- EUR/GBP advances further and approaches 0.9100.

- UK political uncertainty keeps weighing on the Pound.

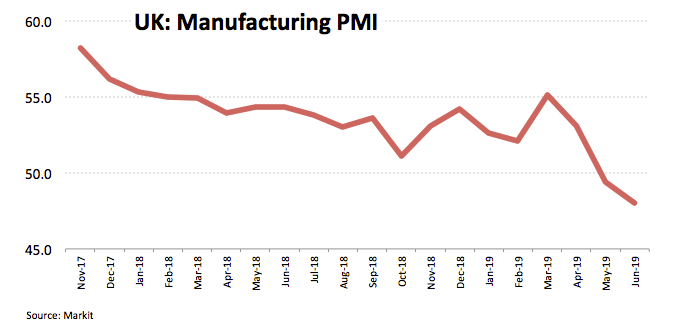

- UK Manufacturing PMI dropped further in August.

The increasing selling pressure around the Sterling is helping EUR/GBP to clinch daily highs in the 0.9080 region.

EUR/GBP looks to politics, Brexit, data

The British Pound is extending the downside bias since the second half of last week, coming down under extra downside pressure as political jitters have intensified in the UK against rising bets of general elections and a ‘no deal’ outcome at the October deadline.

In fact, the Sterling faces a critical week, including the probability of a no-confidence motion against PM Boris Johnson, ahead of the suspension of the Parliament at some point between September 9-12.

In addition, GBP is deriving extra weakness after the manufacturing PMI dropped to 47.4 for the month of August, the lowest level since October 2012, accentuating the deterioration in this sector.

What to look for around GBP

The recent move by PM Boris Johnson to suspend Parliament has given way to heightened uncertainty in UK politics and boosted odds of a ‘no deal’ scenario on October 31. Supporting this view, opposition MPs seems to be losing the battle to avoid a ‘hard divorce’ while investors have started to factor in the chances of general elections. On another direction, there are no changes nor fresh news from the BoE’s stance towards Brexit. It is worth recalling that, at its last meeting, the central bank refused to incorporate the likeliness of a ‘no deal’ scenario to its projections.

EUR/GBP key levels

The cross is gaining 0.49% at 0.9076 and faces the next hurdle at 0.9148 (21-day SMA) followed by 0.9183 (high Aug.20) and finally 0.9324 (2019 high Aug.12). On the other hand, a drop below 0.9016 (low Aug.27) would expose 0.8891 (monthly low Jul.25) and then 0.8836 (200-day SMA).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to strong gains above 1.1050 as US-China trade war deepens Premium

EUR/USD trades decisively higher on the day above 1.1050 on Wednesday as the US Dollar (USD) stays under persistent selling pressure on growing fears over a recession, as a result of the US trade war with China. Later in the American session, the Federal Reserve will release the minutes of the March policy meeting.

GBP/USD holds above 1.2800 on broad USD weakness

GBP/USD stays in positive territory above 1.2800 in the American session on Wednesday. After China's decision to respond to the US tariffs by imposing additional 84% tariffs on US goods, the US Dollar remains under pressure and helps the pair hold its ground ahead of FOMC Minutes.

Gold extends rally to $3,050 area as safe-haven flows dominate markets

Gold preserves its bullish momentum and trades near $3,050 in the second half of the day. Further escalation in the trade conflict between the US and China force markets to remain risk-averse midweek, allowing the precious metal to capitalize on safe-haven flows.

Top 3 gainers NEO, Plume and Story: NEO surges despite Trump's tariff firestorm as investors succumb to extreme fear

Cryptocurrencies are enduring progressive market carnage from the US President Donald Trump administration's incessant tariffs on its trade partners, with some selected altcoins like NEO, Plume and Story (IP) leading the bullish brigade on Wednesday.

Tariff rollercoaster continues as China slapped with 104% levies

The reaction in currencies has not been as predictable. The clear winners so far remain the safe-haven Japanese yen and Swiss franc, no surprises there, while the euro has also emerged as a quasi-safe-haven given its high liquid status.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.