financial Stability Report at 07:00 GMT, followed by Eurozone Retail Sales for October at 10:00 GMT.

Investors will be keeping an eye on the Financial Stability Report for finer details on the hawkish or dovish lean to the Bank of England (BoE) over the state of the UK's domestic economy.

Eurozone Retail Sales are expected to see a rebound but still remain in contraction territory with the headline annualized figure to print at -1.1% compared to the previous period's -2.9%.

EUR/GBP Technical Outlook

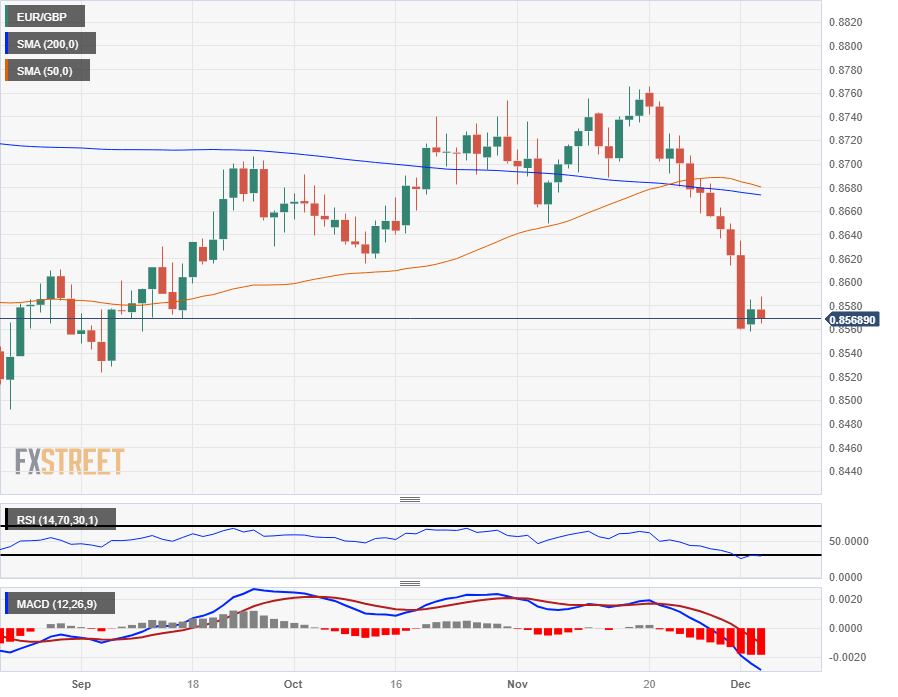

The EUR/GBP is seeing little rebound after falling within sight of 2023's low bids near 0.8500 and the pair is now kidding along the bottom of familiar technical levels near 0.8550.

The pair's recent drop from the 0.8750 neighborhood leaves the EUR/GBP stranded below the 200-day Simple Moving Average (SMA) near 0.8675, and any bullish rebounds will be facing a technical ceiling from the 50-day SMA, which is set to confirm a bearish cross of the longer 200-day SMA.

EUR/GBP Daily Chart

EUR/GBP Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.