EUR/GBP Price Analysis: Slid on high UK yields, dark cloud cover formation

- EUR/GBP slides as UK bond yields surpass German bond yields, strengthening the Pound.

- From a technical perspective, the pair exhibits a neutral to downward bias, with long-term daily EMAs standing above exchange rates.

- The EUR/GBP must regain the 0.8600 level and surpass the May 24 daily low resistance of 0.8648 to shift its bias.

- The pair’s immediate support is at 0.8500, a breach below, which could lead to a decline toward 0.8535.

EUR/GBP slid during the Friday session as UK bond yields surpassed German bond yields, the strongest of the Eurozone (EU), bolstering the appetite for the Pound Sterling (GBP). That, alongside a dark-cloud conver technical chart pattern, exacerbated the EUR/GBP’s fall below the 0.8600 figure. At the time of writing, the EUR/GBP is trading at 0.8585, down 0.33%.

EUR/GBP Price Analysis: Technical outlook

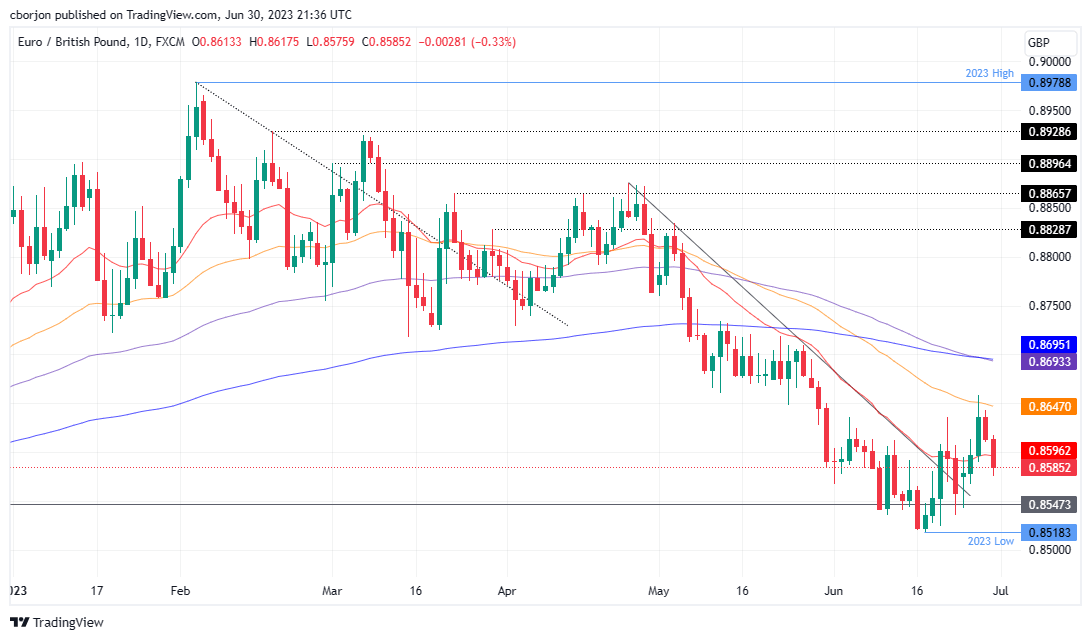

From a technical perspective, the EUR/GBP is still neutral to downward biased, with long-term daily Exponential Moving Averages (EMAs) standing above the exchange rates; while the EUR/GBP remains unable to break the May 24 daily low support area turned resistance at around 0.8648, and seen as the latest swing low needed to be broken, to change the pair’s bias.

However, on its way toward that level, the EUR/GBP must reclaim the 0.8600 figure. A breach of the latter will expose the 0.8648 May low, which, If broken decisively, it could pave the way toward the confluence of the 100 and 200-day Exponential Moving Averages (EMAs) at 0.8693/95 before challenging 0.8700.

Conversely, and the path of least resistance, the EUR/GBP first support would be the 0.8500 mark. A dip below will send the cross toward the June 23 daily low of 0.8535 before testing the June 19 swing low of 0.8518 before slumping to the 0.85 figure.

EUR/GBP Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.