- EUR/GBP taking up a bid in a continuation of bullish correction.

- EUR/GBP has added around 4.5% since last week despite COVID-19 spread in Europe.

- UK current account deficit is the largest in the G10 FX, a problem for GBP.

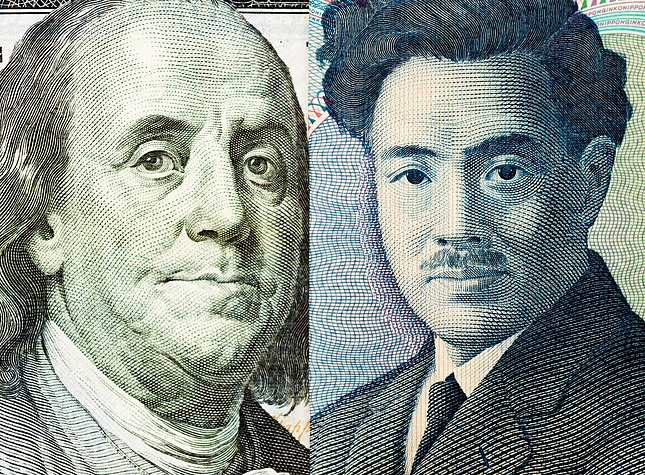

EUR/GBP is trading with a 0.9155 and 0.9387 range, currently oscillating in the higher end around 0.9321 as the euro firms, taking advantage of a slightly less prominent US dollar as the Federal Reserve floods the markets will USD in open-ended QE.

The US dollar, which has been the FX and money market's go-to asset since the explosion of global COVID-19 pandemic cases over the past couple of weeks, has finally slowed down in its pace, giving back some ground to the euro and pound. The Fed's latest action is explained here and how it impacts USD.

EUR/GBP bulls have fared better of late though, rallying from 0.8995 and scoring up around 4.5% on the bid to the aforementioned high as investors fear the worst for the UK economy given the government's indecisive action plan to stave off a full-blown Italian style COVID-19 crisis.

Also, the UK current account deficit is the largest in the G10 FX space and has been a long-standing negative for GBP. Consequently, GBP/USD reached the lowest level since 1985 while the dollar funding squeeze turned the screw.

All eyes on government stimulus solutions

Markets will continue to monitor COVID19 developments and progress on rescue packages in Europan and the UK, but at this stage of the game, the Bank of England has some wiggle room left not much, and it really will be all down to the governments.

EUR/GBP levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD climbs above 1.0400 on broad USD weakness

EUR/USD gathers bullish momentum and trades above 1.0400 on Monday. The US Dollar remains under heavy selling pressure and helps the pair push higher as risk mood improves on news of US President-elect Donald Trump considering tariffs that would only cover critical imports.

GBP/USD surges above 1.2500 as risk flows dominate

GBP/USD extends its recovery from the multi-month low it set in the previous week and trades above 1.2500. The improving risk mood on easing concerns over Trump tariffs fuelling inflation makes it difficult for the US Dollar (USD) to find demand and allows the pair to stretch higher.

Gold rises toward $2,650 as US yields edge lower

Gold regains its traction and rises to the $2,650 area after dropping toward $2,620 earlier in the day. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% heading into the American session, helping XAU/USD hold its ground.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important Nonfarm Payrolls (NFP) stand out, but a look at the Federal Reserve (Fed) and the Chinese economy is also of interest.

The week ahead: Three things to watch

Analysts believe that American exceptionalism will persist in 2025, and the first trading week of the year would suggest that investors are also betting on another strong year for the US.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.