- EUR/GBP trims intraday losses while bouncing off 0.9014.

- Momentum dwindles inside a multi-day-old symmetrical triangle.

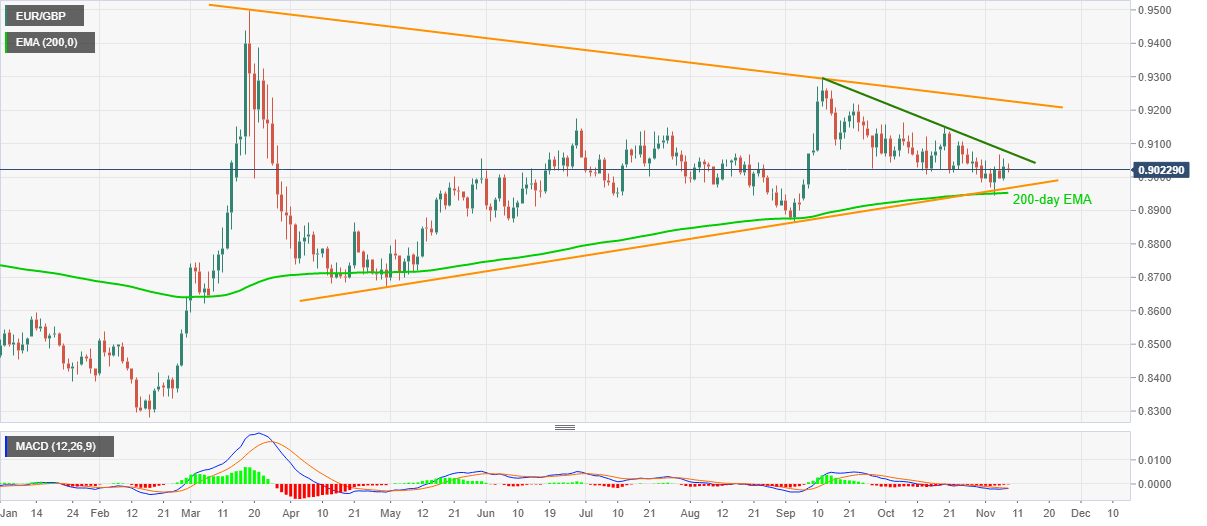

EUR/GBP picks up bids to 0.9022, down 0.10% on a day, during the pre-European trading on Monday. The pair dropped to the lowest in two months the last Wednesday before recovering from 200-day EMA.

However, upside momentum fizzled below a descending trend line from September 11, currently around 0.9075.

Considering the recent pullback moves, amid downbeat MACD signals, the quote is likely to remain depressed. This directs the EUR/GBP sellers towards an ascending support line from April 30, at 0.8966 now, before highlighting the 200-day EMA level of 0.8952 again.

Although the key EMA is likely to keep buyers hopeful, a clear downside below 0.8950 will direct the bears towards the September bottom surrounding 0.8865.

On the upside, a clear break of the stated trend line resistance near 0.9075 can aim for the October 20 peak close to 0.9150 and September 22 peak around 0.9220.

Though, a downward sloping trend line connecting highs marked in March and September, forming part of the broad symmetrical triangle, presently near 0.9230, becomes a key resistance to watch afterward.

EUR/GBP daily chart

Trend: Sideways

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD trades deep in red below 1.0300 after strong US jobs report

EUR/USD stays under bearish pressure and trades below 1.0300 in the American session on Friday. The US Dollar benefits from the upbeat jobs report, which showed an increase of 256,000 in Nonfarm Payrolls, and forces the pair to stay on the back foot heading into the weekend.

GBP/USD drops toward 1.2200 on broad USD demand

GBP/USD extends its weekly slide and trades at its weakest level since November 2023 below 1.2250. The data from the US showed that Nonfarm Payrolls rose by 256,000 in December, fuelling a US Dollar rally and weighing on the pair.

Gold ignores upbeat US data, trades above $2,680

Following a drop toward $2,660 with the immediate reaction to strong US employment data for December, Gold regained its traction and climbed above $2,680. The risk-averse market atmosphere seems to be supporting XAU/USD despite renewed USD strength.

Sui bulls eyes for a new all-time high of $6.35

Sui price recovers most of its weekly losses and trades around $5.06 at the time of writing on Friday. On-chain metrics hint at a rally ahead as SUI’s long-to-short ratio reaches the highest level in over a month, and open interest is also rising.

Think ahead: Mixed inflation data

Core CPI data from the US next week could ease concerns about prolonged elevated inflation while in Central and Eastern Europe, inflation readings look set to remain high.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.