EUR/GBP Price Analysis: Forms reversal pattern and begins falling again

- EUR/GBP forms a two bar reversal pattern and begins descending.

- This follows price filling a gap on the charts – another reversal sign.

- The correction from the June 14 lows may have ended and a new leg of the intermediate downtrend could be evolving.

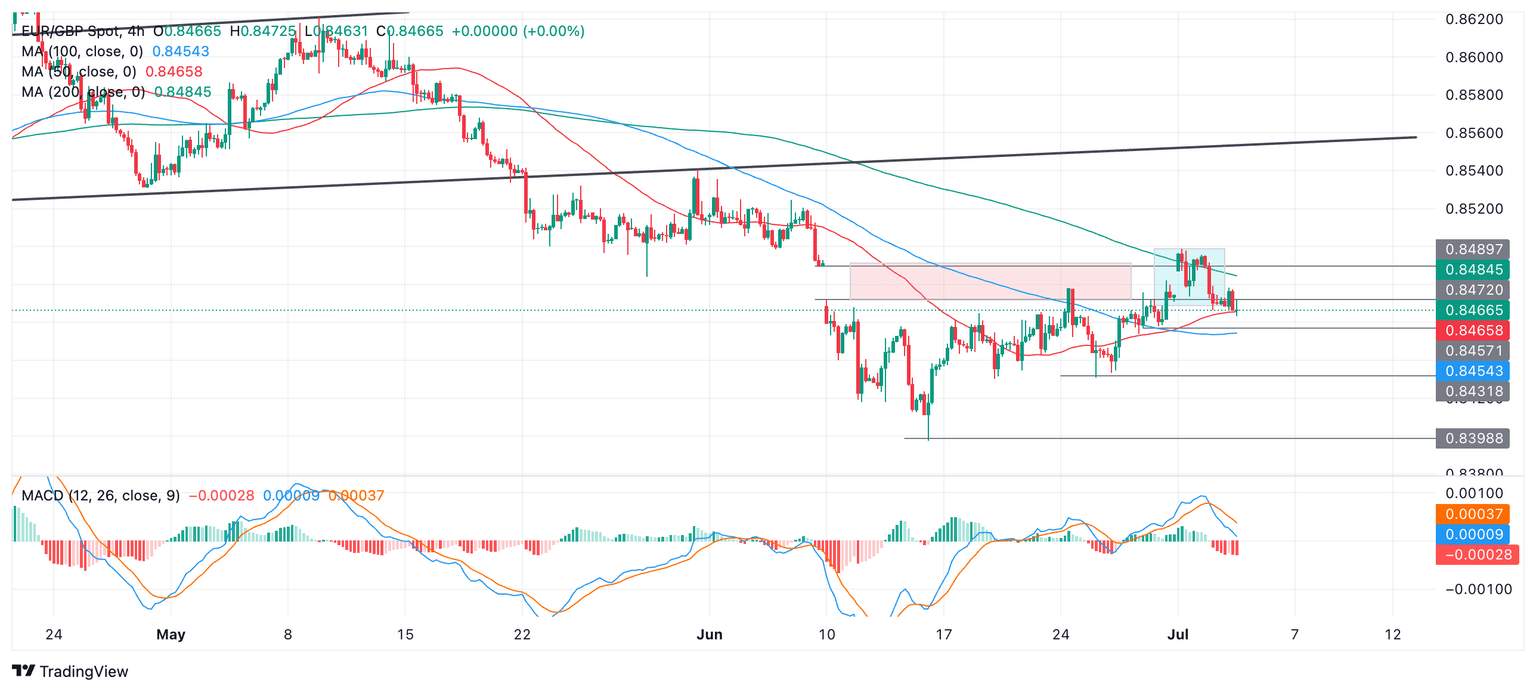

EUR/GBP has moved lower after filling the price gap that opened between 0.8472 and 0.8490 (red shaded area) during the steep decline of June 10.

The pair has formed a two-bar reversal pattern on July 1-2 (light blue rectangle) which is a bearish reversal sign. These patterns form after an up move when a green candle is succeeded by a red candle of a similar shape and size. The pattern indicates a reversal of sentiment at a peak. This and the gap-fill increase the odds the up move from the June 14 lows has finished. It is likely the pair is probably rolling over and entering a bearish phase.

EUR/GBP Daily Chart

Taken together with the fact that the pair seems to be in a medium-term downtrend and “the trend is your friend” the odds favor a resumption lower.

A break below 0.8457 (June 28 low) would add confirmation.

The next target below that would be the 0.8431 June 25 low.

EUR/GBP 4-hour Chart

The Moving Average Convergence Divergence (MACD) on the 4-hour chart has crossed below its signal line during the reversal at the recent July 1 highs. This further indicates the correction may have run its course and is now turning lower.

It is still possible the pair could recover, however, and a break above 0.8499 (July 1) high would indicate a continuation of the correction higher, with the 50-day Simple Moving Average at 0.8517 providing the next resistance target to the upside.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.