EUR/GBP easing back towards 0.8700 heading into data double-header

- The EUR/GBP is seeing downside drift ahead of Tuesday's data headliners.

- The Euro is falling back after last week's steady climb.

- Up Next: UK wages & labor, EU labor & GDP.

The EUR/GBP is softening ahead of a key data double-header for both the EU and the UK, with labor, wages, and Gross Domestic Product (GDP) numbers.

The Euro (EUR) is falling back against the Pound Sterling (GBP) heading into the Tuesday market session, declining around 0.4% peak-to-trough on Monday.

UK Average Earnings for the 3rd quarter is expected to decline slightly from 7.8% to 7.7%, while earnings including bonuses is expected to tick downward at a fast pace, from 8.1% to 7.4%.

The UK will also be seeing Employment Change for September, which last showed the UK shed 82 thousand jobs over the month, while Claimant Count Change in October showed an increase in unemployment benefits seekers to the tune of nearly 20.5 thousand.

On the EU side, quarter-on-quarter Employment Change for the 3rd quarter is expected to show a moderate 0.2% gain, while the EU's pan-continental GDP for the quarter is expected to print at a steady reading of -0.1%.

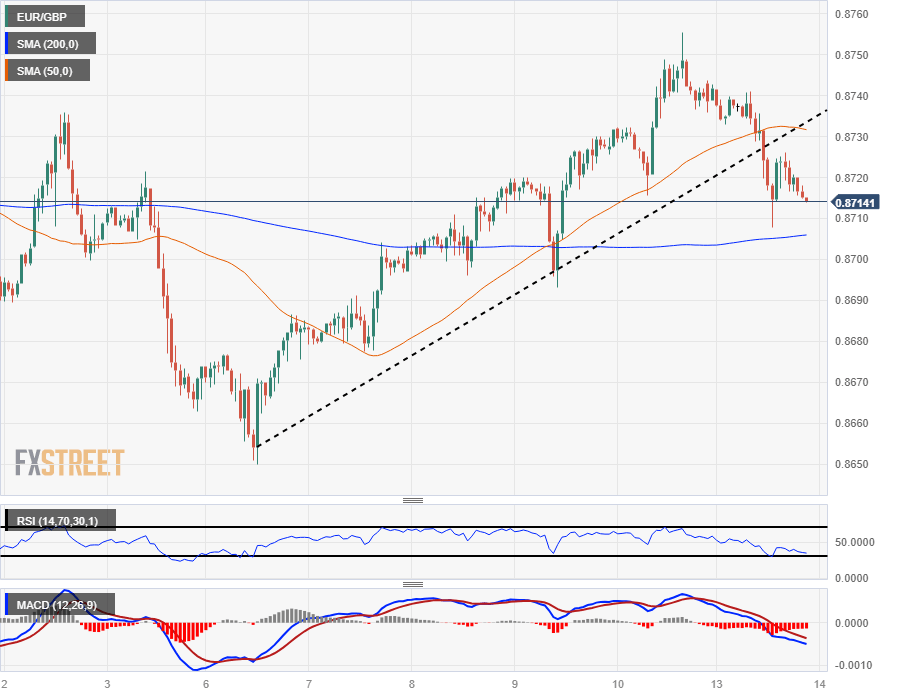

EUR/GBP Technical Outlook

The Euro is falling back into the 200-hour Simple Moving Average (SMA) Against the Pound Sterling, paring back some of the pair's gains from last week.

Monday's decline trims away gains from the swing high into 0.8755, slipping into the bearish side of a rising trendline from last week's low bids near 0.8650.

With the EUR/GBP drifting towards the midrange in the near-term, bidders will be waiting for a downside break of the 0.8700 handle before re-upping positions, while sellers will be considering a trimming below the same level.

EUR/GBP Hourly Chart

EUR/GBP Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.