EUR/GBP extends towards 0.8700 as bullish rebound firms up

- The EUR/GBP is up half a percent to kick off the pre-holiday trading week.

- The Euro is firming up a technical rebound against the Pound Sterling on Monday.

- Dueling speeches from ECB & BoE officials leave the EUR the winner.

The EUR/GBP is hardening a technical rebound towards the 0.8700 handle after a rough battle over the 0.8600 handle last week. December saw the pair struggling to develop momentum after getting pinned into 0.8560 in November’s 2.3% decline from 0.8765.

ECB's Kazimir: Drop in inflation not enough to declare victory and move to next stage

It’s a heavy week of inflation figures across several market sessions this week, but the hat-tip for high-impact data goes to the Pound Sterling (GBP) this week, with UK Consumer Price Index (CPI) and Producer Price Index (PPI) inflation figures due on Wednesday. Friday will round out the GBP’s trading week with a UK Gross Domestic Product (GDP) update, as well as a fresh print of UK Retail Sales.

The Euro (EUR) sees a final print of the Eurozone’s Harmonized Index of Consumer Prices (HICP) for November, but the confirmation figures are not expected to deviate from the preliminary figures that showed a -0.5% contraction in Eurozone inflation in November.

BoE's Broadbent: It takes time to understand the forces driving the economy

Policymakers from both the European Central Bank (ECB) and the Bank of England (BoE) made appearances early Monday, but markets tipped in favor of the Euro as ECB officials appeared slightly more confident than their UK counterparts.

The ECB’s Peter Kazimir noted that while it’s too early to “declare victory” over inflation, ECB officials remain confident that inflation will continue to deflate towards the ECB’s targets by 2025. Kazimir’s message was echoed by ECB Governing Council member Yannis Stournaras, who noted that the ECB would need to see inflation dipping below 3% and then remaining in that neighborhood by mid-2024 before the ECB even begins to consider rate cuts.

On the UK side, BoE Deputy Governor Ben Broadbent struck a notably less-hopeful tone than his ECB contemporaries, focusing on volatility in official estimates and bemoaning the disparity between different economic indicators plaguing the UK’s economy and clouding the BoE’s ability to provide an accurate outlook.

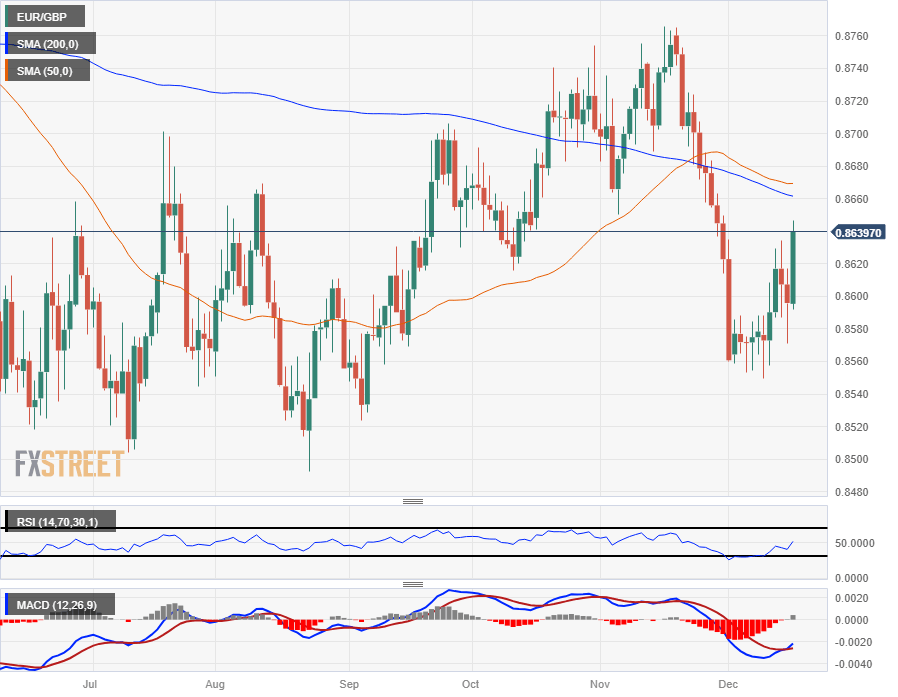

EUR/GBP Technical Outlook

The EUR/GBP’s rally back over 0.8600 sends the pair towards the 200-day Simple Moving Average (SMA) near 0.8660, and a clear break of the moving average will set the pair up for a challenge of the 0.8700 handle.

The pair remains notably down from November’s peak bids, and December opened with the EUR/GBP testing four-month lows before sluggishly pricing in a floor from 0.8560.

Consolidation patterns have been the EUR/GBP’s common theme in 2023, and it won’t take much for short-sellers to interrupt the current bullish climb to chalk in another interim turnaround region near the 200-day SMA at 0.8660.

(This story was corrected on December 18 at 18:20 GMT to say, in the second paragraph, that the ISO code for the Pound Sterling is GBP, not EUR.)

EUR/GBP Daily Chart

EUR/GBP Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.