EUR/GBP finds itself back down near multi-year lows after BoE decision

- EUR/GBP sinks back down to lows not seen since 2022 after the Bank of England decision on Thursday.

- Even though the BoE decided to cut interest rates as expected, their uncertainty over the impact of the Budget supported GBP.

- The Euro had a mixed day after weak German export and industrial data but strong overall Retail Sales from the region.

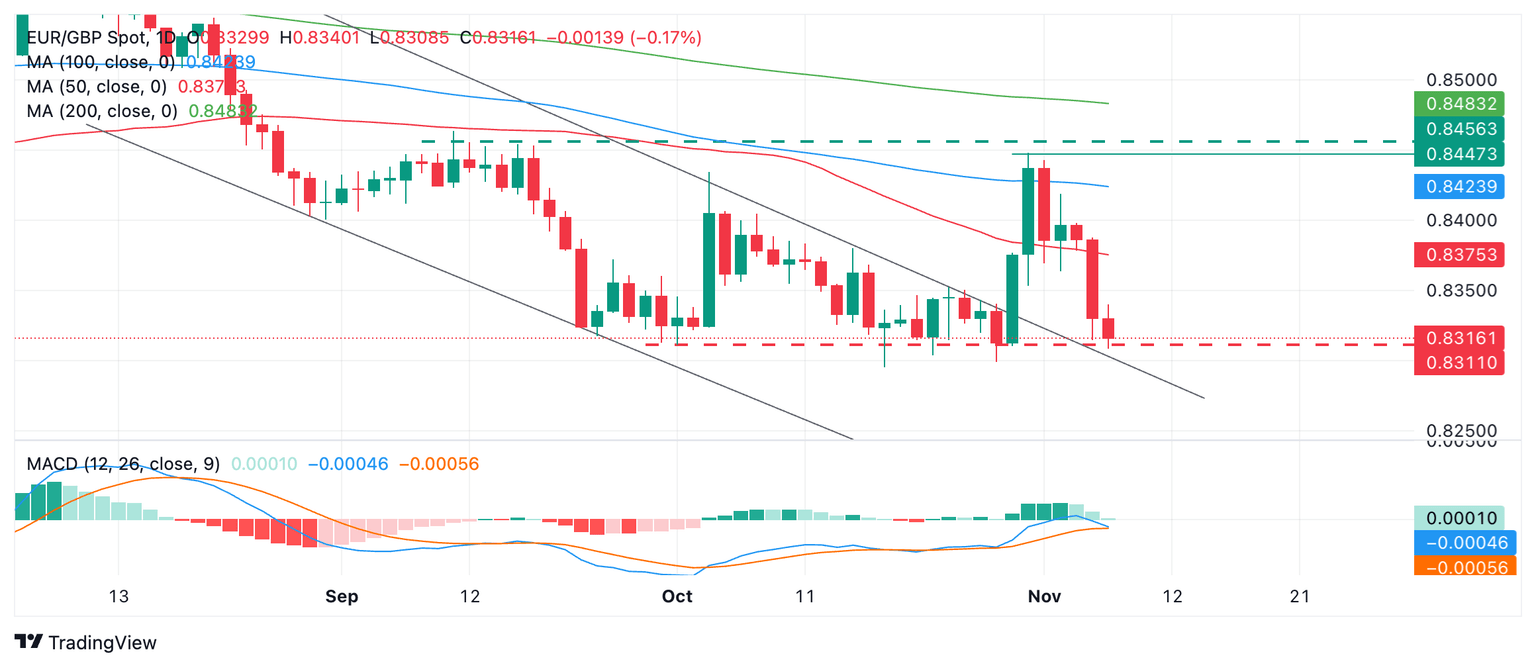

EUR/GBP trades marginally lower on Thursday, in the 0.8320s as it consolidates just above two-and-a-half year lows, and the bottom of a five-week range.

The pair started Thursday deep in the red after the release of lackluster German Industrial Production and Export data weighed on the Euro (EUR).

EUR/GBP Daily Chart

World-renowned exporter Germany suffered a bad month in September as exports fell 1.7%, below both the previous and expected rate. Industrial Production in Europe’s largest economy, meanwhile, declined 2.5% in the same period, also below the estimates of economists, though not as low as the month before.

EUR/GBP then recovered and rose during the European session after upbeat Eurozone Retail Sales data showed shoppers continuing to spend liberally despite relatively high borrowing costs and constrained growth. This gave the Single Currency a boost and the pair sailed higher.

Retail Sales in the Euro Area rose by 2.9% YoY in September, and were revised up from 0.8% to 2.3% in August. The result also beat expectations of 1.3%.

On a monthly basis, Retail Sales rose 0.5% which was above expectations of 0.4% but below the previous month’s 1.1%, although that figure too was revised up substantially from 0.2%.

EUR/GBP fell back to the bottom of its five-week range in the low 0.8300s, however, following the Bank of England (BoE) meeting despite the MPC voting by a clear majority of eight to one to lower the bank rate by 0.25% (25 basis points) to 4.75%, with one dissenter preferring them to remain unchanged. This was one more than voted to cut last time.

Lowering interest rates is usually negative for a currency as it reduces foreign capital inflows, however, in the case of the Pound Sterling (GBP) this was not the case on Thursday. Part of the reason may have been because the move was widely telegraphed, another because it remains well above the European Central Bank’s (ECB) comparable rate of 3.4% and the divergence favors the Pound.

Yet another reason for GBP’s outperformance could be the BoE’s uncertainty regarding the outlook post the new government’s autumn Budget.

In the Budget, the government announced an estimated 70 billion (GBP) of increased spending as well as a rise in the minimum wage. This led economists at the Office of Budgetary Responsibility (OBR) to revise up their forecasts for inflation in the UK to 2.6% in 2025 from 1.1% previously. This, in turn, is expected to lead the BoE to keep interest rates relatively elevated next year, resulting in a stronger Pound.

In his press conference after the decision, BoE Governor Andrew Bailey said the BoE would be keeping a close eye on inflation but that although he expected the decisions in the Budget to raise prices they would fall back down to target, and that confidence “allowed us to cut rates today”.

At the same time, he added that he did not expect the projected path of interest rates to deviate much as a result of the Chancellor’s autumn statement.

"I do not think it is right to conclude that the path of interest rates will be very different due to budget," said Bailey at the press conference.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.