EUR/GBP Price Analysis: Bears push down, eyes on support break

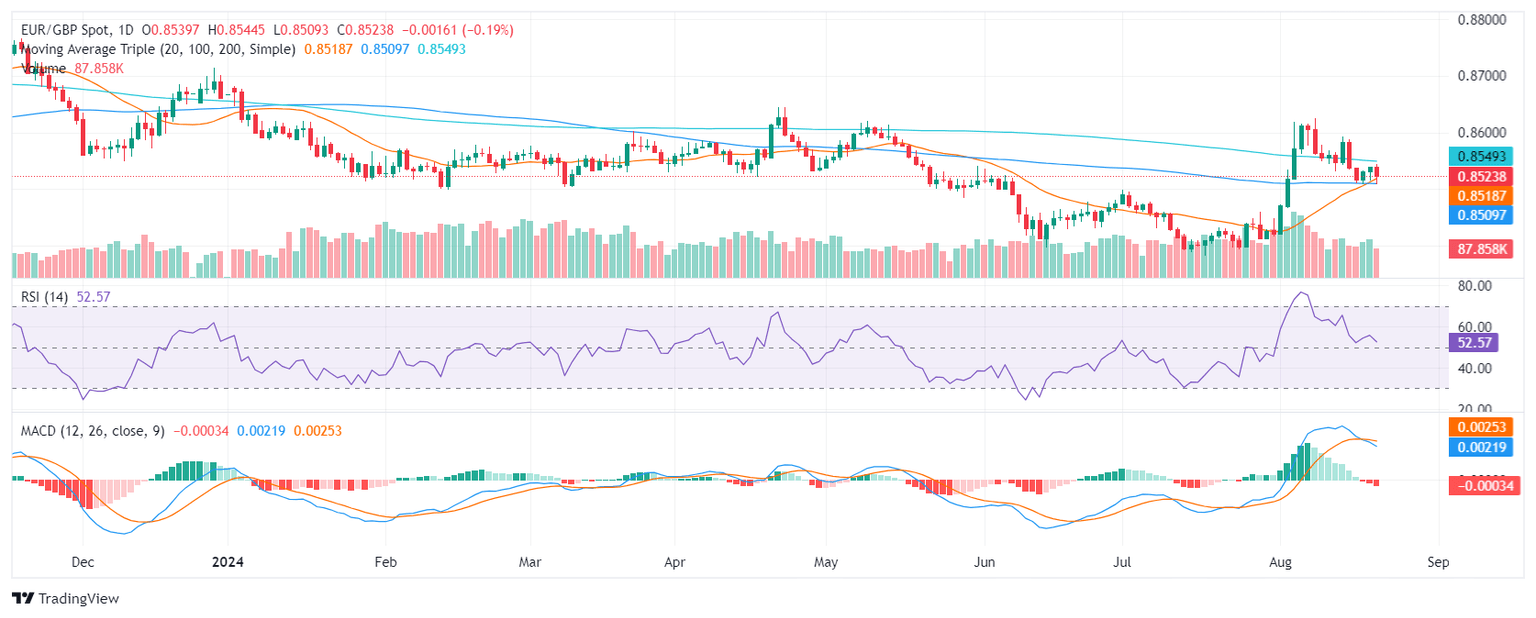

- The EUR/GBP declined towards reaching 0.852 and bears threatened the 0.8500 area.

- Bearish indicators signal the potential for a downside move.

- The 0.8500 (20 and 100-day SMA crossover) level remains a critical support to watch.

In Wednesday's session, the EUR/GBP resumed its losses, to settle at 0.8520. Technical indicators paint a mixed picture but the sellers appear to be threatening with breaking the 0.8500 support.

The Relative Strength Index (RSI) has fallen to 55, suggesting a decrease in buying pressure, while the Moving Average Convergence Divergence (MACD) is forming rising red bars, indicating growing bearish momentum. Volume patterns have been mixed, with a flat trend in recent sessions.

In summary, the EUR/GBP pair is facing a potential bearish trend, with selling pressure likely to persist. A break below the key 0.8500 support would reinforce the bearish bias and open up the possibility for further downside. On the positive side, the bullish crossover between the 20 and 100-day Simple Moving Averages (SMA) provides strong support

EUR/GBP daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.