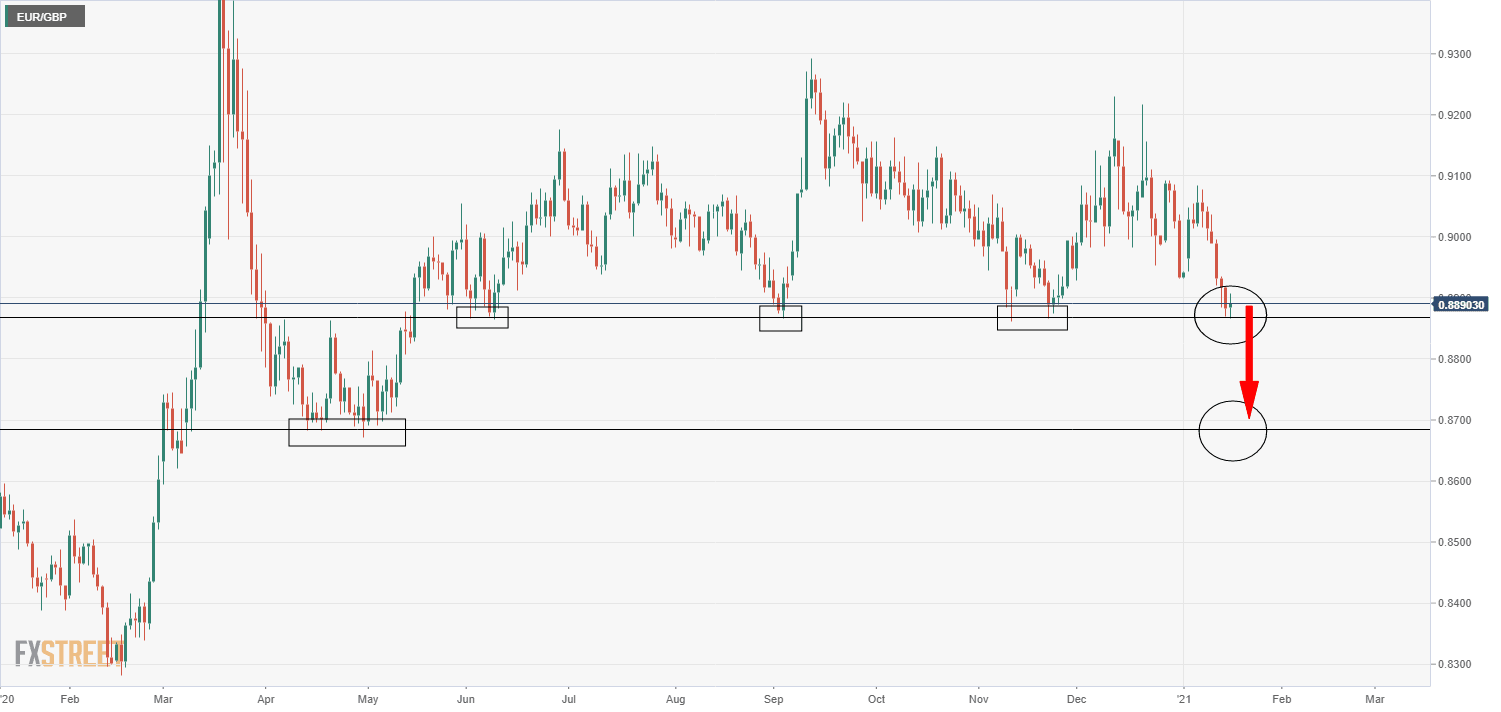

EUR/GBP rebounds modestly from key resistance just above 0.8850

- EUR/GBP is a little higher on the final trading day of the week, amid what appears to be mild profit-taking.

- The pair rebounded from significant support just above 0.8850.

- Both EUR and GBP much more focused on global risk appetite and US dollar dynamics as opposed to domestic themes.

EUR/GBP is a little higher on the final trading day of the week, amid what appears to be mild profit taking by those who made money this week from shorting the pair from above 0.9000. The pair, which hit a key long-term area of resistance just above 0.8850 on Thursday and again during early European trade on Friday briefly crossed back to the north of the 0.8900 level and now trades around 0.8890. At present, the pair trades with modest gains of just over 0.1%.

Eurozone troubles

Both EUR and GBP much more focused on global risk appetite and US dollar dynamics as opposed to domestic themes. Indeed, though it did seem to weigh on European stock markets, news that Italy (and likely soon Germany too) is tightening lockdown restriction did little to dent EUR sentiment versus any of its non-safe haven peers.

Moreover, the ongoing Italian government “crisis”, as well as a new government crisis in the Netherlands (the government just resigned over a child-subsidy scandal), seem not to be affecting EUR too badly versus its non-safe haven peers.

Markets maintain the confidence that the continent will soon (as in, by H2 2021) achieve herd immunity to Covid-19, meaning lockdowns will be a thing of the past and as long as these governmental crises don’t give rise to any more anti-EU national leaders, then market ought not to worry too much over a little turbulence.

UK fundamentals

Though a little lower on the day versus EUR, GBP retains its spot as this week’s best G10 FX performer. GBP has been emboldened by the UK’s progress with its mass vaccination programme, which is well ahead of most of its developed market peers. Reports last night suggest that the country is going to attempt to ramp up daily vaccinations to 500K per day, with vaccines potentially set to be administered 24/7. This means all over the 50s might be able to be vaccinated by the end of March.

Meanwhile, the currency has also received tailwinds from a repricing of money market expectations for BoE negative interest rate policy (NIRP) in 2021 and beyond; after comments from BoE Governor Andrew Bailey earlier in the week, who did not sound overly enamored with NIRP at all, markets downgraded their bets for further rate cuts in the coming months, supporting sterling.

EUR/GBP daily chart

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset