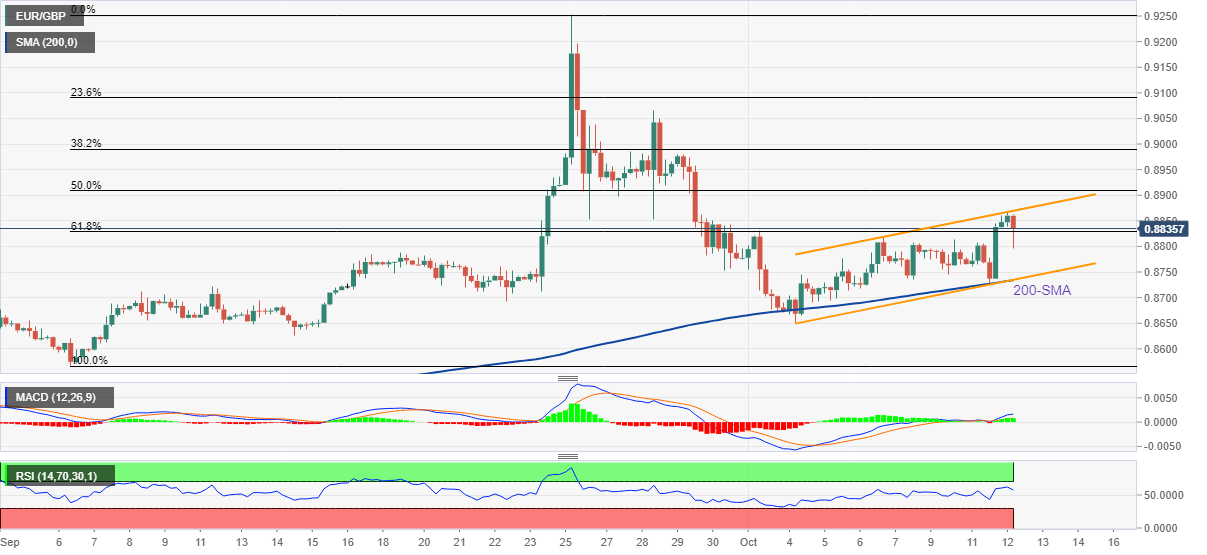

EUR/GBP Price Analysis: Slides to 0.8800 inside weekly bullish channel on BOE chatters

- EUR/GBP consolidates biggest daily gains in two weeks inside bullish chart formation.

- Reports that BOE could extend bond-buying triggered GBP’s immediate strength.

- 200-SMA adds strength to 0.8735 support confluence, oscillators also favor buyers.

EUR/GBP portrays the British Pound’s (GBP) immediate run-up on the Financial Times (FT) report that the Bank of England (BOE) is likely to extend the bond-buying program. In doing so, the cross-currency pair reverses from the upper line of a weekly bullish channel while flashing 0.8796 as the daily low, around 0.8825 by the press time of early Wednesday morning in Europe.

“The Bank of England has signaled privately to bankers that it could extend its emergency bond-buying program past this Friday’s deadline, according to people briefed on the discussions, even as Governor Andrew Bailey warned pension funds that they “have three days left” before the support ends,” mentioned FT.

Although the recent news suggests further downside of the EUR/GBP pair, a convergence of the 200-SMA and the stated bullish channel’s bottom, around 0.8735, appears a tough nut to crack for the bears.

Following that, a slump towards refreshing the monthly low, currently around 0.8650, can’t be ruled out.

It should be noted that the MACD and the RSI (14) are both in favor of the quote’s further upside. That said, the aforementioned channel’s top, close to 0.8870, guards the EUR/GBP pair’s immediate rebound.

Also acting as an upside filter is the 50% Fibonacci retracement level of September month upside, near 0.8910, a break of which will direct the EUR/GBP bears towards the 0.9000 psychological magnet.

EUR/GBP: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.