EUR/GBP Price Analysis: Gathers momentum, trades at around six-month high

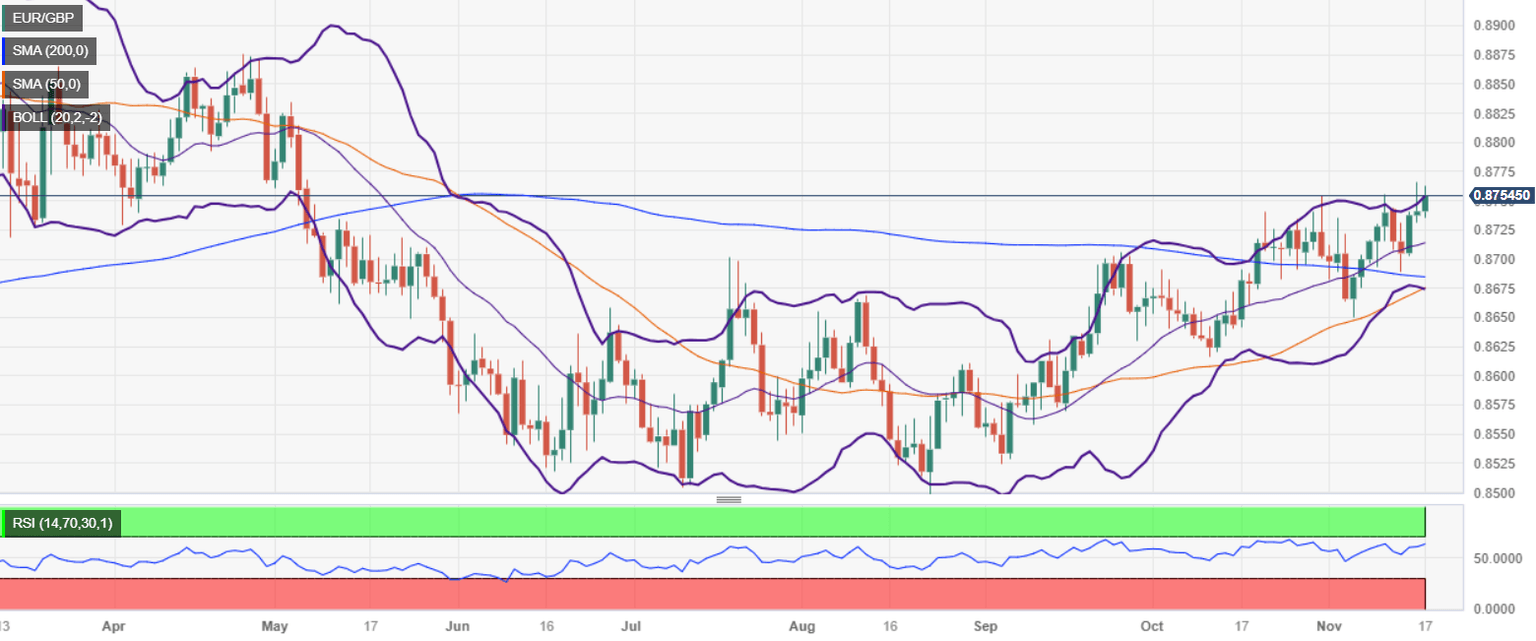

- EUR/GBP continues its upward trajectory for the third day, retreating slightly from a six-month high of 0.8765.

- A significant break above the 200-day moving average has fueled the pair's recent gains, with a monthly increase of over 0.59%.

- On the downside, an EUR/GBP move below the November 14 swing low of 0.8688 could see the pair testing the 200-day SMA, followed by the 50-day SMA at 0.8674.

The EUR/GBP extended its advance for the third consecutive day, though it retreated from the six-month high reached on Thursday at 0.8765. On Friday, the cross-pair exchanges hands at 0.8753, post gains of 0.14%, ahead of the weekend.

After breaking above the 200-day moving average (DMA), the pair has extended its gains sharply. Since the beginning of November, the pair has gained more than 0.59%, with buyers eyeing additional gains.

The EUR/GBP's next resistance level is at 0.8800 before it reaches the May 3 high at 0.8834 before challenging the February 17 daily high of 0.8928. Once cleared, the next ceiling level would be the year-to-date (YTD) high of 0.8978.

On the other hand, if EUR/GBP sellers drag prices below the latest swing low reached on November 14 at 0.8688, the pair would dive toward the 200-day moving average (DMA), before challenging the 50-day moving average (DMA) at 0.8674.

EUR/GBP Price Analysis – Daily Chart

EUR/GBP Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.