EUR/GBP Price Analysis: Trades with modest losses below 0.8750 ahead of the UK Retail Sales

- EUR/GBP trades with modest intraday losses around 0.8740 ahead of UK Retail Sales data.

- The cross keeps the bullish stance as the cross holds above the 50- and 100-hour EMA.

- The first resistance level is located at 0.8765; 0.8713 acts as an initial support level for the cross.

The EUR/GBP cross retreats from 0.8765 to 0.8740 during the early European session on Friday. Traders await the United Kingdom (UK) Retail Sales data for October. The monthly Retail Sales are expected to rise by 0.3% while the Retail Sales ex-Fuel is estimated to climb by 0.04% MoM. The weaker-than-expected data could exert some selling pressure on the British pound (GBP) against the Euro (EUR).

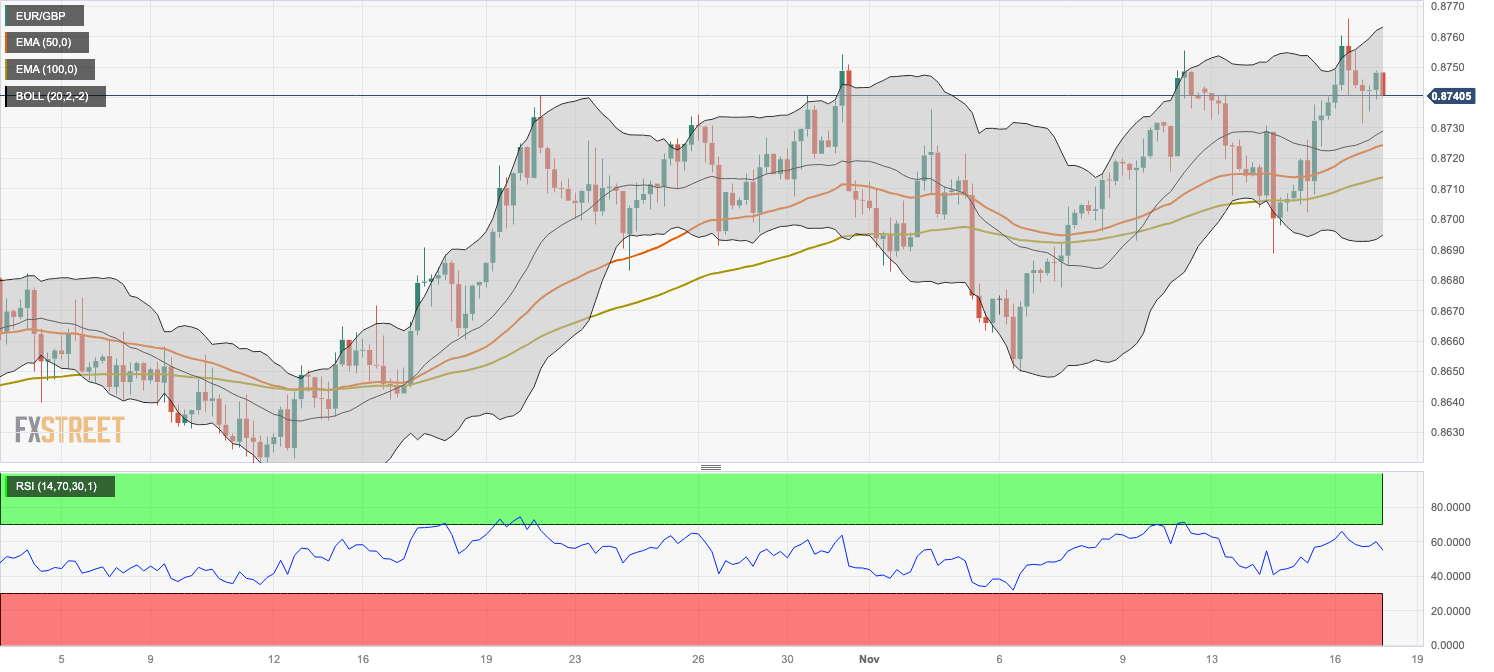

According to the four-hour chart, EUR/GBP keeps the bullish stance as the cross holds above the 50- and 100-hour Exponential Moving Averages (EMAs). Furthermore, the Relative Strength Index (RSI) stands in bullish territory above 50, supporting the buyers for now.

The first upside barrier is located near the upper boundary of the Bollinger Band and a high of November 16 at 0.8765. A decisive break above the latter will see a rally to a high of May 3 at 0.8835. The additional upside filter to watch is a high of April 25 at 0.8865.

On the flip side, the 100-hour EMA at 0.8713 acts as an initial support level for the cross. A breach of the latter will see a drop to the lower limit of the Bollinger Band at 0.8695. Further south, the next contention level is seen near a low of November 1 at 0.8682.

EUR/GBP four-hour chart

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.