EUR/GBP sees ten-week lows near 0.8580 as Euro extends declines agaisnt the Pound Sterling

- The EUR/GBP is extending into a seventh-straight day of losses as the Euro waffles.

- Eurozone data continues to build support for a dovish-leaning ECB.

- ECB President Lagarde to speak again on Monday.

The Euro (EUR) has accelerated declines against the Pound Sterling (GBP) in Friday trading, tumbling out of a near-term descending channel. The EUR/GBP tested 0.8580 during the US Friday market session with the Euro down nearly six-tenths of a percent against the Pound Sterling on the day.

The EUR is staring down the barrel of seven straight down days against the GBP, and the EUR/GBP has shed over 2% from mid-November’s peak bids near 0.8765. The Euro is on pace to see its worst consecutive-day performance in 2023, with the EUR/GBP set to close in the red for all but one of the last ten consecutive trading days.

The GBP is no stranger to flopping economic data, but this week’s dovish European Central Bank (ECB) showings is highlighting the Eurozone’s wobbling data releases on the economic calendar.

Eurozone inflation slipped faster than expected this week after the European Core Harmonized Index of Consumer Prices (HICP) printed below-forecast on Thursday, with the YoY figure for the annualized period into November slipping to 3.6% against the forecast 3.9%, extending a decline from October’s YoY print of 4.2%.

ECB's President Lagarde: Central bank to discuss QT in the “not too distant future”

ECB President Christine Lagarde made an appearance earlier in the week highlighting just how dovish the ECB has rotated in recent weeks, expressing the sentiment that quantitative easing could soon be back on the table for the Euro.

Next week will kick things off with yet another appearance from ECB President Lagarde on Monday, who will be speaking specifically about monetary policy at the Academy of Moral and Political Sciences, in Paris.

The UK follows up on Tuesday with BRC Like-For-Like Retail Sales for the year into November, forecast to tick down slightly from 2.6% to 2.5%. After that will be Eurozone Producer Price Index (PPI) figures, and the MoM number in October is expected to confirm a decline from September’s 0.5% to a nearly-flat 0.2%.

EUR/GBP Technical Levels

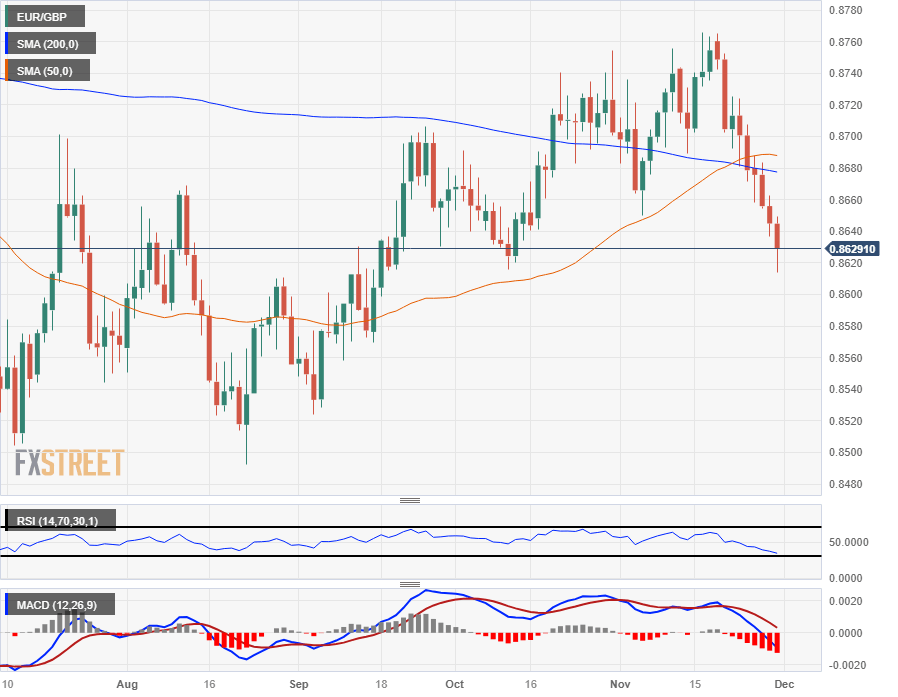

The EUR/GBP's bearish acceleration on Friday sends the pair tumbling out of a near-term descending channel from last week's high bids near 0.8760, and the pair easily slipped below the 0.8600 handle in Friday trading.

Intraday action has been steadily capped by the 50-hour Simple Moving Average (SMA) through most of the week's trading, and a seven-straight-day decline on the daily candlesticks sees the EUR/GBP falling away from the 200-day SMA at 0.8680.

The 50-day SMA barely had a chance to confirm a bullish crossover of the 200-day SMA before rotating back into a bearish stance, and the shorter-term moving average will be capping off any technical recoveries from ten-week lows.

EUR/GBP Hourly Chart

EUR/GBP Daily Chart

EUR/GBP Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.