EUR/GBP grinding towards 0.8700 with EU Retail Sales in the pipe for Wednesday

- The EUR/GBP is clawing for further gains, trying to extend the early week's gains.

- EU Retail Sales around the corner, as well as a speech from BoE Governor Bailey.

- UK GDP figures loom ahead on Friday.

The EUR/GBP is looking for further topside on Tuesday with EU Retail Sales data landing on Wednesday.

Before that, Bank of England (BoE) Governor Andrew Bailey will be speaking at the Central Bank of Ireland Financial System Conference in Dublin, and investors will be looking for policy clues ahead of the BoE's next policy meeting after the last meeting saw another rate hold.

BoE moving further away from additional rate hikes

The number of BoE policymakers that voted for a rate hike at the last meeting decreased from 4 to 3, with 6 of the 9 Monetary Policy Committee voting members opting to hold rates unchanged for the third straight meeting. The BoE meets again for a rate vote duting the first week of December.

EU Retail Sales for the year into September are broadly expected to etch in further declines, with the median market forecast calling for an acceleration from -2.1% to -3.2 %.

The MoM figure for September is expected to see a minor recovery from -1.2% to just -0.2%.

EUR/GBP Technical Outlook

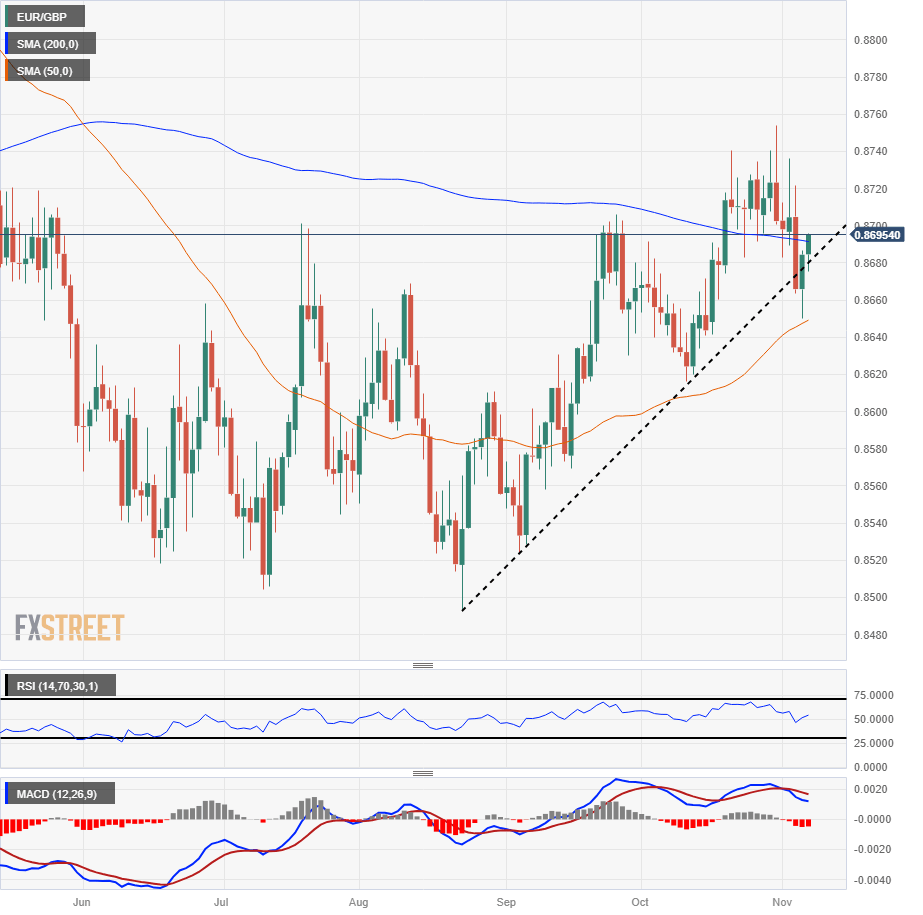

The EUR/GBP is clawing back into the topside after recently tumbling out of consolidation, and the pair is set to confirm a daily close back over the 200-day Simple Moving Average (SMA) near 0.8690.

The pair has rebounded from a false break of a risking trendline from August's swing low below 0.8500, and the pair is catching technical support from the 50-day SMA near 0.8650.

EUR/GBP Daily Chart

EUR/GBP Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.