EUR/GBP Price Analysis: Euro holds firm near 0.86 with bullish support from moving averages

- EUR/GBP was last seen trading near the 0.8600 zone after modest gains in Monday’s session

- MACD signals buy while broader momentum remains neutral

- Support builds around 0.8560 as moving averages continue to favor bulls

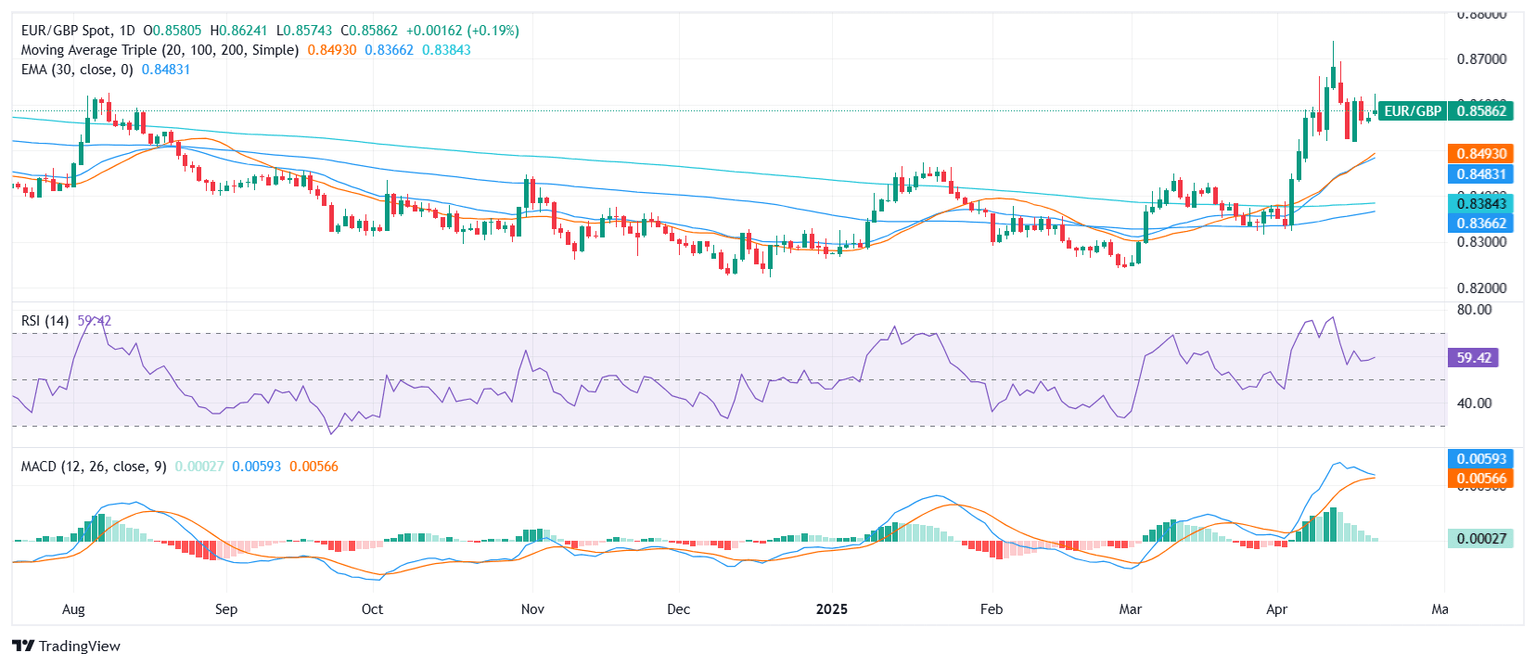

The EUR/GBP pair extended its positive momentum on Monday after the European session, holding near the 0.8600 area following a 0.31% daily gain. Price action hovered mid-range between 0.8577 and 0.8624, with bulls managing to sustain control without triggering a breakout.

From a technical perspective, the MACD shows a buy signal, reinforcing the bullish tone. However, other indicators such as the Relative Strength Index (RSI) at 60, the Williams Percent Range at -34.32, and the Stochastic %K at 61.06, remain in neutral territory, pointing to a steady rather than aggressive upward bias.

The broader technical structure continues to support buyers. The 20-day SMA at 0.84937, along with the 100-day and 200-day SMAs at 0.83665 and 0.83854, respectively, confirm the bullish backdrop. Near-term averages — the 10-day EMA at 0.85657 and 10-day SMA at 0.85909 — also align with the ongoing upward trend.

On the downside, support is seen at 0.85909, followed by 0.85680 and 0.85657. If the pair manages to break above its daily peak, it could face resistance near the 0.8625 area.

Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.