EUR/GBP Price Analysis: Climbs after hitting YTD low below 0.8500, oscillates around 0.8540s

- EUR/GBP rebounds from a YTD low of 0.8492 to trade at 0.8542, gaining 0.28%, but remains below crucial moving averages.

- The intraday outlook is neutral; a daily close above the August 22 high of 0.8545 could signal a move toward 0.8600.

- Sellers could target the 0.8500 level if the pair closes below 0.8545; further downside is expected below that mark.

EUR/GBP currency pair is showing a neutral to downward bias as it hovers below both the 50 and 200-day Moving Averages (DMAs), according to the daily chart. Despite hitting a new year-to-date low of 0.8492, the pair saw buyers step in to reclaim the 0.8500 level, sparking a modest recovery towards the current exchange rate at around 0.8542, for a gain of 0.28%.

EUR/GBP Price Analysis: Technical outlook

The EUR/GBP daily chart portrays the pair as neutral to downward biased, with the EUR/GBP standing below the 50 and 200-day Moving Averages (DMAs). It should be noted the cross printed a new year-to-date (YTD) low of 0.8492, but buyers moved in and reclaimed the 0.8500 figure, spurring a recovery toward the 0.8540 area.

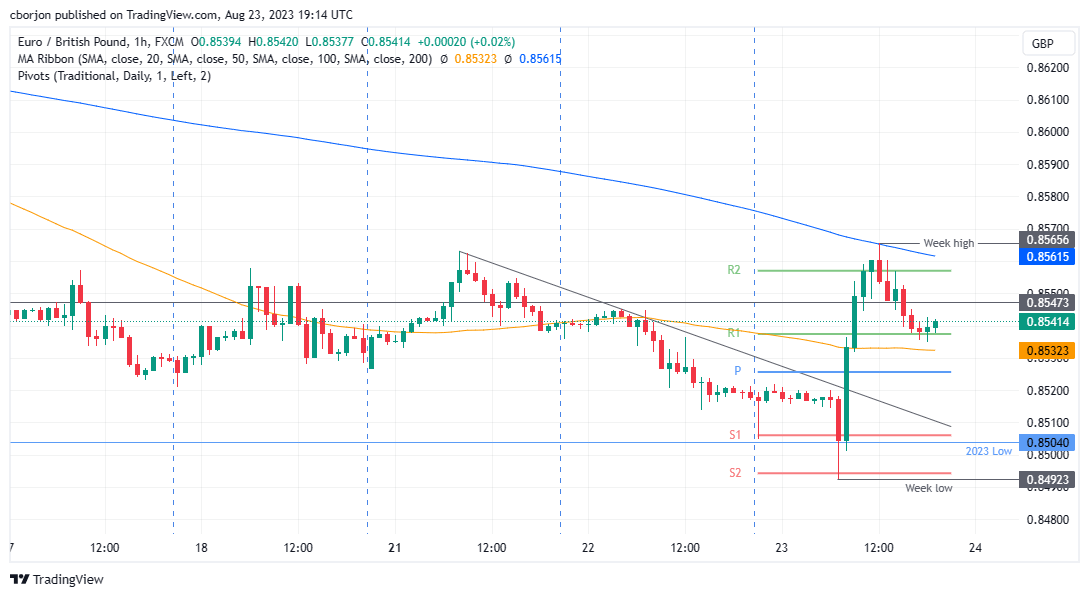

From an intraday perspective, the EUR/GBP hourly chart is neutral-biased, but it could turn upwards if it achieves a daily close above the August 22 daily high of 0.8545. Once done, the EUR/GBP could test the 200-hour Moving Average (HMA) at 0.8561, followed by the current week’s high of 0.8565. A breach of the latter could test the 0.8600 level.

Otherwise, if EUR/GBP registers a daily close below 0.8545, sellers could eye a test of the 0.8500 mark. Further downside is expected below that level.

EUR/GBP Price Action – Hourly chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.